California Partnership Dissolution Agreement

Description

How to fill out Partnership Dissolution Agreement?

If you desire to compile, obtain, or print authentic document templates, utilize US Legal Forms, the premier selection of authentic forms, accessible online.

Employ the website's simple and convenient search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and claims, or search terms. Utilize US Legal Forms to find the California Partnership Dissolution Agreement in merely a few clicks.

Every authentic document template you obtain is yours forever. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the California Partnership Dissolution Agreement with US Legal Forms. There are numerous professional and state-specific forms you can use for business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the California Partnership Dissolution Agreement.

- You can also access forms you previously downloaded from the My documents tab within your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/county.

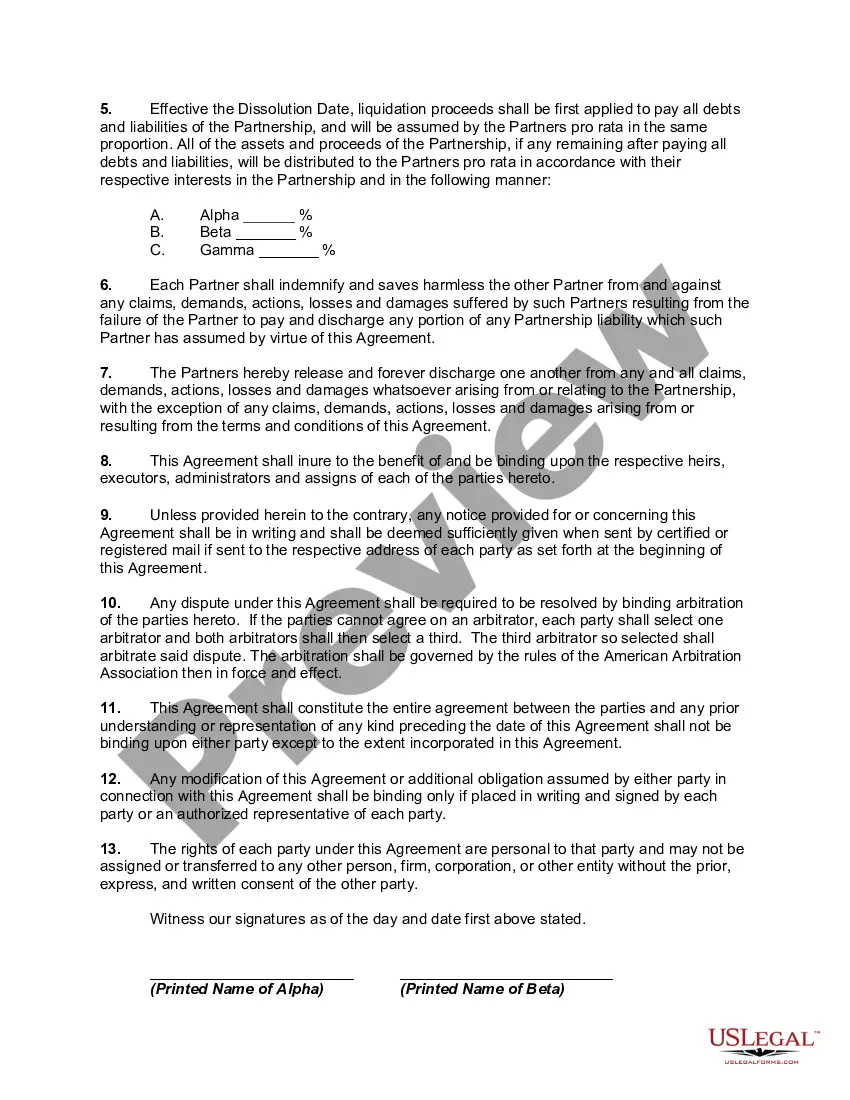

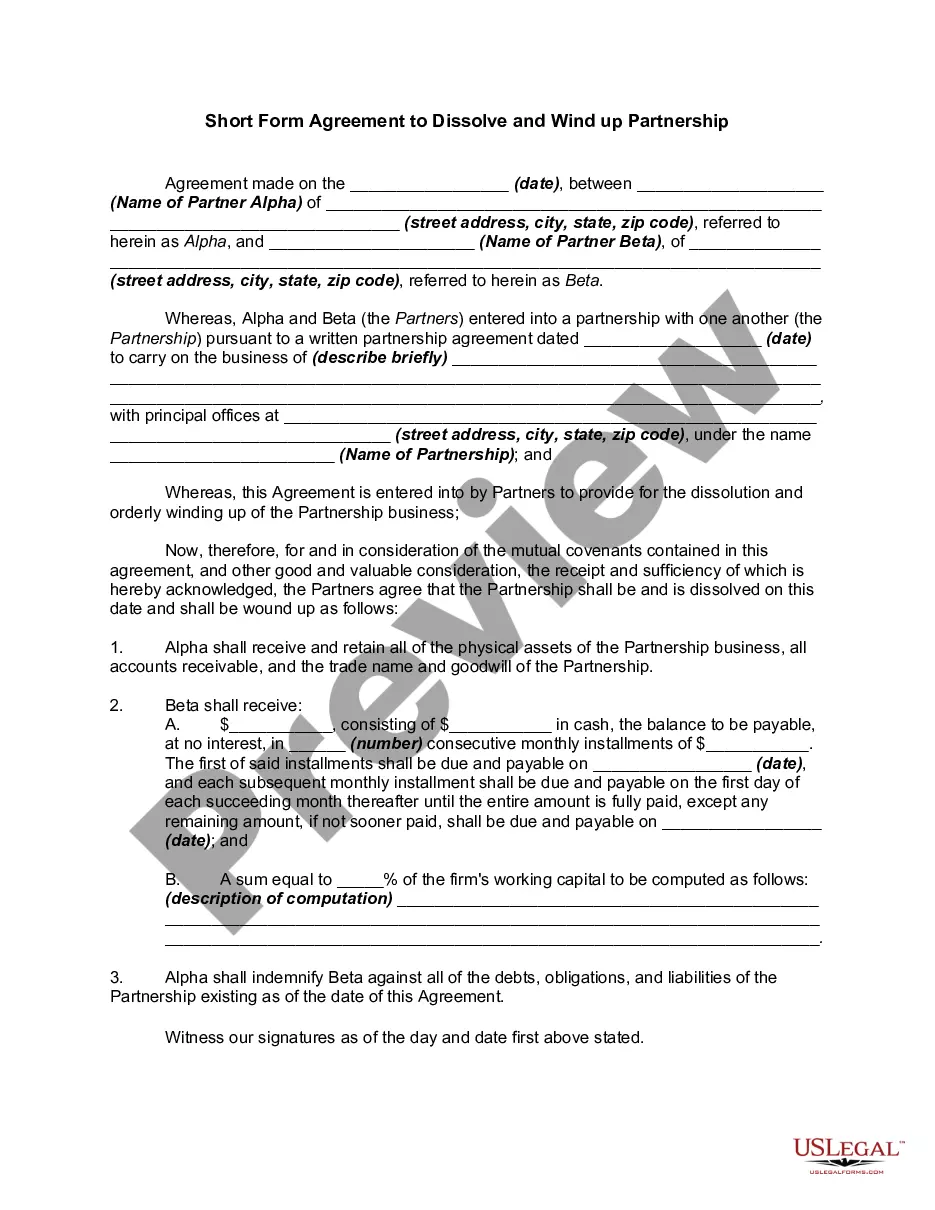

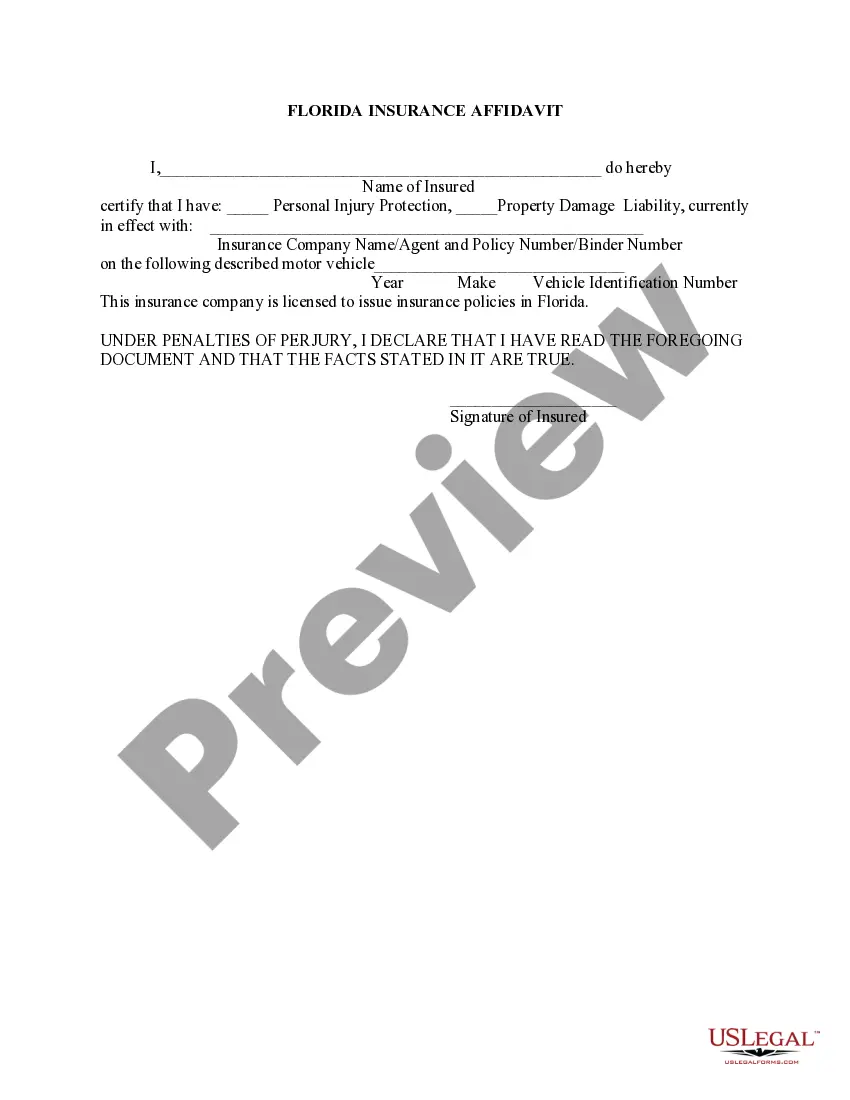

