California Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

You can spend time online attempting to locate the valid file template that satisfies the federal and state requirements you desire.

US Legal Forms offers a vast array of valid forms which are evaluated by experts.

You can download or print the California Payroll Deduction Authorization Form for Optional Matters - Employee from my support.

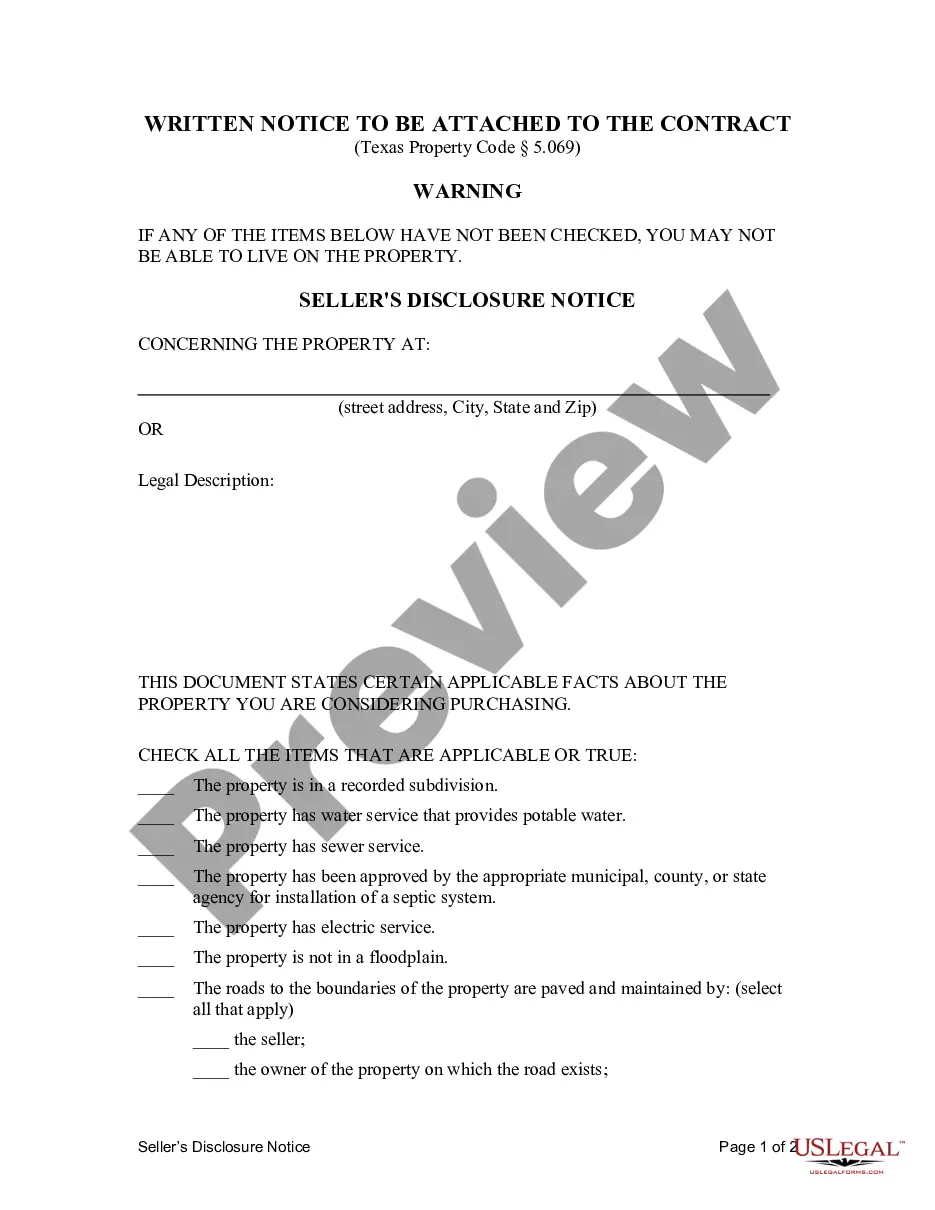

If available, use the Review option to browse through the file template as well.

- If you already possess a US Legal Forms account, you may sign in and select the Obtain option.

- After that, you can complete, modify, print, or sign the California Payroll Deduction Authorization Form for Optional Matters - Employee.

- Each valid file template you acquire is your property indefinitely.

- To obtain another copy of the received form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines listed below.

- First, make sure you have selected the correct file template for the area/zone of your choice.

- Check the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

An example of an optional deduction is employee contributions to a 401(k) retirement plan. This deduction allows employees to save for retirement while reducing their taxable income. When using the California Payroll Deduction Authorization Form for Optional Matters - Employee, you can specify how much you want to contribute, giving you control over your finances and future savings.

An optional deduction on the California Payroll Deduction Authorization Form for Optional Matters - Employee may include contributions to retirement plans, health savings accounts, or insurance premiums. These deductions are not mandated by law, allowing you the flexibility to choose which options best suit your financial needs. It's important to note that you should clearly indicate your choices on the form to avoid any misunderstandings.

Form 2159 is commonly used to authorize payments related to particular deductions, often aligning with benefits and contributions. This form can play a vital role in ensuring that employees' preferences are respected when it comes to payroll deductions. Using the California Payroll Deduction Authorization Form for Optional Matters - Employee simplifies the process, ensuring employees have an organized way to handle various payroll requests.

A payroll deduction authorization form is a formal document that employees complete to authorize their employer to take specific deductions from their paychecks. This form details the deductions and ensures that both parties have a clear understanding of the agreement. By filling out the California Payroll Deduction Authorization Form for Optional Matters - Employee, employees can effectively control their payroll deductions while ensuring compliance with company policies.

A payroll deduction agreement outlines the terms under which an employee agrees to have their wages deducted for specific purposes. This agreement provides clarity on the amounts, frequency, and reasons for the deductions. The California Payroll Deduction Authorization Form for Optional Matters - Employee serves as an essential tool for creating such agreements, protecting both the employee's and employer's interests.

The form for payroll deduction permission is a crucial document that grants companies authority to deduct certain amounts from an employee's paycheck. This form typically includes details about the deductions being authorized and provides a record of consent. Employees can use the California Payroll Deduction Authorization Form for Optional Matters - Employee to ensure that their preferences are officially recorded and legally binding.

A payroll request form is a document that employees submit to request specific actions related to their payroll. This may include changes to their personal information, adjustments to withholding rates, or requests for additional deductions. Utilizing the California Payroll Deduction Authorization Form for Optional Matters - Employee can streamline this process and ensure that requests are accurately processed by the payroll department.

An optional payroll deduction allows employees to choose specific amounts of their paycheck to be set aside for particular deductions. These may include contributions to retirement accounts, insurance premiums, or other benefits. By using the California Payroll Deduction Authorization Form for Optional Matters - Employee, employees can easily manage how their funds are allocated, providing them with greater financial flexibility.

An authorized deduction is a withholding that has received explicit approval from the employee, usually documented through a formal authorization. This may involve deductions for retirement plans, health insurance, or charitable contributions. The California Payroll Deduction Authorization Form for Optional Matters - Employee is designed to facilitate this process, ensuring all deductions align with the employee's consent. By having a clear record, employees can track their deductions and understand their benefits.

Payroll deduction is the method by which an employer withholds a specified amount from an employee's paycheck for designated purposes. This may include taxes, health benefits, or contributions to savings plans. The California Payroll Deduction Authorization Form for Optional Matters - Employee allows employees to specify their desired deductions, making it easier for both parties to understand ongoing commitments. Understanding payroll deduction is crucial for managing personal finances effectively.