California Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

Are you presently in a situation where you require paperwork for both professional or personal matters almost daily.

There are numerous legal document formats available online, but finding reliable ones is not simple.

US Legal Forms offers thousands of form templates, including the California Comprehensive Equipment Lease with Provision Regarding Investment Tax, which are designed to comply with federal and state regulations.

Once you have acquired the correct document, click Buy now.

Choose the payment plan you desire, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Comprehensive Equipment Lease with Provision Regarding Investment Tax template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for the correct area/state.

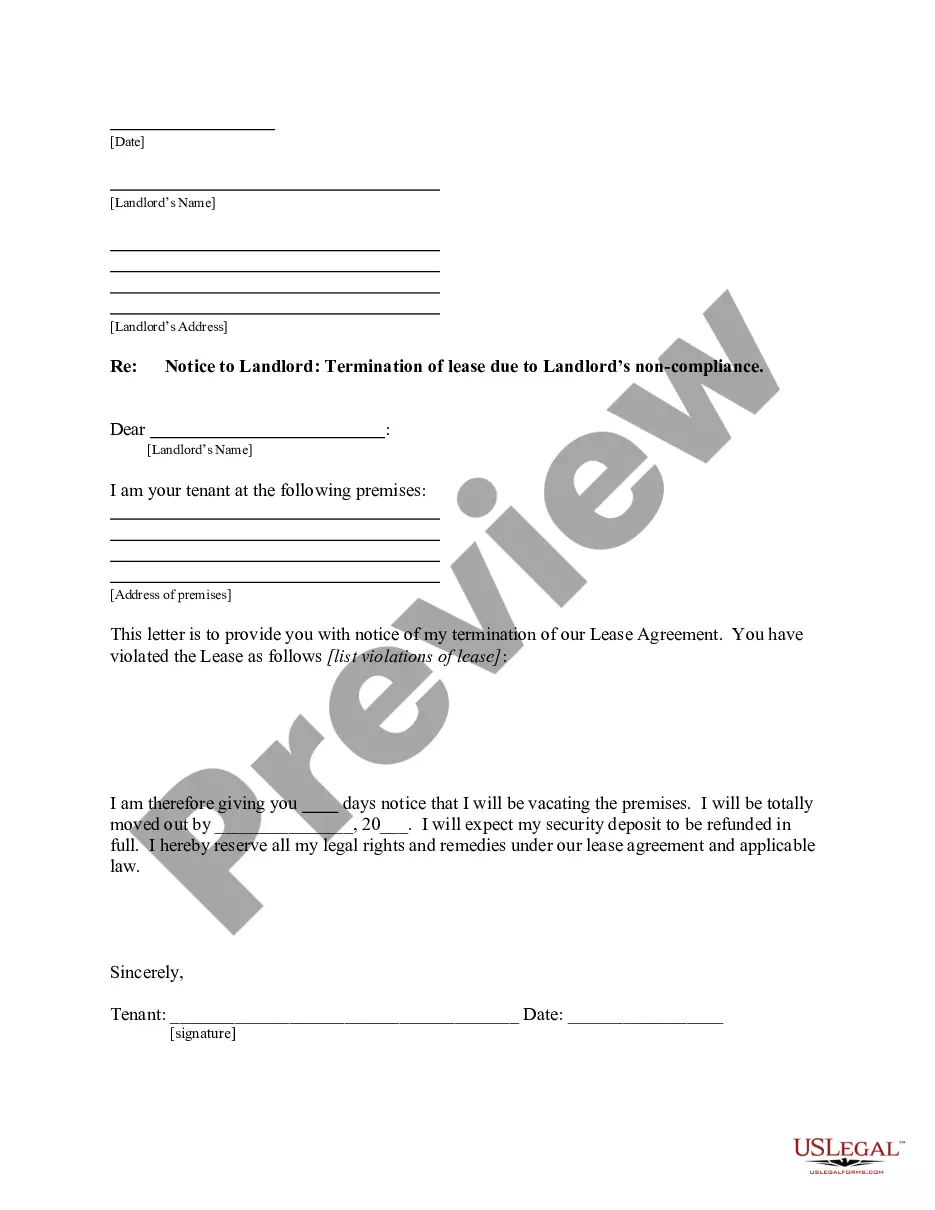

- Utilize the Review button to examine the document.

- Check the details to confirm you have selected the correct document.

- If the document is not what you are searching for, use the Search field to locate the document that fits your requirements.

Form popularity

FAQ

Yes, equipment leases are generally taxable in California. When entering into a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, it is essential to consider potential tax implications. The state typically taxes the rental payments, which can affect your overall costs. By understanding these tax obligations, you can better manage your finances and leverage benefits specific to such leases.

The key difference between a tax lease and a non-tax lease lies in their treatment for tax purposes. A tax lease enables the lessor to pass on tax benefits, such as depreciation, to the lessee, often resulting in lower payments. In contrast, a non-tax lease does not provide these benefits, meaning lessees may incur higher overall costs. When choosing a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding this difference ensures your business selects the most financially beneficial option.

exempt bond is a debt security issued by a state or local government, allowing them to borrow funds without incurring certain tax liabilities. When you consider a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding how these bonds function can be beneficial. The interest earned from these bonds generally remains exempt from federal and, in some cases, state taxes. This can make financing equipment more attractive and less costly over time.

Tax-exempt purchases usually apply to organizations that serve charitable or governmental purposes. In California, entities like non-profits and some public agencies often qualify under a California Comprehensive Equipment Lease with Provision Regarding Investment Tax. To ensure eligibility, it's important to review specific state guidelines and documentation requirements. Understanding these rules helps your organization take full advantage of available tax savings.

In California, the responsibility for paying property taxes on commercial leases usually falls to the tenant, particularly in net leases. It is essential to clarify these terms within your lease agreement. When structuring a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, explicitly addressing property tax responsibilities can prevent misunderstandings.

Equipment rentals are typically not tax exempt in California, as most rental income is subject to sales tax. However, certain exemptions may apply under specific circumstances. Consult tax regulations and your California Comprehensive Equipment Lease with Provision Regarding Investment Tax to ensure compliance and understand your tax obligations.

Equipment leasing can be subject to self-employment tax if the leasing activity constitutes a trade or business. If you actively manage the leasing process, this tax may apply. It’s helpful to evaluate your situation if you are entering a California Comprehensive Equipment Lease with Provision Regarding Investment Tax to understand your potential tax liabilities.

Leases are generally classified as either operating leases or capital leases for tax purposes. This classification affects how businesses account for the lease in their financial reporting and tax filings. If you are exploring a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, knowing the lease classification will help align your financial strategies.

Leased equipment is usually treated as a current expense under tax regulations, impacting how your business’s income is reported. Depending on lease agreements, different tax implications may arise, especially when dealing with the California Comprehensive Equipment Lease with Provision Regarding Investment Tax. Understanding these considerations is key to effective tax planning.

Yes, leasing equipment can often be tax deductible, allowing businesses to reduce their taxable income. The deductibility of these expenses helps businesses manage their finances and invest in essential equipment. When engaging in a California Comprehensive Equipment Lease with Provision Regarding Investment Tax, confirm the criteria for deducting these expenses with a tax professional.