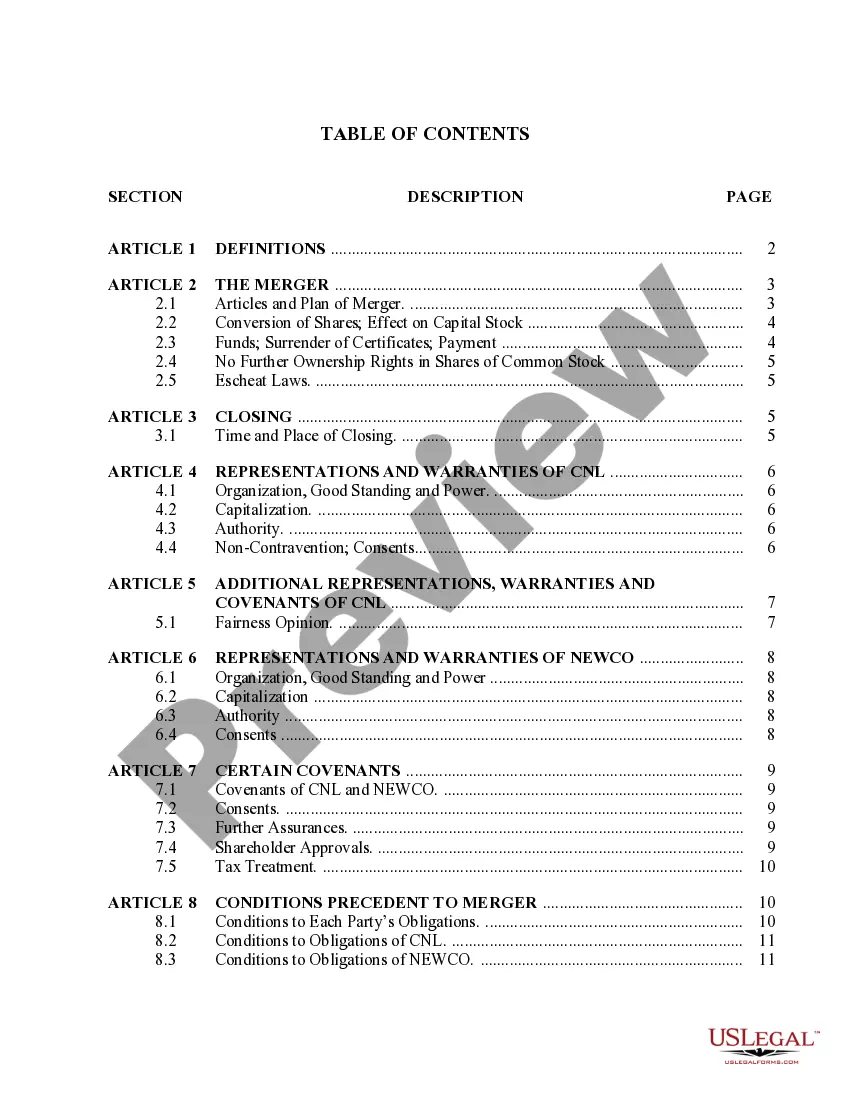

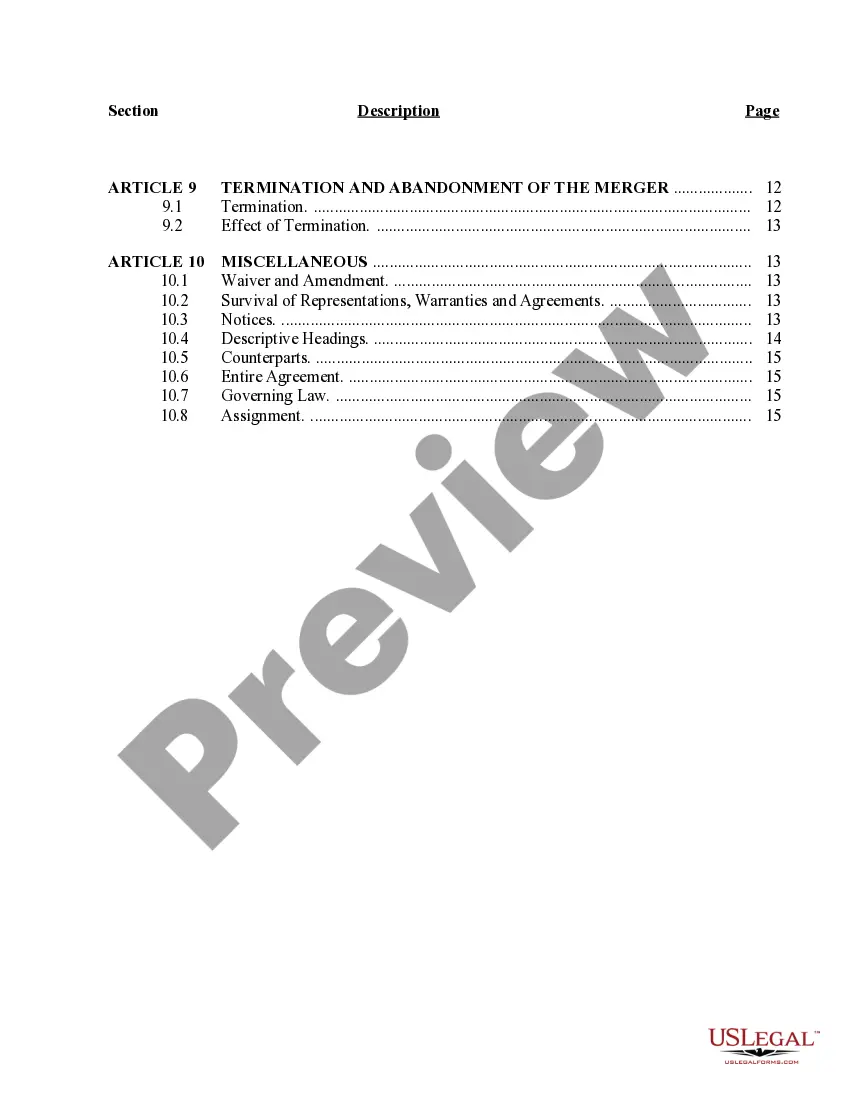

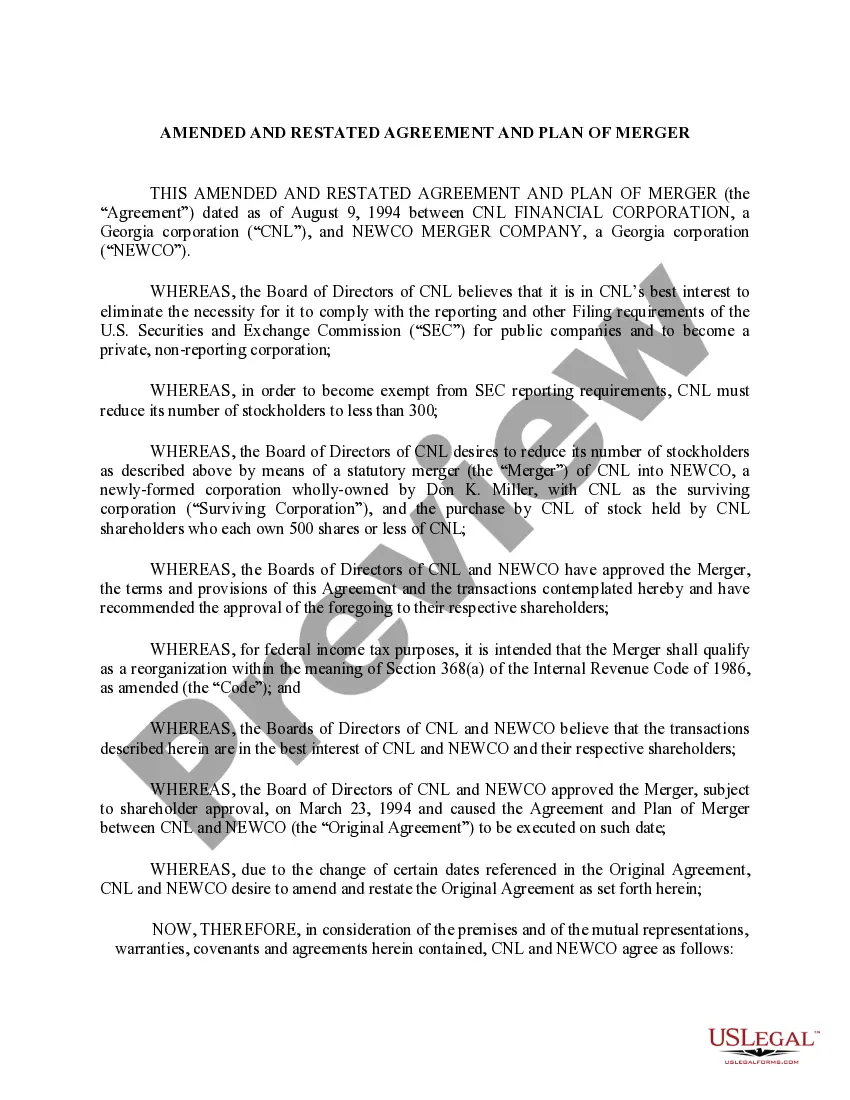

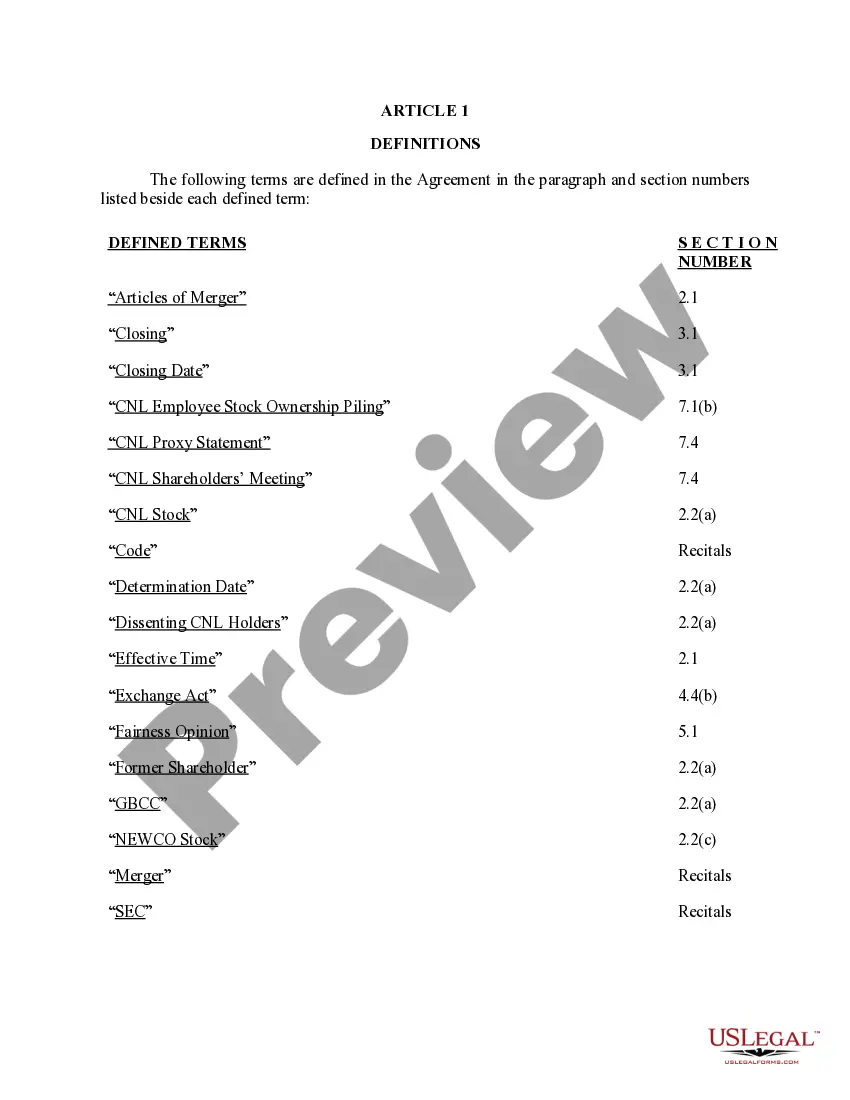

California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

How to fill out Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

Are you within a placement the place you need to have papers for possibly business or personal functions nearly every working day? There are plenty of legal papers web templates available on the Internet, but finding ones you can rely on is not straightforward. US Legal Forms provides a huge number of form web templates, like the California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co, that happen to be written in order to meet state and federal demands.

In case you are currently familiar with US Legal Forms website and also have an account, simply log in. Afterward, you are able to down load the California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co design.

Unless you provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Get the form you will need and make sure it is for your right area/region.

- Utilize the Preview key to review the form.

- See the description to ensure that you have chosen the appropriate form.