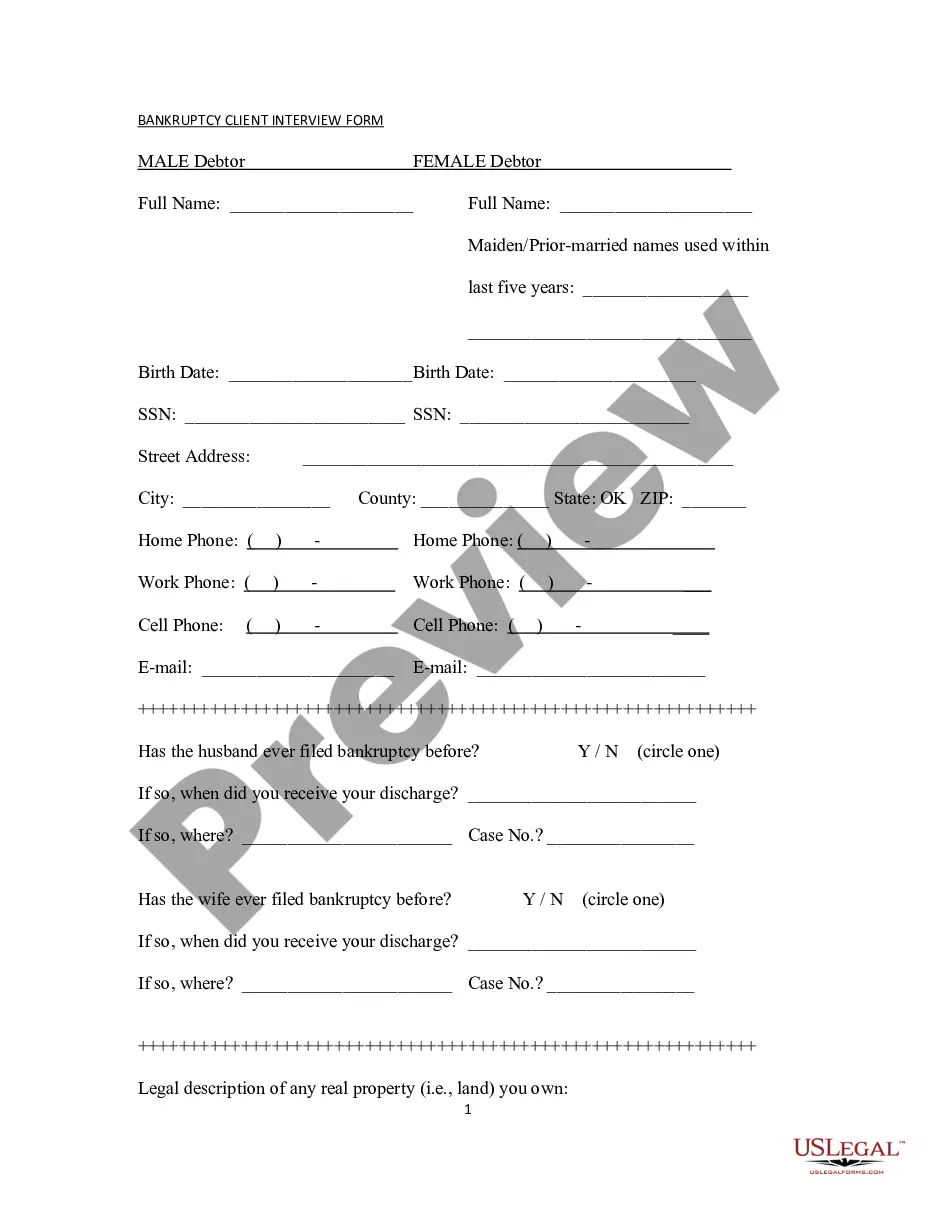

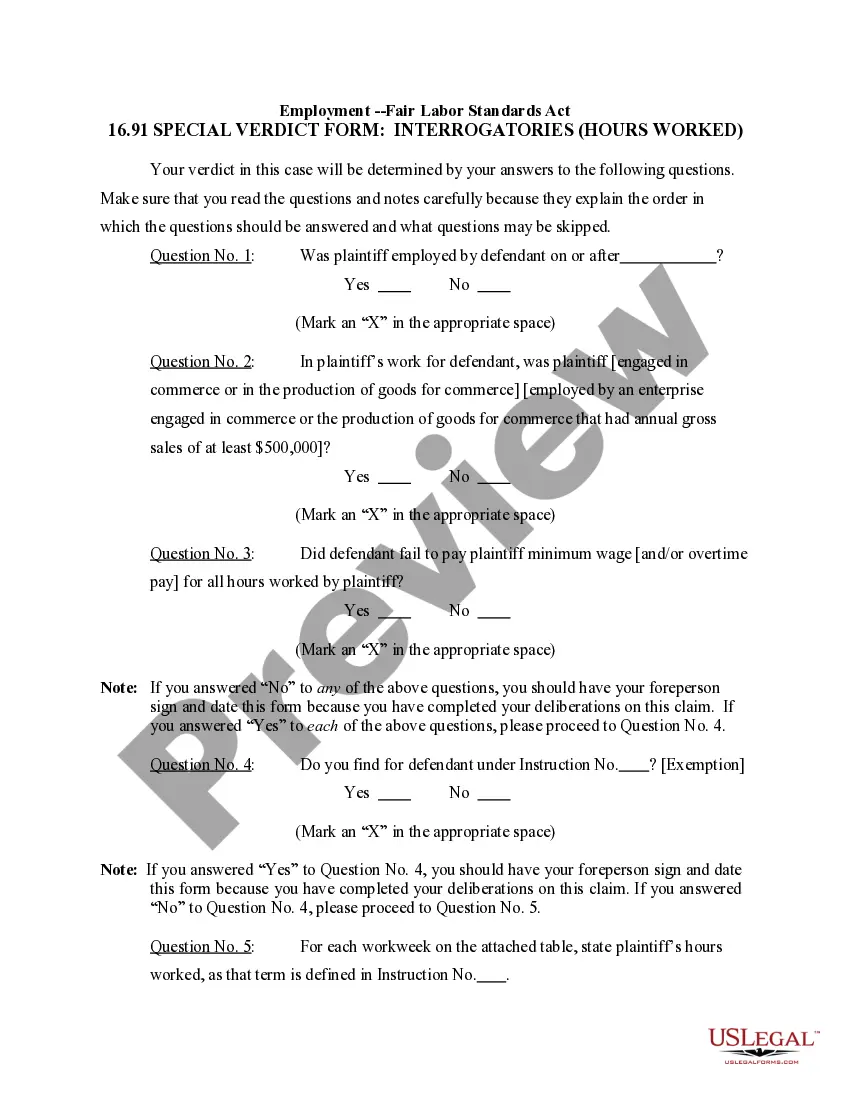

- Step 2. Utilize the Preview option to review the form’s contents. Don’t forget to read the details.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find alternate versions of the authentic form template.

- Step 4. Once you have identified the form you want, click the Acquire now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Process the transaction. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the authentic form and download it onto your device.

- Step 7. Complete, modify, and print or sign the California Partnership Dissolution Agreement.

Form popularity

FAQ

To dissolve a partnership agreement effectively, start by discussing the decision with your partners to ensure everyone is on the same page. Then, draft a California Partnership Dissolution Agreement that encapsulates the terms and conditions of the dissolution. This structured approach not only clarifies responsibilities but also provides a solid legal foundation for the closing process.

