California Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

If you desire to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and convenient search to locate the documents you need. Multiple templates for business and personal purposes are categorized by types and jurisdictions, or by keywords.

Use US Legal Forms to discover the California Security Agreement concerning Member Interests in Limited Liability Company with just a few clicks.

Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, as well as print the California Security Agreement concerning Member Interests in Limited Liability Company with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click on the Purchase option to obtain the California Security Agreement concerning Member Interests in Limited Liability Company.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form relevant to your city/state.

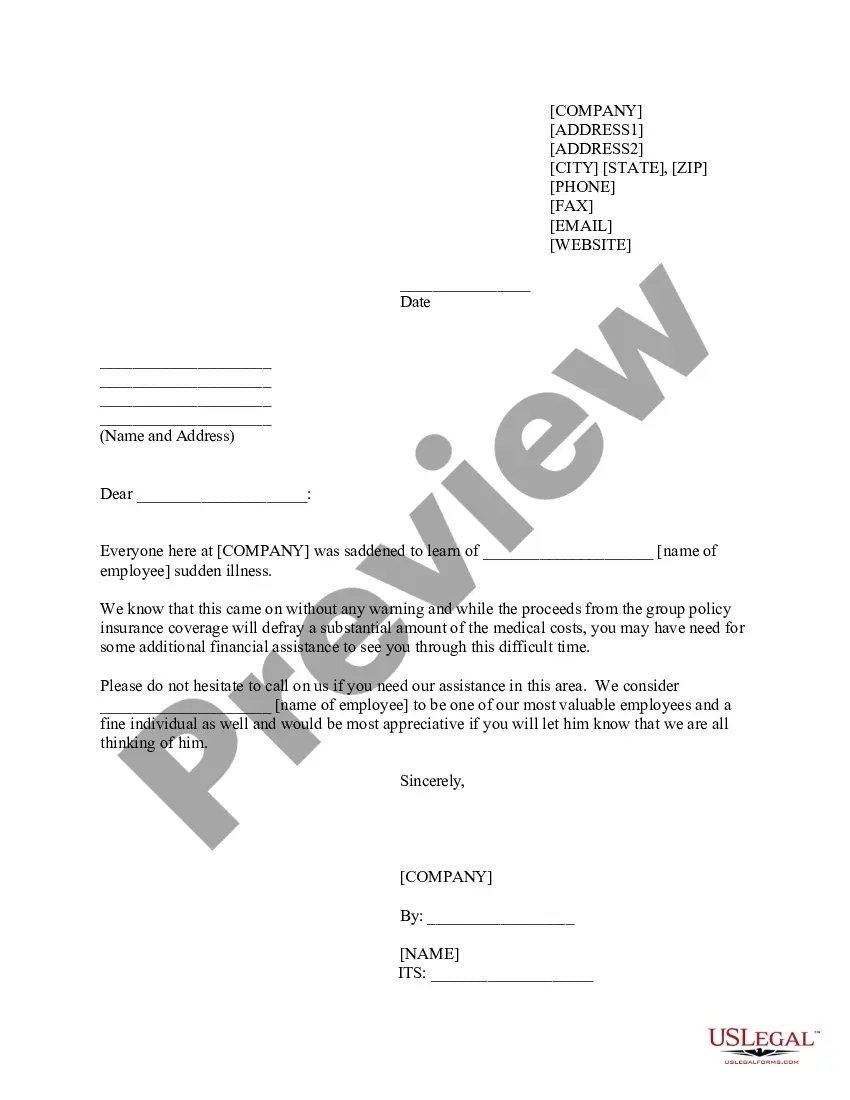

- Step 2. Utilize the Review option to examine the form's content. Remember to read the information thoroughly.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the required form, select the Buy Now option. Choose the pricing plan you prefer and input your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the California Security Agreement concerning Member Interests in Limited Liability Company.

Form popularity

FAQ

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

Because the Agreement of Limited Partnership is considered an investment contract, the SEC classifies LP units as securities. If the partnership is sold to the public, then they must be registered under the Securities Act of 1933.

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

Under most circumstances, an LLC interest is a general intangible, and the lender will perfect its security interest by filing an initial UCC financing statement in the state where the pledgor is located, which for an individual pledgor is the state of his/her principal residence and for a registered organization

A member's interest includes both a right to capital and income and also the obligation to manage the business1. The law is clear that non-members can have an interest in an LLP2 and so a member of an LLP can charge his membership interest. Conversely, a lender will not want to be responsible for running the LLP.

Hence, a general partnership interest is not necessarily or even typically securities unless the Animal Farm1 rule applies, i.e., some general partners have much greater power and/or control of the information so that the other general partners are seen more like relatively passive investors.

Limited liability partnership interests are typically securities, since, like in limited partnerships, LLP limited interests lack managerial powers and have limited liability.

A partnership can't grant a floating charge so lenders don't have the ease of taking security over assets under a debenture as they can with a company or LLP (the exception to this is if one of the partners is a company or LLP itself, in which case it can grant a floating charge over the assets it holds).

As a result, lenders desiring to secure their loans with an equity pledge (typically either in the borrower itself or its subsidiaries) are increasingly taking pledges of LLC membership interests as part of their collateral.