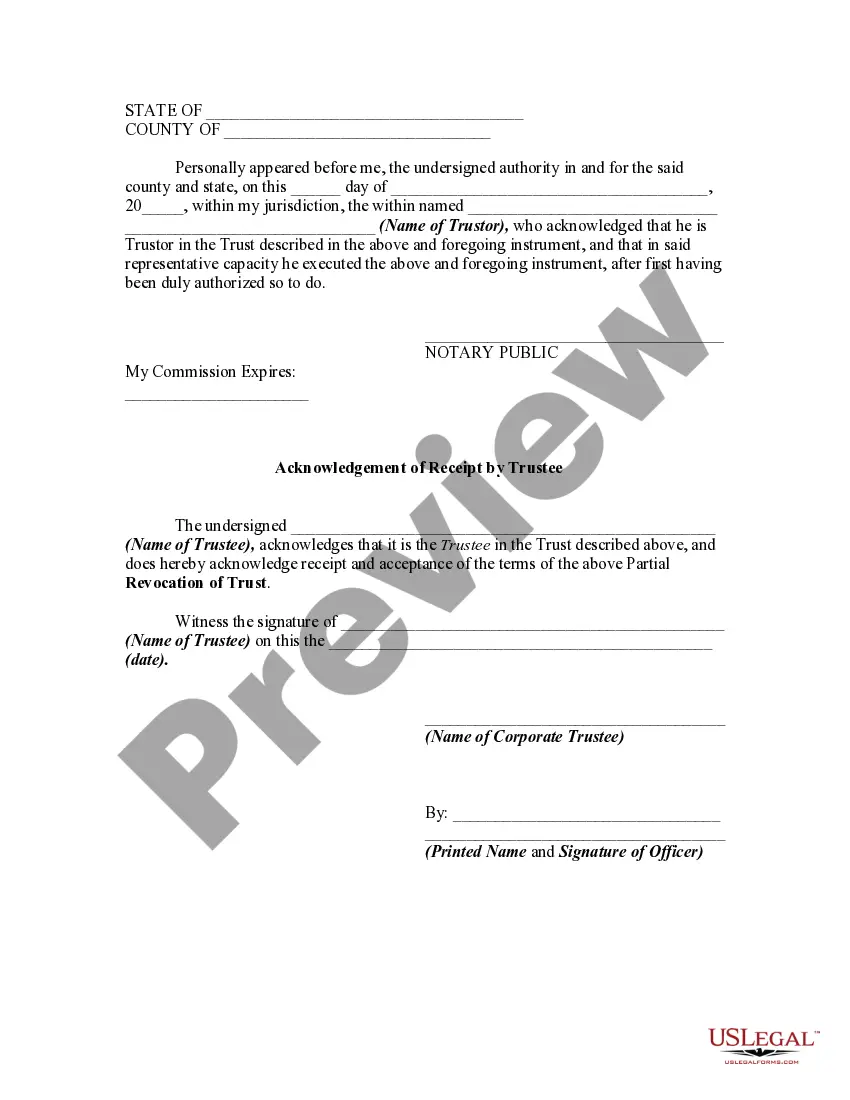

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Finding the appropriate legal document template can be challenging. Clearly, there are numerous formats accessible online, but how do you acquire the legal form you need? Use the US Legal Forms website. The platform provides thousands of templates, including the California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, which can be utilized for business and personal purposes. All templates are reviewed by experts and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Download button to access the California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents section of your account and download another version of the document you require.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, make sure you have selected the correct form for your city/state. You can preview the form by clicking the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is right, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the downloaded California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

US Legal Forms is the largest repository of legal forms where you can discover a variety of document templates. Utilize the service to obtain well-crafted documents that adhere to state guidelines.

- Finding the suitable legal document template can be difficult.

- Numerous formats are available online.

- Use the US Legal Forms website.

- The platform offers thousands of templates.

- Templates are verified by experts.

- Comply with state and federal regulations.

Form popularity

FAQ

A revocable trust can be revoked in California by executing a written revocation document and notifying the trustee and beneficiaries. This document must clearly state your intention to revoke the trust. Furthermore, it's crucial to document this action through an Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, which ensures that all parties are aware of the trust's status. Utilizing platforms like USLegalForms can simplify this process and help you ensure compliance with legal standards.

To terminate a revocable trust in California, you must follow a few steps. First, the trustee should prepare a written document stating the intent to revoke the trust. Additionally, all beneficiaries should receive a formal Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. This process ensures that everyone is informed of the trust's termination and contributes to clarity and transparency.

