California Sample Letter for Petition for Approval of the Sale

Description

How to fill out Sample Letter For Petition For Approval Of The Sale?

Have you been in the situation in which you will need paperwork for either enterprise or specific reasons just about every time? There are tons of legal file web templates accessible on the Internet, but locating versions you can rely on isn`t easy. US Legal Forms gives thousands of type web templates, just like the California Sample Letter for Petition for Approval of the Sale, that are created in order to meet federal and state specifications.

When you are already informed about US Legal Forms site and possess a free account, simply log in. Afterward, you may acquire the California Sample Letter for Petition for Approval of the Sale design.

Should you not have an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the type you require and make sure it is for that right town/state.

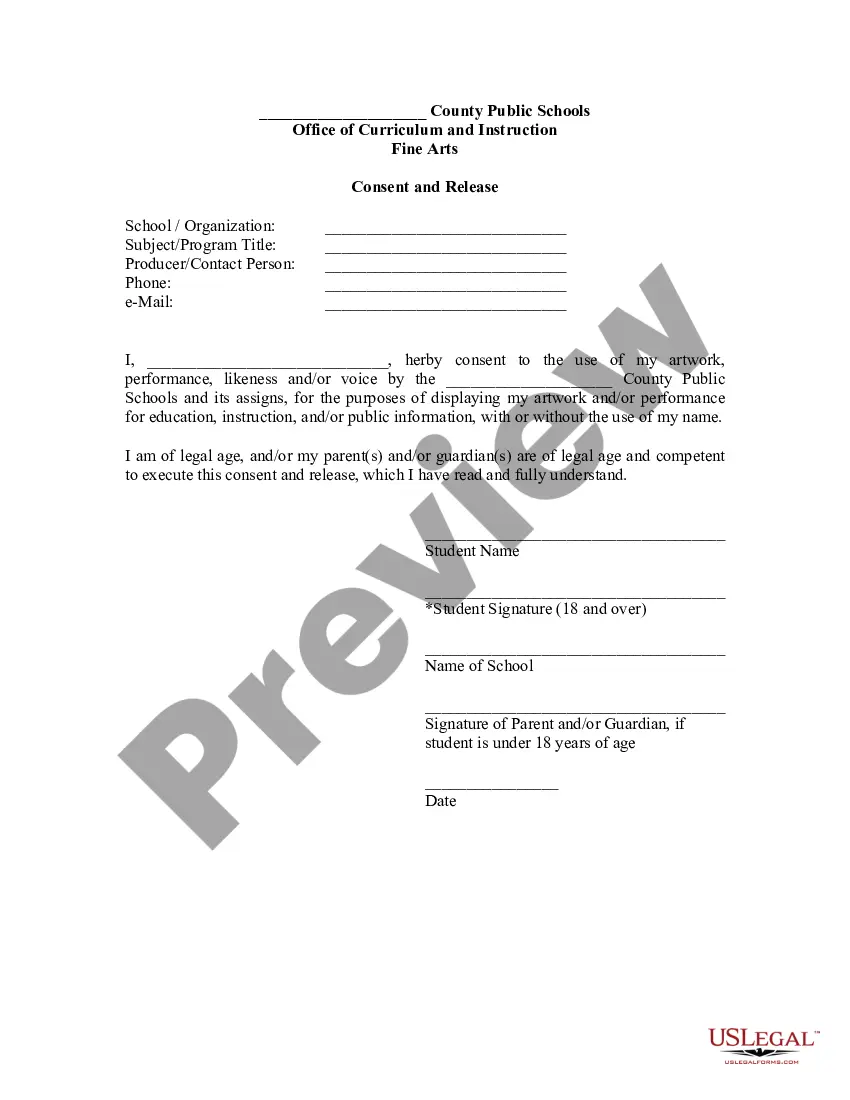

- Make use of the Review switch to analyze the form.

- See the description to ensure that you have selected the appropriate type.

- If the type isn`t what you`re trying to find, utilize the Look for area to discover the type that suits you and specifications.

- Whenever you get the right type, simply click Buy now.

- Opt for the prices program you need, complete the required details to create your account, and pay money for the order using your PayPal or credit card.

- Choose a handy file formatting and acquire your backup.

Get all the file web templates you have bought in the My Forms menu. You can aquire a further backup of California Sample Letter for Petition for Approval of the Sale whenever, if required. Just go through the needed type to acquire or produce the file design.

Use US Legal Forms, one of the most considerable variety of legal forms, to save lots of time as well as prevent errors. The service gives professionally manufactured legal file web templates that can be used for a selection of reasons. Generate a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

To establish heir status in California, you may file an ?affidavit of heirship? in the Superior Court of the county where your deceased family member's property is located. California family code states that the petition must include the heir's basic information including a description of the property you are claiming, ...

An order determining succession to real property is an alternative petition to get a court order transferring the property. (Prob. Code § 13154.)

Real estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.

Make a sworn statement to the court that the value of all the property in California in a deceased person's estate is $166,250 or less and ask the court, without going through the probate process, to decide that you (and anyone else making the request) should get the deceased person's real property because you are a ...

You have to have some interest in the proceeding, but for an example, if you're a creditor of an Estate, you may want to file a request for special notice just to make sure that you know everything that's being filed and nobody forgets to give you notice, and under some circumstances, a creditor may not be required to ...

A final account and petition for distribution can be filed by the Personal Representative when there are sufficient funds available to pay all debts and taxes, the time for filing creditors' claims has expired, and the estate is in a condition to be closed.

If you have the legal right to inherit personal property, like money in a bank account or stocks, and the estate is worth $184,500 or less, you may not have to go to court to have the property transferred to you.

In the event of death without a will, the surviving spouse or partner typically inherits 50% of the separate property. The remaining 50% is distributed to the deceased's children, parents, siblings, and other relatives, ing to California's intestate succession law.