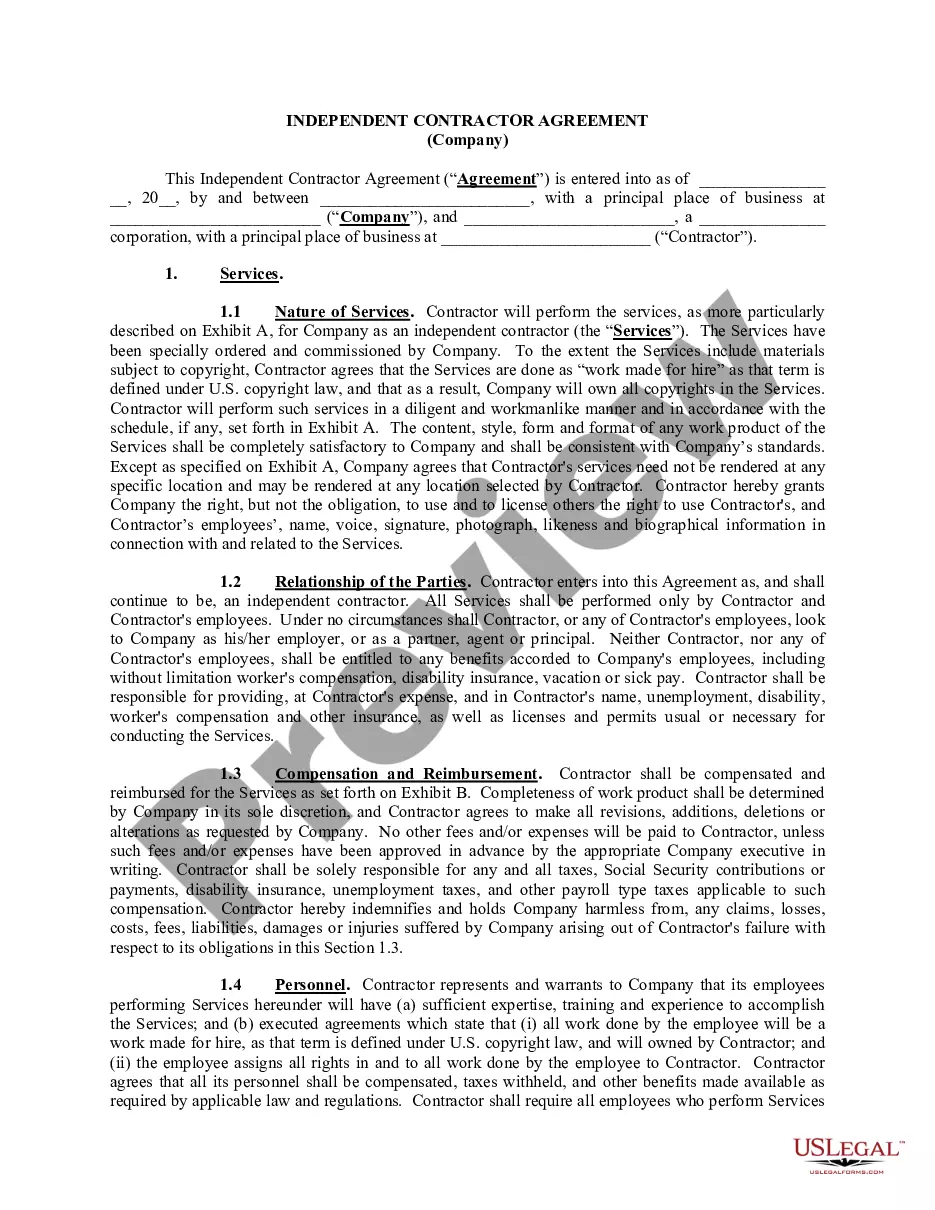

California Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

If you need to acquire, procure, or print official document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal use are sorted by categories and options, or keywords.

Step 4. Once you find the form you need, click on the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to obtain the California Lease of Computer Equipment with Equipment Schedule and Option to Purchase in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the California Lease of Computer Equipment with Equipment Schedule and Option to Purchase.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

