California Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

Should you wish to gather, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's user-friendly and efficient search feature to find the documents you need.

Various templates for commercial and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment process. You may use a credit card or a PayPal account to finalize the transaction.

- Use US Legal Forms to quickly find the California Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- If you are an existing US Legal Forms user, Log Into your account and click on the Download button to obtain the California Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow these steps.

- Step 1. Verify that you have selected the form for the correct city/state.

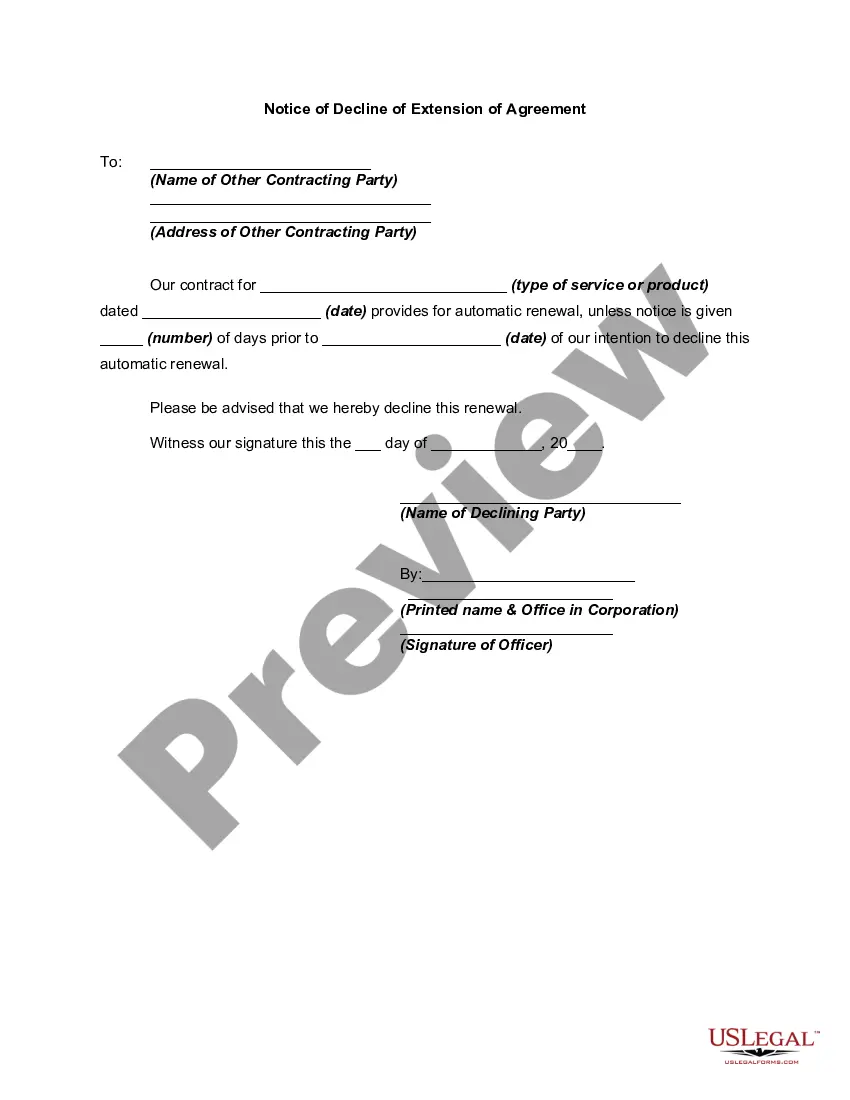