Closing a partnership involves several essential steps, including informing all partners and complying with the partnership agreement. Next, settle any outstanding debts and obligations before drafting a California Partnership Dissolution Agreement. This agreement should clearly document all terms of the closure, helping to prevent future disputes.

In California, GP 1 refers to the General Partnership Form, which is not always required for all partnerships. However, obtaining a California Partnership Dissolution Agreement is vital when closing your partnership, as it ensures that the dissolution complies with state laws. Consulting with legal experts can provide guidance on whether GP 1 applies to your situation.

To dissolve a partnership in California, you must initiate a conversation among all partners about the decision. Following this discussion, a California Partnership Dissolution Agreement should be prepared to outline the terms of the dissolution. Be sure to file any necessary paperwork with the California Secretary of State to fully complete the dissolution process.

Terminating a partnership agreement involves notifying all partners of the decision and referring to the partnership's governing documents. It’s important to follow the specific procedures outlined in your agreement for termination. A California Partnership Dissolution Agreement provides a structured method to officially end the partnership and cover any outstanding matters.

To dissolve a partnership agreement, first, review the terms outlined in your partnership contract. Next, the partners must communicate openly and reach a consensus to dissolve the partnership. Finally, a California Partnership Dissolution Agreement should be drafted to formalize the dissolution process, ensuring all legal obligations are met.

Dissolving a partnership in California involves filing certain documents that detail your intent to end the partnership. You will need to create a California Partnership Dissolution Agreement to outline the terms and distribute assets accordingly. This agreement helps protect your interests and ensures that all partners agree on how to handle outstanding debts and responsibilities. Utilizing UsLegalForms can simplify this process by providing templates and guidance tailored to California law.

To exit a 50/50 partnership, you typically need to refer to your partnership agreement, which should outline the steps for withdrawal. If both partners agree, you can negotiate terms for a buyout or amicable exit. In situations where an agreement cannot be reached, you may have to consider a California Partnership Dissolution Agreement to formally dissolve the partnership, ensuring all obligations are resolved properly.

Yes, you can dissolve a California corporation online through the California Secretary of State's website. They provide a straightforward electronic filing system that allows you to complete the necessary forms and submit them with ease. If you're also working through a California Partnership Dissolution Agreement for a partnership, consider utilizing comprehensive online resources that can assist in ensuring all aspects of dissolution are properly handled.

CA 565 is a tax form that needs to be filed by partnerships operating in California, reporting income and other tax-related information. If your business was structured as a partnership and is coming to an end, it is crucial to file this form as part of the dissolution process. Incorporating a California Partnership Dissolution Agreement can help navigate the filing requirements, ensuring that all necessary details are accurately reported.