California Terms for Private Placement of Series Seed Preferred Stock

Description

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

Discovering the right legal record design can be quite a battle. Needless to say, there are tons of templates accessible on the Internet, but how would you find the legal kind you require? Take advantage of the US Legal Forms web site. The services offers a huge number of templates, including the California Terms for Private Placement of Series Seed Preferred Stock, which you can use for business and personal requirements. Each of the kinds are examined by pros and fulfill federal and state needs.

When you are currently registered, log in in your bank account and click the Download button to obtain the California Terms for Private Placement of Series Seed Preferred Stock. Make use of bank account to search throughout the legal kinds you have ordered in the past. Visit the My Forms tab of your bank account and have another backup of your record you require.

When you are a fresh consumer of US Legal Forms, here are basic instructions that you can adhere to:

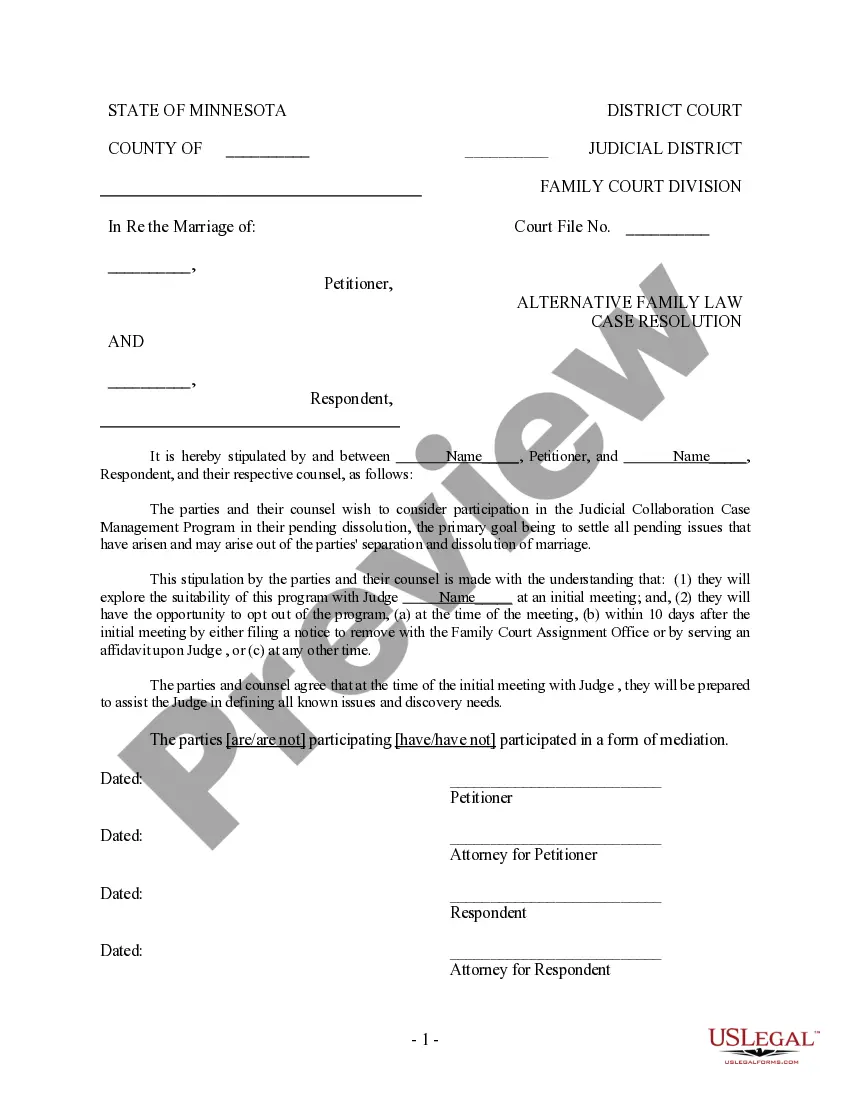

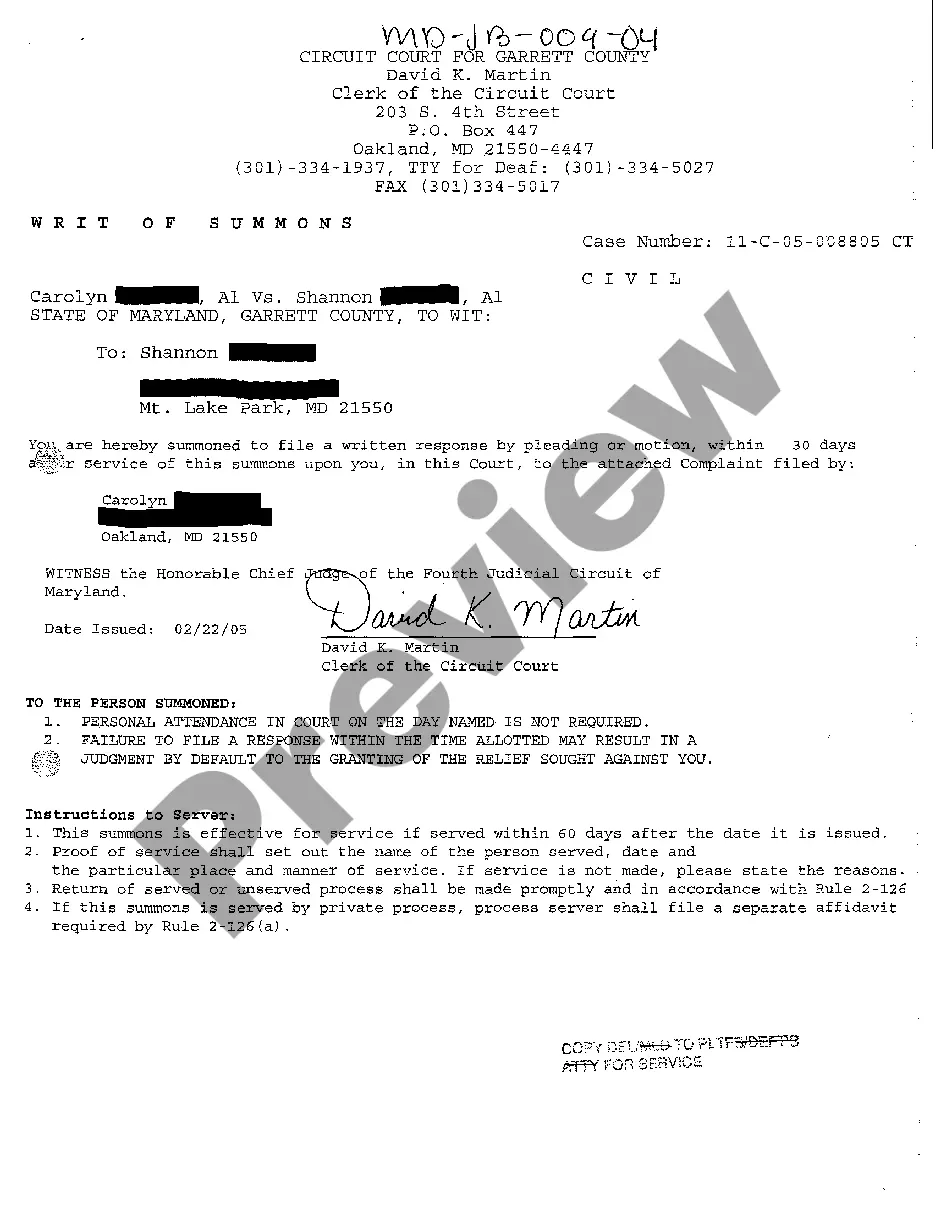

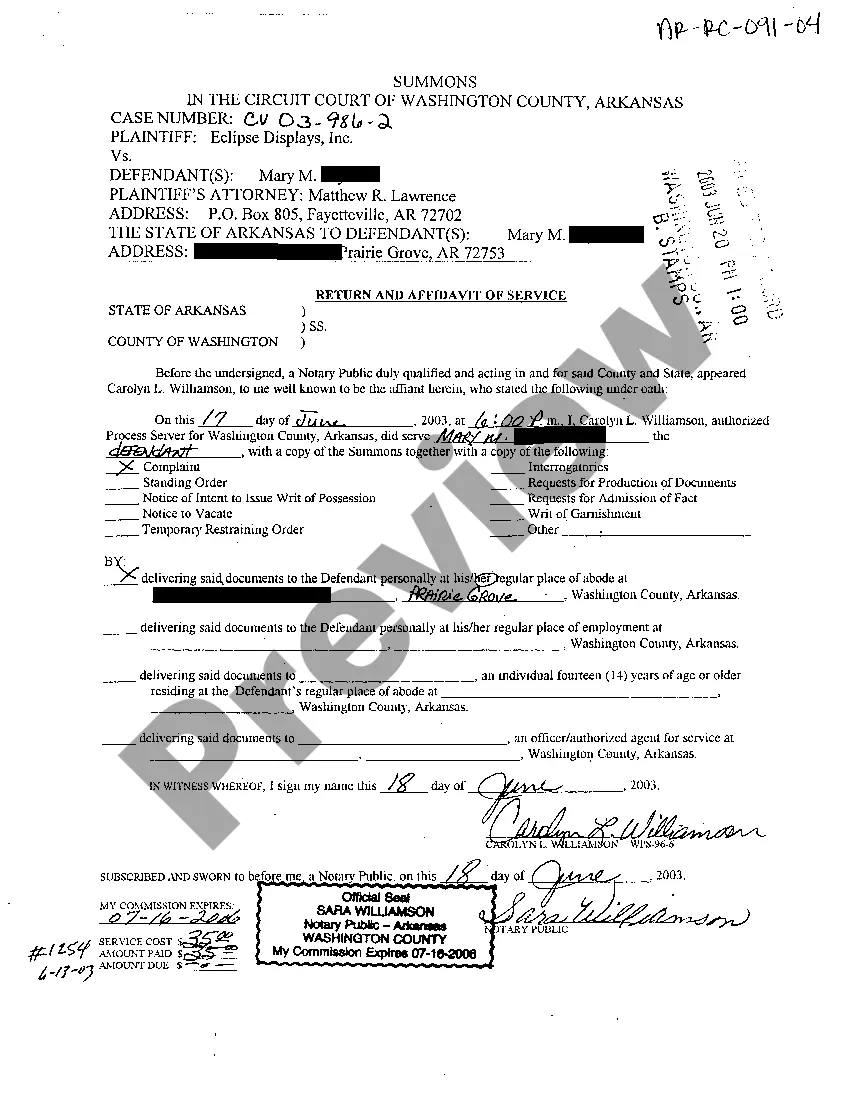

- Initial, make certain you have selected the correct kind for your city/area. It is possible to check out the shape while using Review button and study the shape information to make certain it is the right one for you.

- When the kind is not going to fulfill your needs, use the Seach field to get the correct kind.

- When you are positive that the shape is suitable, select the Purchase now button to obtain the kind.

- Opt for the pricing prepare you would like and enter the necessary info. Design your bank account and purchase your order utilizing your PayPal bank account or bank card.

- Choose the submit formatting and down load the legal record design in your product.

- Comprehensive, modify and print and indication the obtained California Terms for Private Placement of Series Seed Preferred Stock.

US Legal Forms is definitely the most significant local library of legal kinds that you can see a variety of record templates. Take advantage of the service to down load professionally-manufactured paperwork that adhere to status needs.

Form popularity

FAQ

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds. ... Pre-money valuation. ... Non-participating liquidation preference. ... conversion to common. ... Anti-dilution provisions. ... The pay-to-play provision. ... Boardroom makeup. ... Dividends.

Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders.

Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

Payment-in-kind (PIK) is the use of a good or service as payment instead of cash. Payment-in-kind also refers to a financial instrument that pays interest or dividends to investors of bonds, notes, or preferred stock with additional securities or equity instead of cash.

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

Protective provisions are the set of terms that 'protect' an investor's rights such as their ability to veto a decision or action that they do not agree with?e.g. the issuance of more stock, the liquidation of the company, or the acquisition of the company.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).