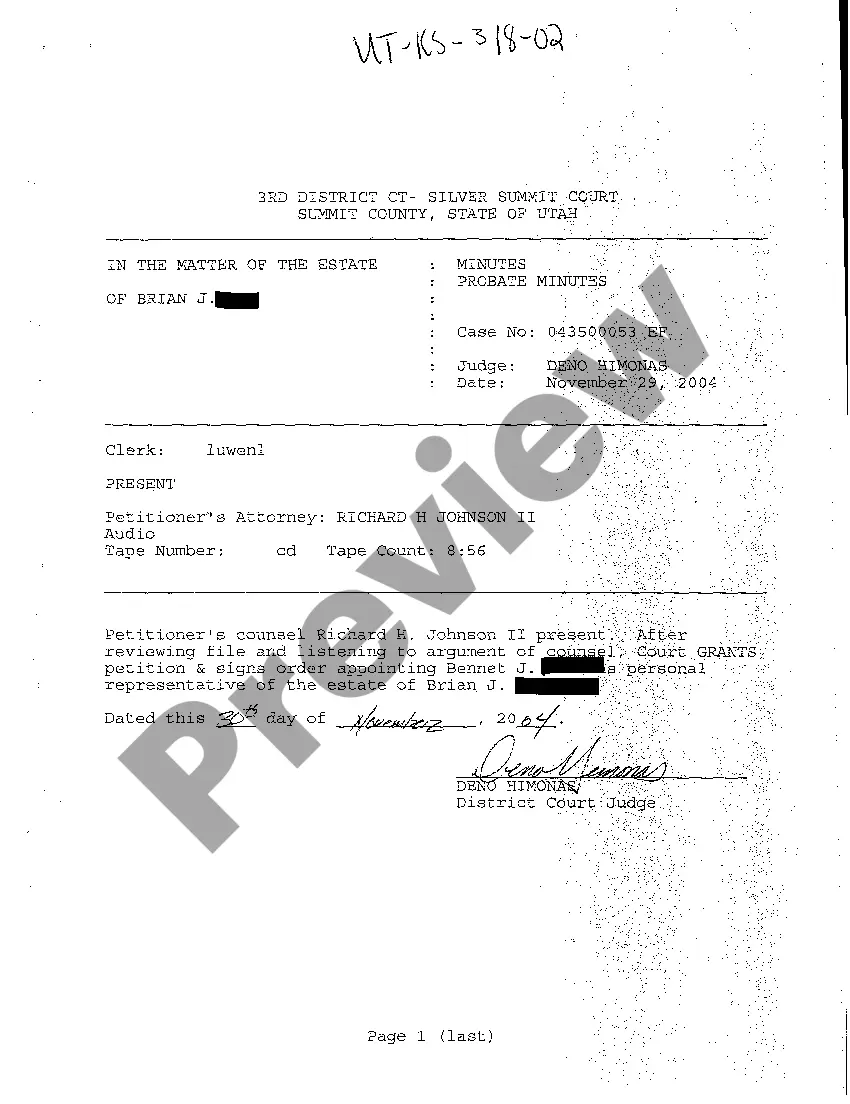

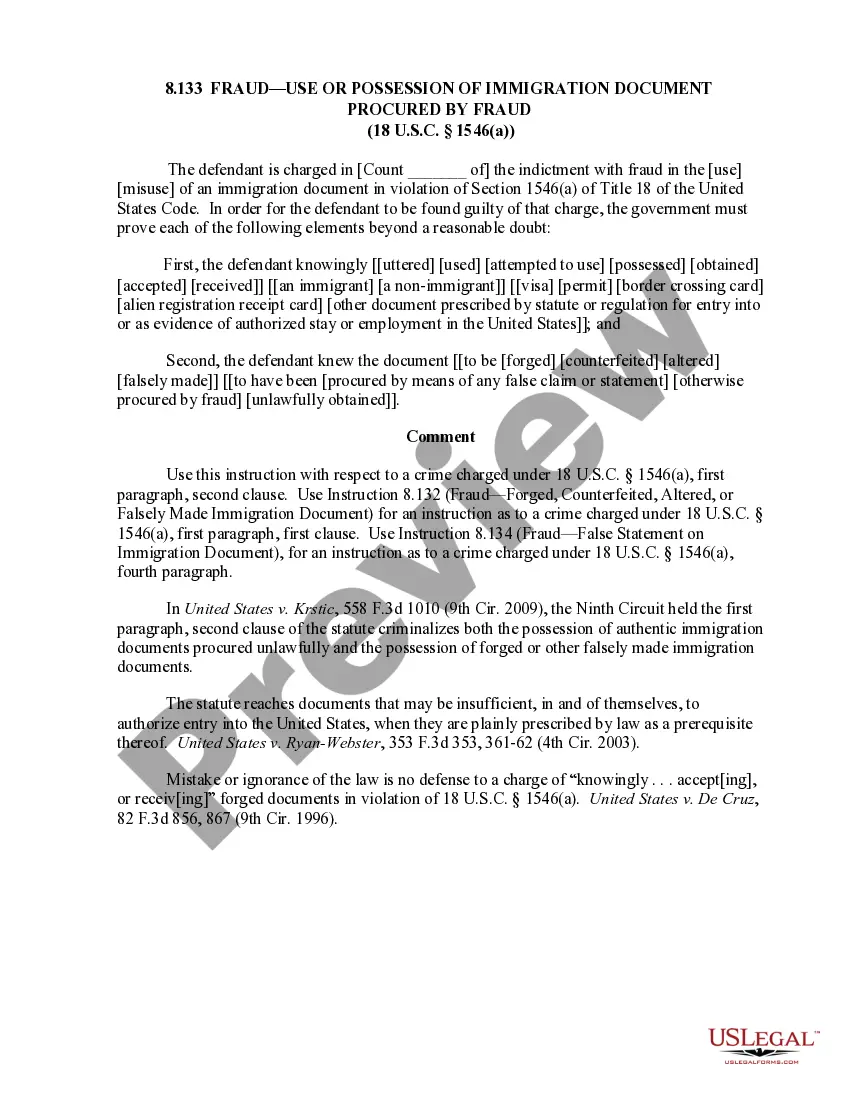

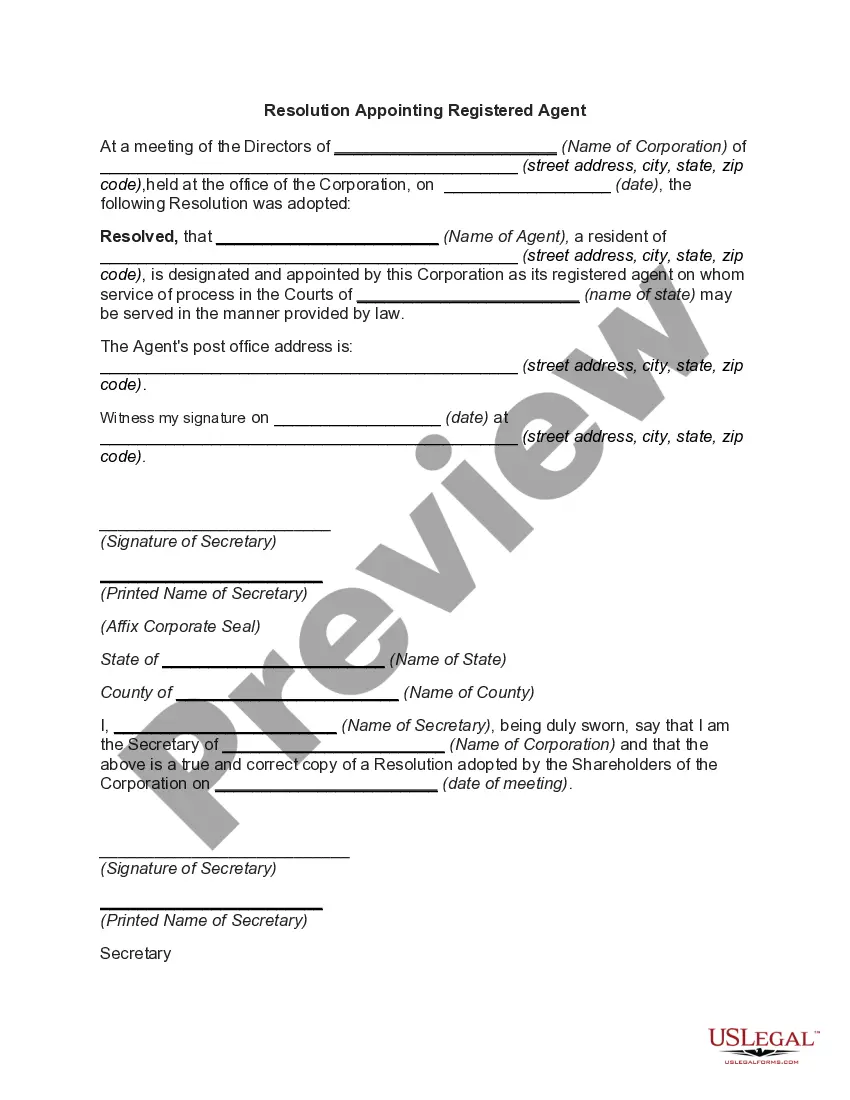

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the template, use the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Yes, you can usually exit an equipment lease under certain conditions described in your contract. Common ways include negotiating a lease transfer or early termination. Always consult with your lessor to discuss your specific situation for a mutually agreeable solution.

Typically, a credit score of 680 or higher is preferred for leasing computer equipment in California. However, factors such as your business revenue and history also come into play. If your score is lower, consider reaching out to uslegalforms for guidance and options tailored to your needs.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Equipment LeaseGo to the Lists menu, then choose Chart of Accounts.From the Account 25bcdropdown, click New.Select an account type, then select Continue.Complete the account details.Once done, click Save & Close.

option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an upfront option fee and an additional amount each month that goes toward the eventual down payment.

Lease Options are commonly seen in California. The agreement gives the tenant an irrevocable right to buy the property under certain conditions, and usually have restrictions based on tenant defaults.

How to Record "Lease to Own" Computer assetCreate Other Current Liability account for the loan/lease payable.Create Fixed Asset account for Computer Equipment.You must use a General Journal Entry, as taxes cannot be entered from the register.

A lease option allows the landlord to retain the legal title of the lease option property, without the mundane management responsibilities. Lease options are also an ideal way of securing long term tenants. Most lease-options are for an average term of between 7 and 10 years.

Typically, these leases were recorded on the asset side of the balance sheet under Property, Plant and Equipment (PP&E) while the lease liabilities were recorded in Debt or Other Liabilities.