California Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

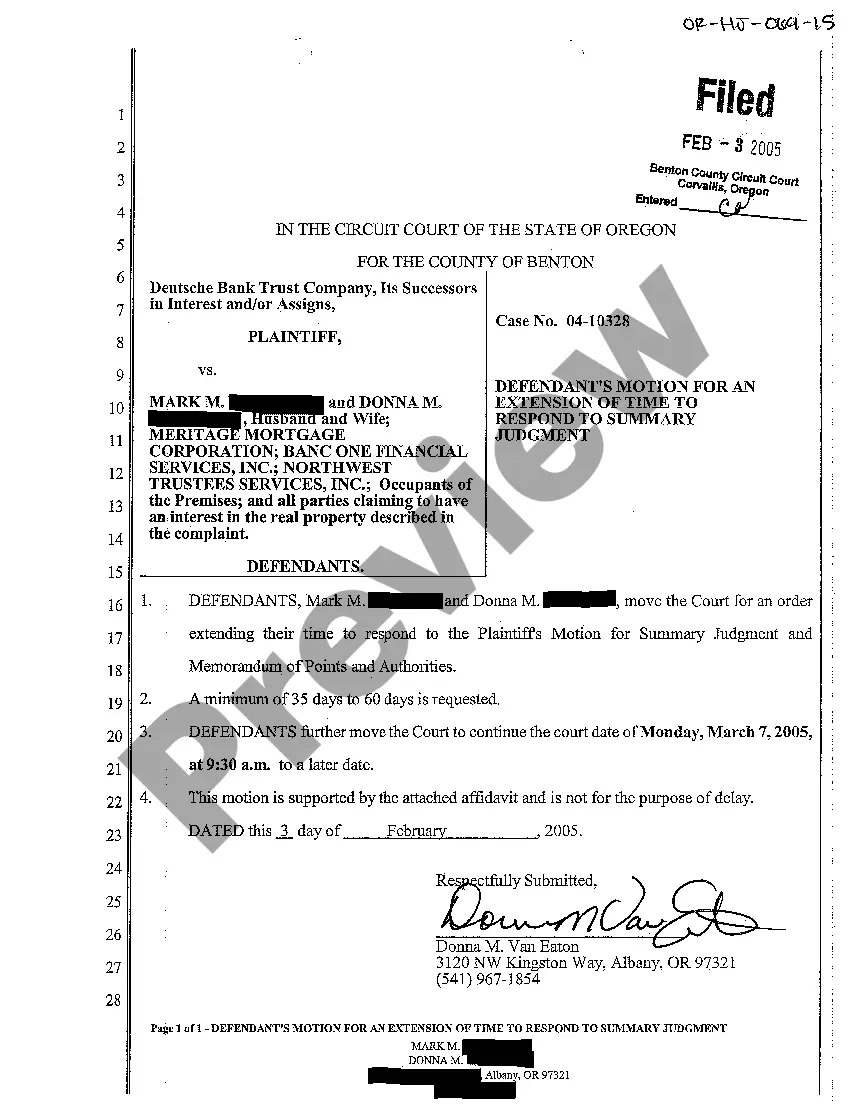

Are you currently in a situation the place you require paperwork for both organization or person purposes almost every day time? There are a variety of legitimate record layouts available on the net, but discovering versions you can depend on is not straightforward. US Legal Forms delivers a large number of type layouts, such as the California Grant Agreement from 501(c)(3) to 501(c)(4), that are written to fulfill federal and state needs.

In case you are presently informed about US Legal Forms web site and have an account, basically log in. Next, you are able to acquire the California Grant Agreement from 501(c)(3) to 501(c)(4) design.

Unless you have an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for the appropriate area/county.

- Use the Preview key to review the form.

- See the information to ensure that you have chosen the appropriate type.

- In the event the type is not what you are searching for, utilize the Research industry to find the type that meets your needs and needs.

- Once you get the appropriate type, simply click Acquire now.

- Opt for the rates strategy you would like, complete the necessary information to create your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Pick a handy file structure and acquire your version.

Get each of the record layouts you have bought in the My Forms food list. You may get a extra version of California Grant Agreement from 501(c)(3) to 501(c)(4) anytime, if needed. Just select the essential type to acquire or printing the record design.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, in order to save some time and stay away from mistakes. The service delivers skillfully manufactured legitimate record layouts that can be used for a selection of purposes. Create an account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

Grants are awards of financial assistance, usually from a governmental agency or foundation, primarily for carrying out a public purpose of support or stimulation. A grant is distinguished from a contract, which is used to acquire property or services for the government's direct benefit or use. Grant and Contract - Division of Financial Services - Cornell University cornell.edu ? topics ? revenueclass ? grant... cornell.edu ? topics ? revenueclass ? grant...

The government uses grants and cooperative agreements as a means of assisting researchers in developing research for the public good, whereas it uses contracts as a means of procuring a service for the benefit of the government. Grants are much more flexible than contracts. What is the difference between a Federal Grant and a Federal ... pitt.edu ? news ? what-difference-betwe... pitt.edu ? news ? what-difference-betwe...

In addition to 501c3 organizations, 501c3 nonprofits can also donate to 501c4 organizations. These contributions must be used for charitable purposes, and no amount can be used for political activities.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

If the purpose is to acquire property or services for the direct benefit or use of the federal government, the agency is to use a procurement contract; if the purpose is to stimulate or support an activity that serves a public purpose, the agency is to use a grant or cooperative agreement. Henke v. U.S. Department of Commerce, 83 F.3d 1445 - Casetext casetext.com ? case ? henke-v-us-department-of-c... casetext.com ? case ? henke-v-us-department-of-c...

Grants from a 501(c)(3) to a 501(c)(4) should not be made to cover fundraising costs or general support of the 501(c)(4) (this is to protect the 501(c)(3) from the grant being used for impermissible purposes).

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

The grant agreement defines what activities will be undertaken, the project duration, overall budget, rates and costs, the EU budget's contribution, all rights and obligations and more. Managing your project under a grant agreement European Commission ? funding-tenders ? man... European Commission ? funding-tenders ? man...