California Account Executive Agreement - Self-Employed Independent Contractor

Description

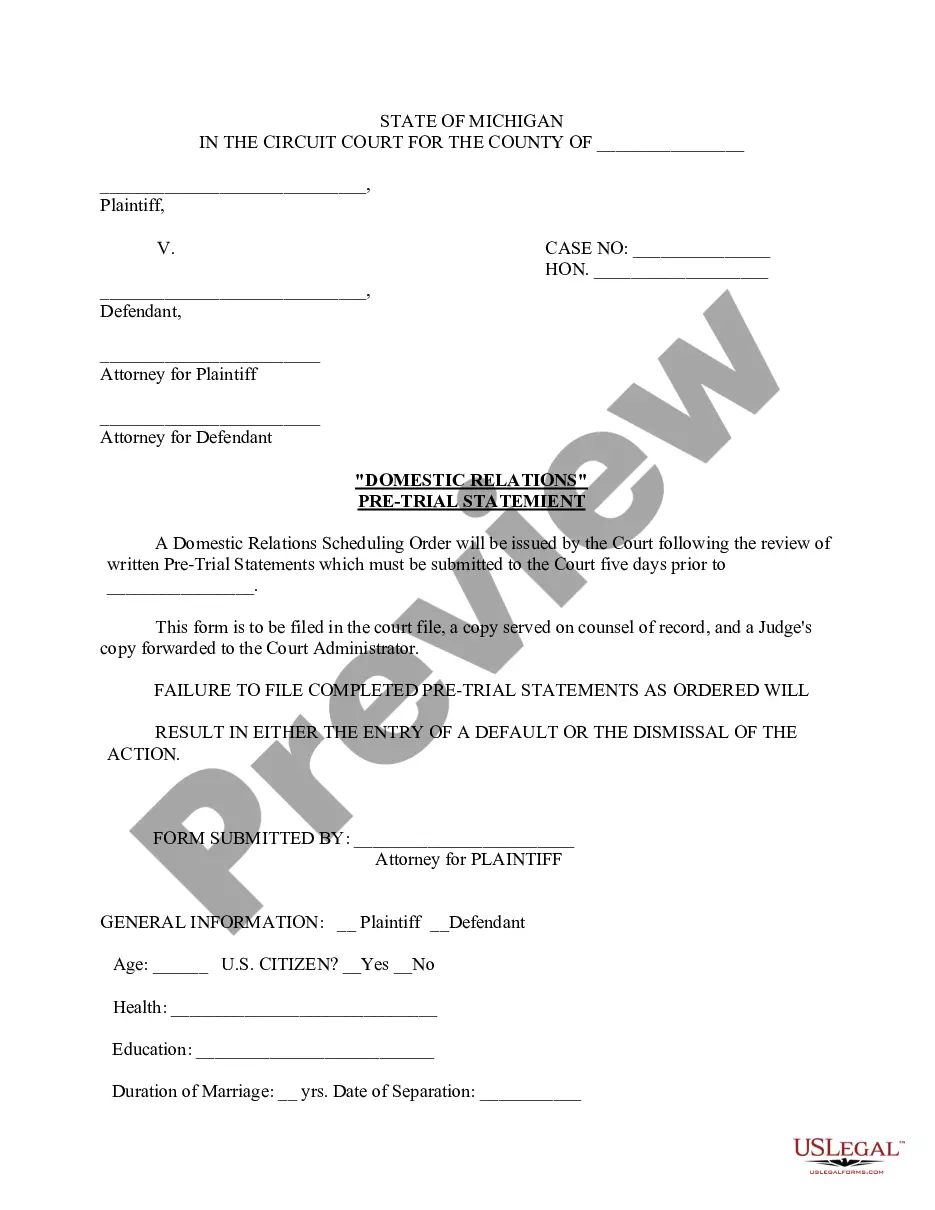

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the California Account Executive Agreement - Self-Employed Independent Contractor in just minutes.

If you already have an account, Log In and download the California Account Executive Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously acquired forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple steps to get you started: Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's content. Check the form summary to confirm that you have chosen the right form. If the form doesn't meet your requirements, use the Search box at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account. Process the payment. Use a credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded California Account Executive Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the California Account Executive Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

Creating a California Account Executive Agreement - Self-Employed Independent Contractor is a straightforward process. Begin by clearly defining the roles and responsibilities of both parties involved. Use a reliable template, like those offered by uslegalforms, to ensure you include all necessary legal elements, such as payment terms and confidentiality clauses. By following these steps, you can establish a solid agreement that protects your interests and clarifies expectations.

In many cases, independent contractors are not considered employees in California. However, due to the ABC law, it’s essential to understand the criteria defining the classification. If the conditions of the ABC test are not met, an independent contractor could be misclassified as an employee, resulting in legal complications. To navigate these complexities accurately, consider using platforms like uslegalforms to assist in drafting a compliant California Account Executive Agreement - Self-Employed Independent Contractor.

The ABC rule for independent contractors in California is a legal guideline that outlines specific conditions under which a worker can be classified as an independent contractor. This rule emphasizes the need for autonomy, work that falls outside the company’s normal activities, and involvement in an independently established trade. When drafting a California Account Executive Agreement - Self-Employed Independent Contractor, you must apply the ABC rule to ensure the proper classification of your independent workers, thus avoiding potential legal pitfalls.

Yes, an accountant can be classified as an independent contractor, provided they meet the criteria set by California's ABC law. If the accountant operates independently and satisfies the conditions of the ABC test, businesses can engage them under a California Account Executive Agreement - Self-Employed Independent Contractor. This arrangement allows for flexibility while ensuring compliance with legal standards.

The new law in California regarding independent contractors, primarily framed by AB5, aims to clarify the distinction between employees and independent workers. This legislation mandates businesses to comply with the ABC test, which helps protect workers' rights. When drafting the California Account Executive Agreement - Self-Employed Independent Contractor, it is vital to consider this law to ensure fair treatment and legal compliance for all parties involved.

The new law for independent contractors in California, also known as Assembly Bill 5 (AB5), was enacted to expand protections for workers. It introduced the ABC test, requiring companies to prove that workers qualify as independent contractors rather than employees. This change significantly impacts how businesses create contracts, including the California Account Executive Agreement - Self-Employed Independent Contractor. By adapting to this law, you can effectively safeguard your business and your contractors.

The ABC law in California establishes strict criteria for classifying workers as independent contractors. Under this law, individuals must meet all three conditions to be classified as independent contractors. This is crucial for those drafting agreements like the California Account Executive Agreement - Self-Employed Independent Contractor. Understanding this law helps you ensure compliance and avoid costly misclassification issues.

Filling out an independent contractor agreement involves detailing the scope of work, payment terms, and responsibilities of both parties. It's imperative to include clear definitions to avoid misunderstandings. Using a reliable platform like US Legal Forms can simplify the process, providing templates that cater to the California Account Executive Agreement - Self-Employed Independent Contractor, ensuring you have all necessary elements covered.

Yes, 1099 income does get reported to the Employment Development Department (EDD) in California. As a self-employed individual under the California Account Executive Agreement - Self-Employed Independent Contractor, you are responsible for reporting your income and expenses accurately. Keeping proper records can help you navigate your tax obligations with confidence.

ABC testing, or A/B testing, allows businesses to compare two versions of a webpage or product to see which performs better. This process is vital for optimizing user engagement and conversion rates. With the right tools, you can easily implement ABC testing for your California Account Executive Agreement - Self-Employed Independent Contractor services, ensuring you attract the right clients effectively.