28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

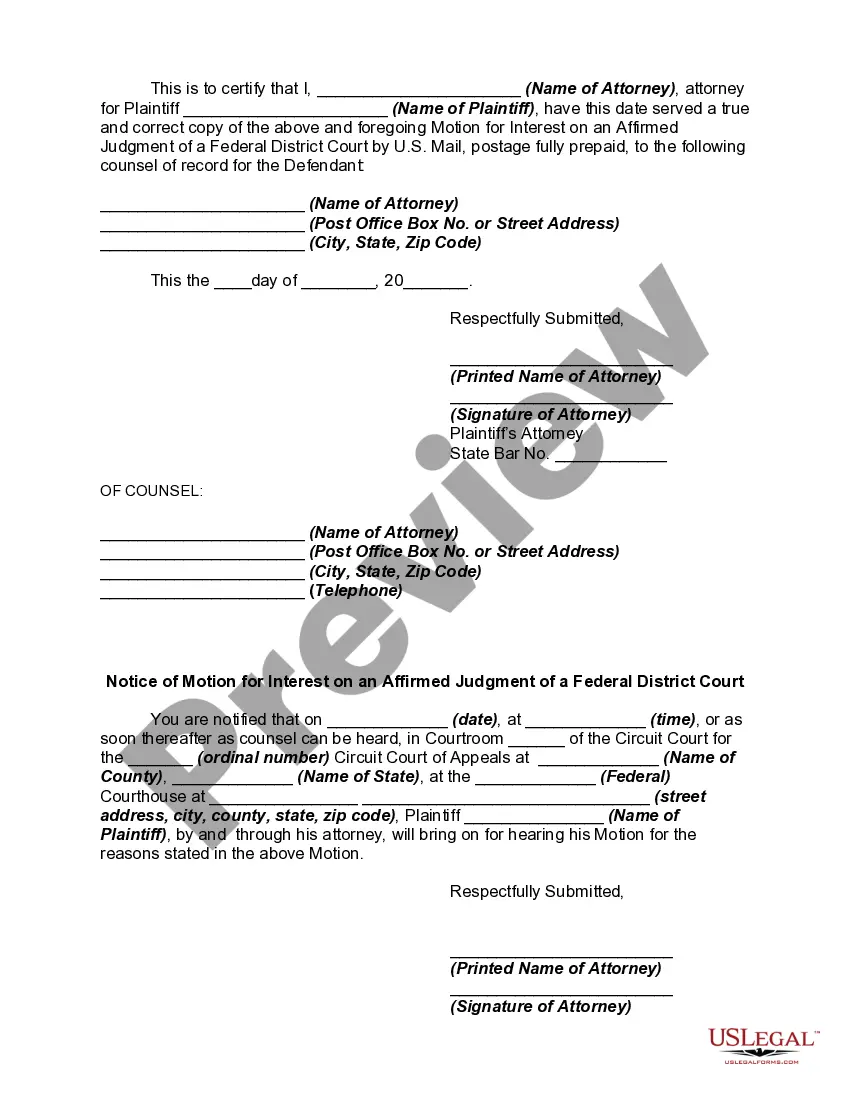

California Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

US Legal Forms - among the biggest libraries of legal varieties in the States - provides an array of legal file templates you can obtain or print out. While using website, you can find 1000s of varieties for business and individual functions, categorized by classes, claims, or search phrases.You will find the latest variations of varieties just like the California Motion for Interest on an Affirmed Judgment of a Federal District Court within minutes.

If you already possess a subscription, log in and obtain California Motion for Interest on an Affirmed Judgment of a Federal District Court from your US Legal Forms catalogue. The Acquire key will show up on each form you view. You gain access to all earlier saved varieties from the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, listed here are easy instructions to get you started:

- Be sure to have chosen the correct form for the town/area. Click the Review key to review the form`s information. Read the form information to actually have selected the appropriate form.

- In the event the form does not match your specifications, use the Research area near the top of the display screen to find the one that does.

- When you are happy with the form, verify your decision by simply clicking the Buy now key. Then, opt for the costs plan you prefer and offer your qualifications to register to have an profile.

- Method the transaction. Utilize your credit card or PayPal profile to accomplish the transaction.

- Select the structure and obtain the form in your system.

- Make adjustments. Fill up, edit and print out and indication the saved California Motion for Interest on an Affirmed Judgment of a Federal District Court.

Each template you included in your account lacks an expiry date and is also your own eternally. So, in order to obtain or print out yet another copy, just visit the My Forms portion and click in the form you require.

Get access to the California Motion for Interest on an Affirmed Judgment of a Federal District Court with US Legal Forms, probably the most considerable catalogue of legal file templates. Use 1000s of expert and express-distinct templates that satisfy your organization or individual needs and specifications.

Form popularity

FAQ

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

Generally, any unpaid principal balance collects interest at 10%, or 7% if the debtor is a government agency. This general rule applies to any judgment against a business or government agency, or when the debtor owes $200,000 or more.

Motions for Judgment Notwithstanding the Verdict (JNOV) must be filed within fifteen days after the service of notice of entry of the judgment. (§§ 629, 659.)

In California, the judgment creditor is entitled to interest on the principal amount of the judgment that remains unsatisfied. CCP § 685.010(a). The rate of interest on a money judgment is 10% per year.

Post-Judgment Interest Rates - 2023 Week EndingRate (%)8/11/20235.348/18/20235.368/25/20235.399/1/20235.3911 more rows

Following is the formula for figuring out the amount of interest earned per day on a judgment. Formula: Total amount of judgment owed x 10% (or 0.10) = interest earned per year. Example: Judgment debtor owes the judgment creditor $5,000 (the ?judgment principal?).