An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate

Description

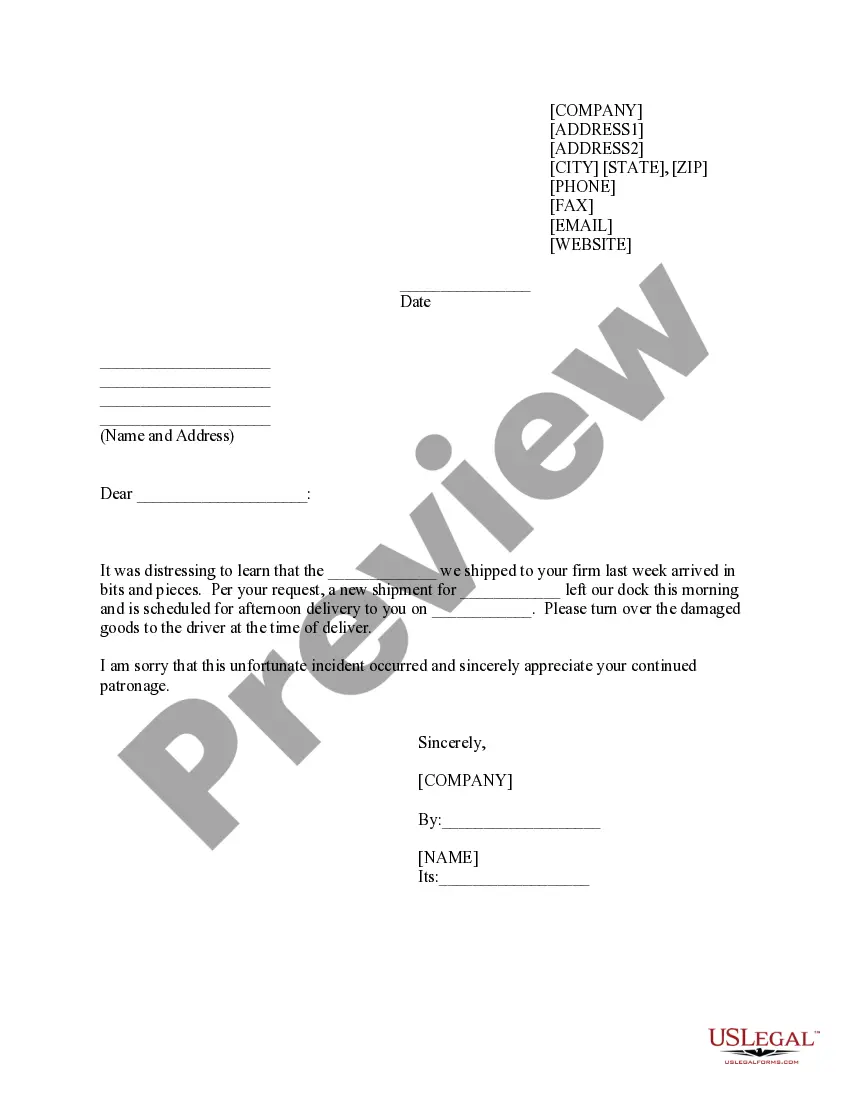

How to fill out Mortgage Loan Extension Agreement As To Maturity Date And Increase In Interest Rate?

You can devote hours on the Internet trying to find the authorized file design that meets the state and federal demands you want. US Legal Forms provides thousands of authorized kinds that are examined by specialists. It is simple to obtain or print the California Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate from the support.

If you currently have a US Legal Forms profile, you are able to log in and then click the Acquire switch. After that, you are able to full, change, print, or signal the California Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate. Every single authorized file design you buy is yours eternally. To acquire one more duplicate associated with a obtained type, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms site initially, adhere to the straightforward instructions below:

- Very first, ensure that you have chosen the correct file design for the area/town of your choosing. Read the type description to ensure you have selected the correct type. If accessible, make use of the Review switch to look from the file design also.

- If you would like get one more edition of your type, make use of the Research industry to obtain the design that suits you and demands.

- After you have discovered the design you would like, just click Purchase now to continue.

- Select the costs strategy you would like, type your accreditations, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal profile to purchase the authorized type.

- Select the file format of your file and obtain it for your system.

- Make changes for your file if necessary. You can full, change and signal and print California Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate.

Acquire and print thousands of file layouts while using US Legal Forms website, which offers the most important assortment of authorized kinds. Use expert and condition-certain layouts to handle your business or person requires.

Form popularity

FAQ

This means that your mortgage term is extended. So, you pay less each month because you have spread the repayments over a longer period of time. The cost of your credit will increase if you extend your mortgage, as it will take you longer to pay your mortgage in full.

Yes, sure! Clients usually extend their mortgage term for two main reasons, the first is to reduce their monthly payments, the second is if their interest-only mortgage is ending soon.

A loan modification involves changing your existing mortgage so it's easier for you to keep up with your payments. These changes can include a new interest rate or a different repayment schedule. It likely won't reduce the amount you owe on the balance of your mortgage.

In general, a loan extension will allow you to skip a certain number of immediate payments?which, while not set in stone, is typically just one?and add them onto the back of the loan. In most cases, the maturity date of the loan is then extended by the number of postponed payments.

You'll likely have to pay a higher interest rate. Because it's a riskier loan to make, lenders charge a higher interest rate. If you get stuck with a higher interest rate on top of paying interest for longer, your loan could be much more expensive.

Extending your loan's term gives you more time to pay off the debt and may lower your monthly payment. But it will also likely lead to paying more interest overall.

As a homeowner, it's possible to change your maturity date by coming to a new agreement with your lender. An extension on your maturity date could give you the time you need to repay the loan in full. Plus, extending your maturity date may also help you lower your monthly payments.

When your fixed term is nearing its end, your lender and mortgage broker will usually contact you to let you know what your options are. You will then have to decide whether to re-fix your loan at a new rate, switch to a variable rate, or refinance with a new lender.