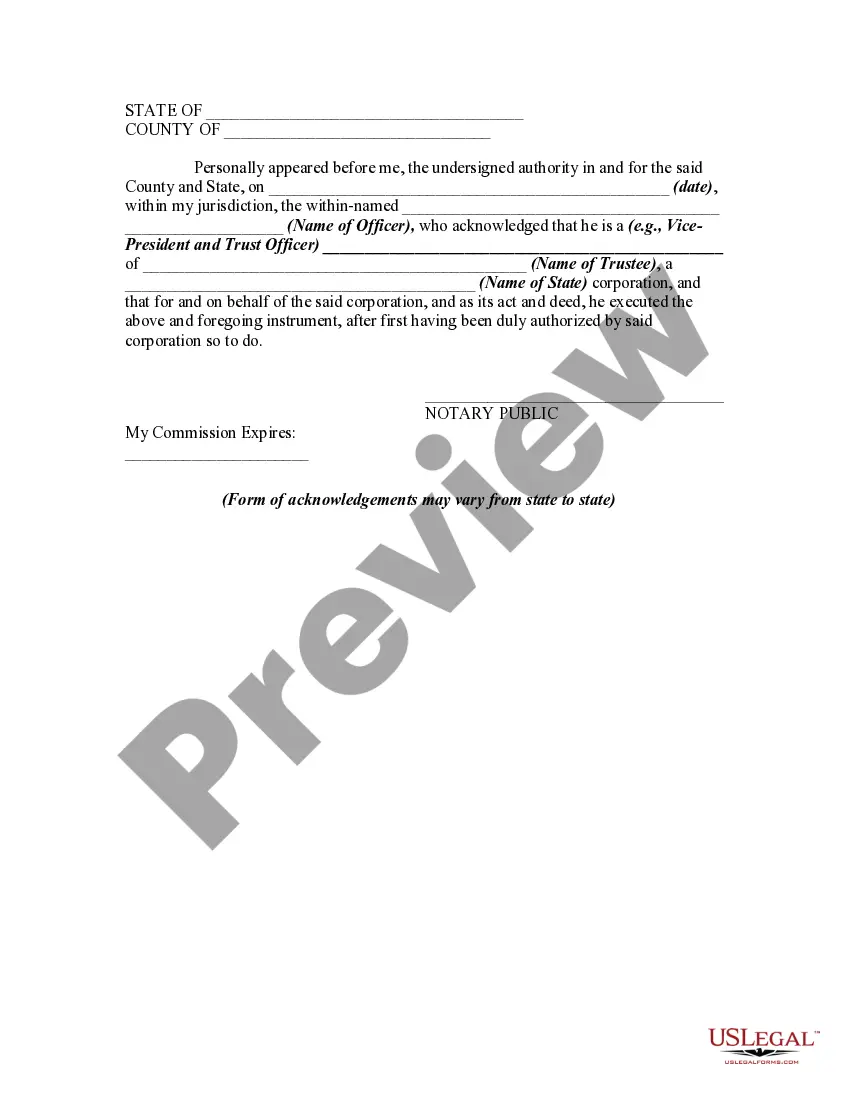

Yes, in California, it is recommended that a revocation of a trust be notarized. Notarization adds a layer of authenticity, ensuring that the document is legally recognized. This step can also protect against any potential disputes that might arise regarding the validity of the revocation. Using resources like USLegalForms can help you navigate the notarization process seamlessly.

A partial revocation refers to the process where only certain provisions of a trust are revoked rather than the entire trust. This action can allow the trust creator to modify roles or change beneficiaries without dissolving the entire trust structure. Understanding this procedure is crucial, especially when managing family assets. The California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee provides a structured approach to implementing partial revocations.

An example of a revocation of a trust would be an individual formally stating that a trust established for their assets is no longer valid. This can occur when the grantor decides to distribute their assets differently or acquires new family circumstances. Creating a documented revocation ensures that all parties are informed and misunderstandings are avoided. Utilizing tools from USLegalForms can provide clarity in this process.

A trustee cannot unilaterally revoke a trust unless granted such authority by the trust creator. In California, the power to revoke typically lies with the individual who set up the trust. However, if there are specific instructions in the trust document that allow the trustee to revoke, they can proceed. For comprehensive guidance, consider referring to the California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

To revoke a revocable trust, you need to draft a revocation document outlining your intent to terminate the trust. Ensure it's signed and dated according to California law. Additionally, you may need to notify the trustee and beneficiaries about this revocation. Seek assistance from USLegalForms to create effective legal documents that meet your needs.

A revocable trust is revoked through a written document signed by the trust creator. This document should clearly state the intent to revoke the trust. In California, it’s also important to provide notice to any interested parties. The California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help ensure this process is completed correctly.

A trust can be terminated in three primary ways: revocation by the trust creator, fulfillment of the trust's terms, or court order. Revocation allows the trust creator to have control over the assets until the trust is dissolved. Additionally, if the objectives of the trust are met, it naturally ends. Utilizing platforms like USLegalForms can simplify the legal processes involved.

Yes, you can remove yourself from a revocable trust in California. By doing so, you will relinquish your rights as a trustee or a beneficiary. This process generally involves creating a document that formally revokes your authority or interest in the trust. Consider utilizing the California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee for guidance.