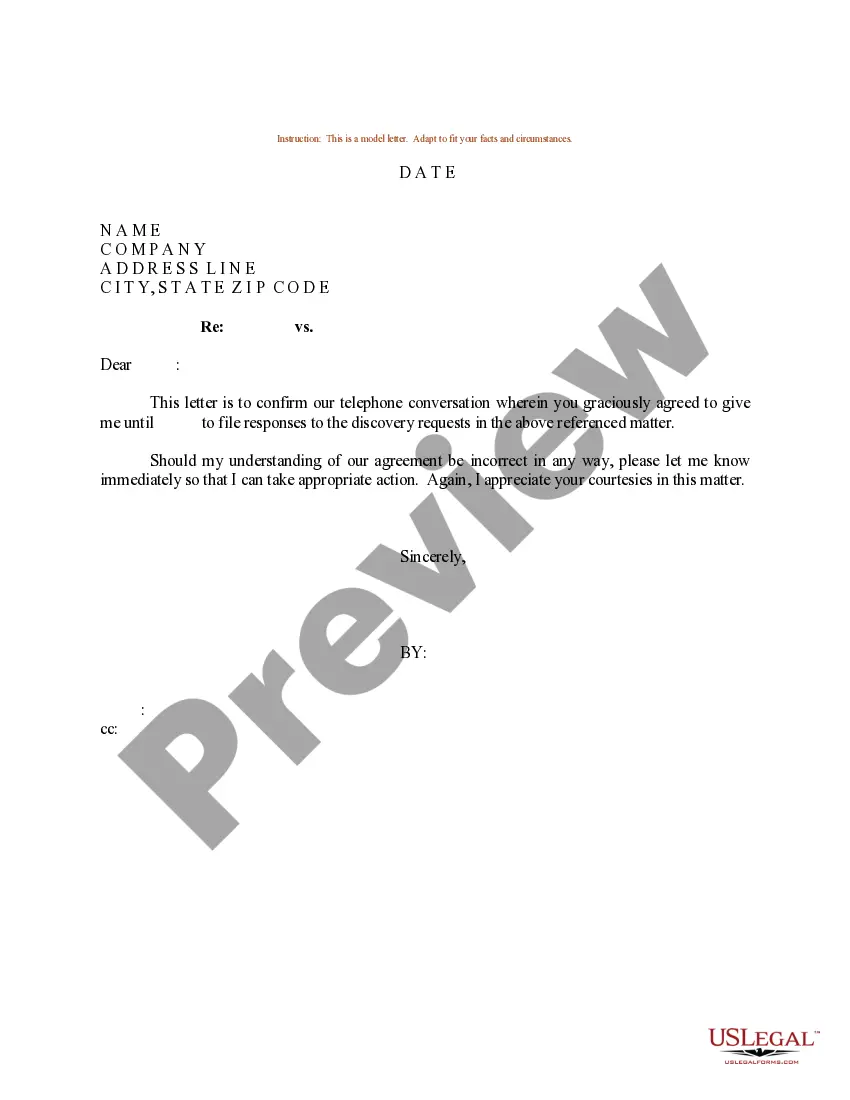

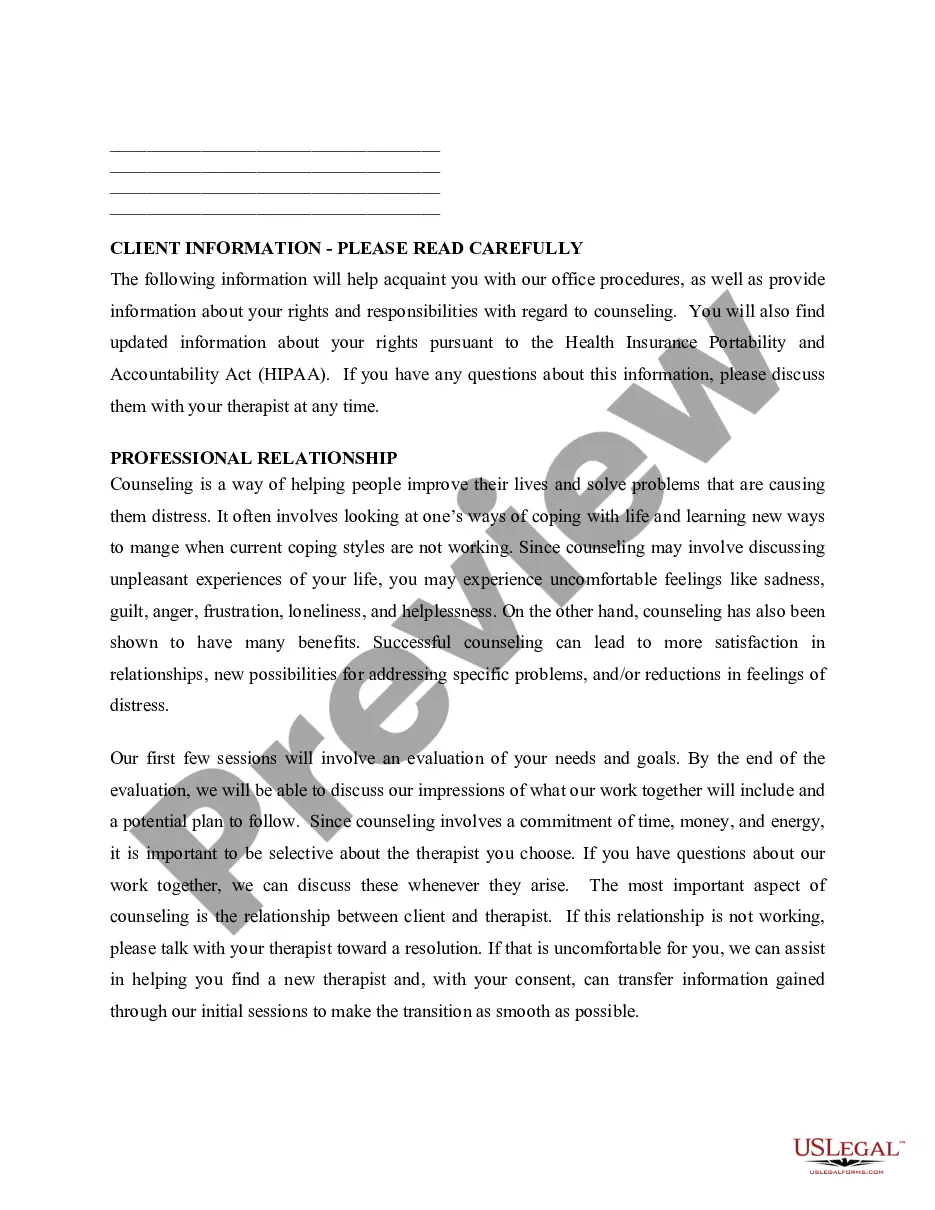

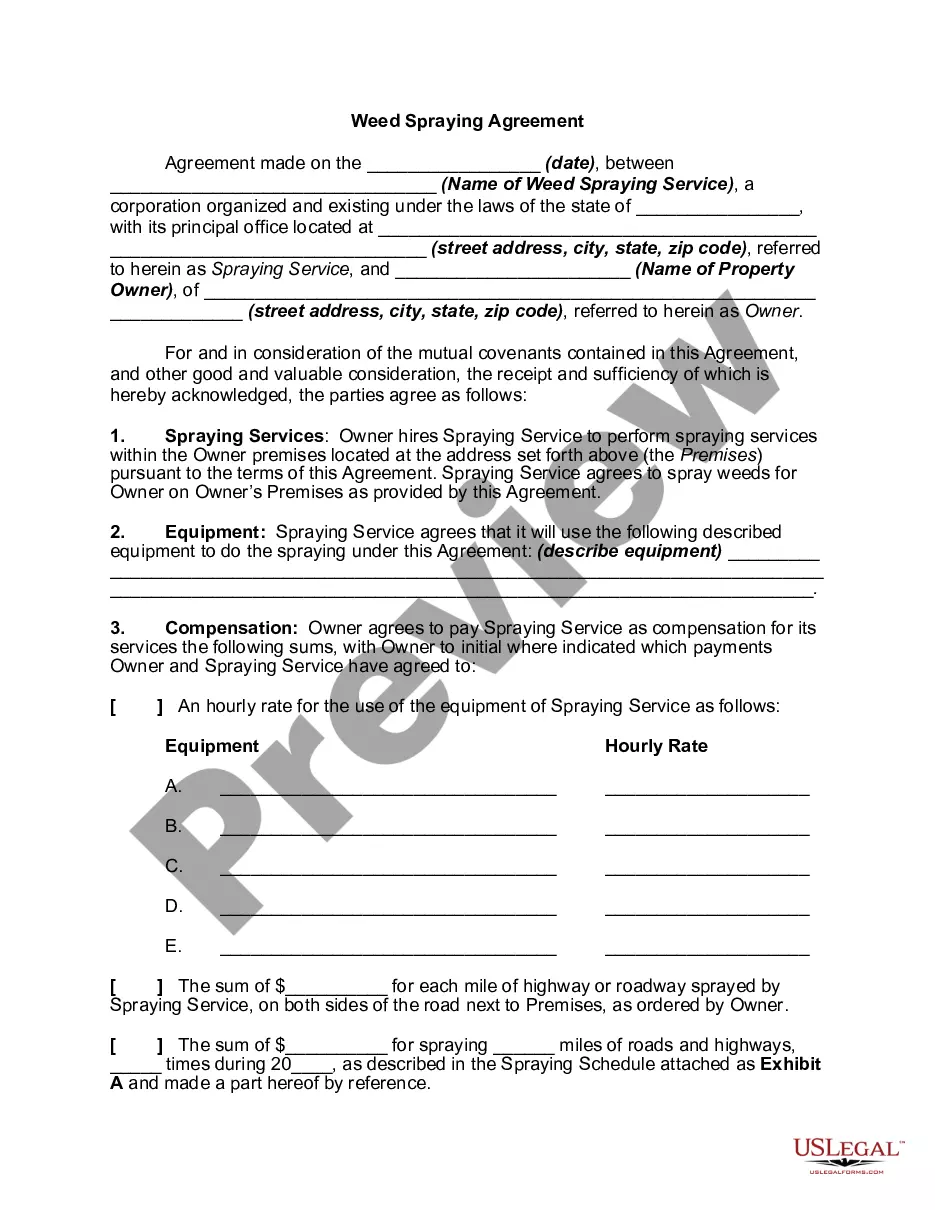

- Step 2. Use the Preview option to review the content of the form. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

A liquidation marks the official ending of a partnership agreement. To end the partnership, the parties involved sell the property the business owns, and each partner receives a share of the remaining money.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

Dissolution terminates the partners' authority to act for the partnership, except for winding up, but remaining partners may decide to carry on as a new partnership or may decide to terminate the firm.

In order to dissolve a partnership, the following four accounting steps must be executed: sell noncash assets; allocate any gains or losses arising from the sale based on the partnership agreement; pay off liabilities; distribute the remaining funds based on capital account balances of the partners.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

Dissolution of partnership means a process by which the relationship between the partners is terminated and comes to an end and all the assets, shares, accounts and liabilities are disposed of and settled. Section 39 of the Indian Partnership Act, 1932 defines the dissolution of the firm.

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.

Retirement of a partner. When a partnership terminates business, the sale of noncash assets is called. Realization. When a partnership interest is purchased. The buyer receives equity equal to the amount of cash paid.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.