California Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

You can spend time online looking for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of valid forms that are evaluated by experts.

It is easy to download or print the California Assignment of LLC Company Interest to Living Trust from the service.

If available, utilize the Review option to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download option.

- After that, you can fill out, modify, print, or sign the California Assignment of LLC Company Interest to Living Trust.

- Each valid document template you purchase is yours indefinitely.

- To obtain an additional copy of any acquired form, go to the My documents tab and select the corresponding option.

- When using the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have chosen the appropriate document template for the state/town you select.

- Review the form details to ensure you have chosen the correct form.

Form popularity

FAQ

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

When it comes to owning and operating a business one of the most tax effective and flexible business structures is a discretionary family trust. It is not uncommon for a business to be started as a sole operator or a partnership of individuals, and then transfer the business to a family trust.

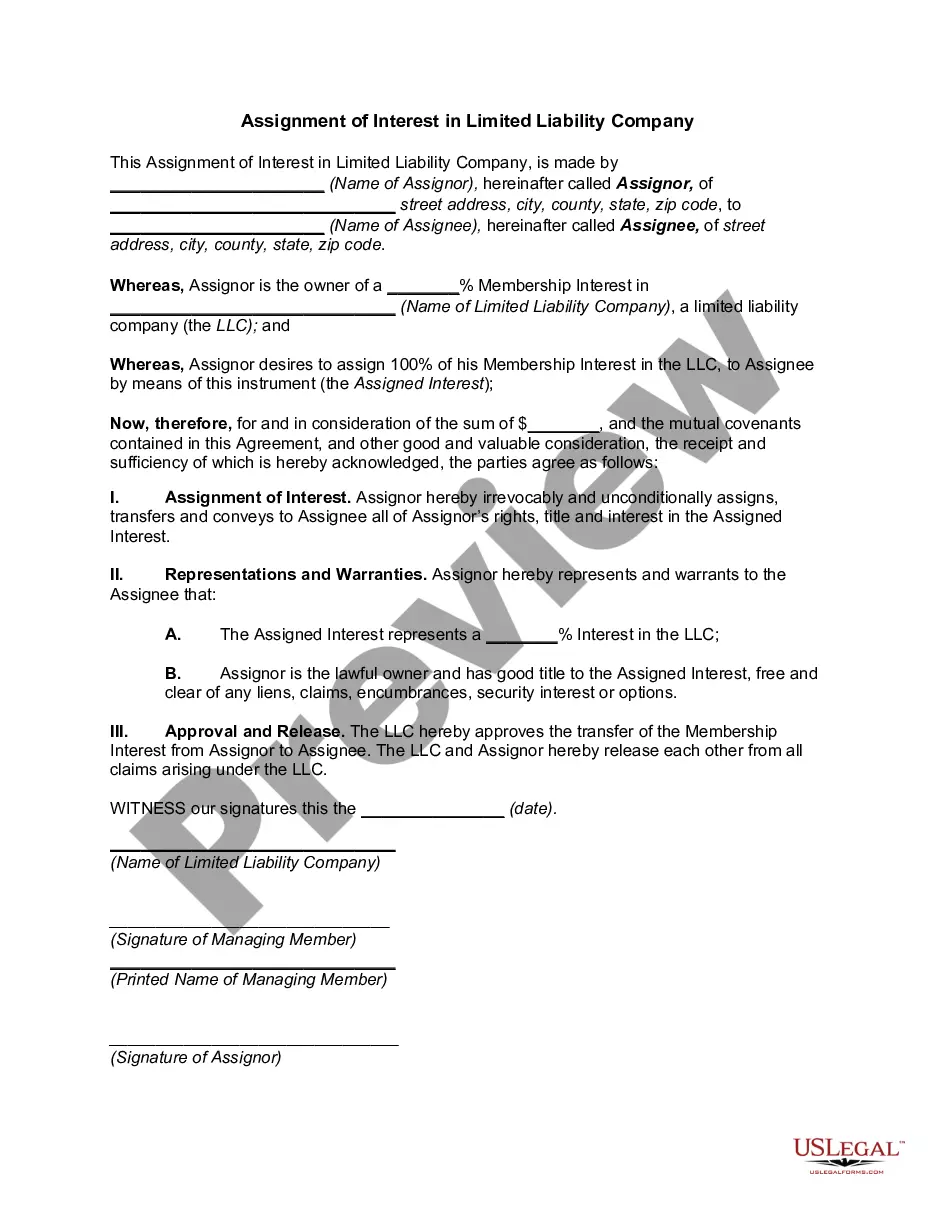

The assignment of interest is typically different from selling the ownership stake. Selling a member's ownership stake in the LLC requires unanimous approval by the other members. A departing member may also assign his membership to another member.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

The settlor instead should execute a separate assignment of the settlor's LLC interest to the trust. For an LLC interest to be properly transferred to a revocable trust, the LLC must change the owner of record to the trust (specifically, to the trustee, as trustee of the trust).