- In the event the form is not what you`re trying to find, take advantage of the Look for area to obtain the form that meets your needs and demands.

- When you discover the right form, click Purchase now.

- Select the prices plan you want, complete the required information to generate your bank account, and purchase the order making use of your PayPal or bank card.

- Pick a handy file formatting and down load your backup.

Locate every one of the papers web templates you may have bought in the My Forms food list. You may get a additional backup of California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co anytime, if necessary. Just go through the needed form to down load or produce the papers design.

Use US Legal Forms, by far the most comprehensive collection of legal varieties, to save efforts and avoid faults. The services provides expertly made legal papers web templates which can be used for a variety of functions. Generate an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The firms that agree to merge are roughly equal in terms of size, customers, and scale of operations. For this reason, the term "merger of equals" is sometimes used.

A merger involves two organizations, their people, and their collaboration capacity. For a merger to succeed, both parties must do thorough due diligence, recognize possible obstacles, capitalize on synergies, and appreciate the value each party brings to the new company.

5 Best Practices for Integrating After a Merger Focus on Leadership. Before you can roll out a large-scale change to any organization, you'll need to establish the process leaders. ... Prioritize Culture. Merging two organizations is no small feat. ... Dedicate Resources. ... Communicate Early and Often. ... Actively Manage the Process.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

7 Components of a Successful Business Merger or Acquisition Liquidity and financial health check. ... Transparency for the full team. ... Well-defined goals and success factors. ... M&A candidate must-haves. ... Planned and executed due diligence. ... A transition team. ... A carefully planned and performed integration.

Both terms often refer to the joining of two companies, but there are key differences involved in when to use them. A merger occurs when two separate entities combine forces to create a new, joint organization. Meanwhile, an acquisition refers to the takeover of one entity by another.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.