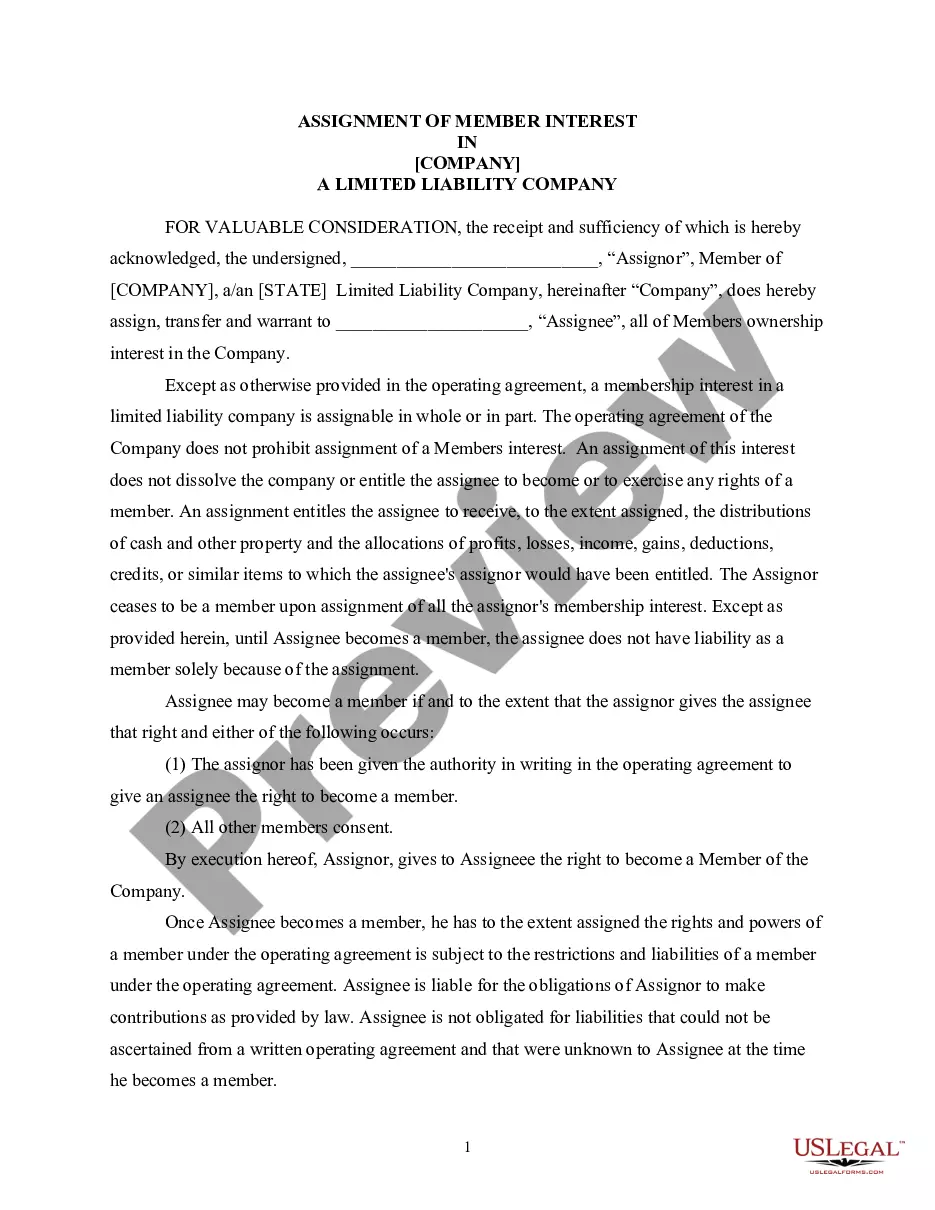

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other