California Loan Agreement - Short Form

Description

How to fill out Loan Agreement - Short Form?

Are you in a circumstance where you require documentation for potential organization or particular operations almost every business day? There are numerous legal document templates available online, but locating ones you can trust is not straightforward.

US Legal Forms offers a vast array of form templates, including the California Loan Agreement - Short Form, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have your account, simply Log In. After that, you can download the California Loan Agreement - Short Form template.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the California Loan Agreement - Short Form anytime, if needed. Click on the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent mistakes. The service provides properly crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that suits you and your needs.

- Once you obtain the right form, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

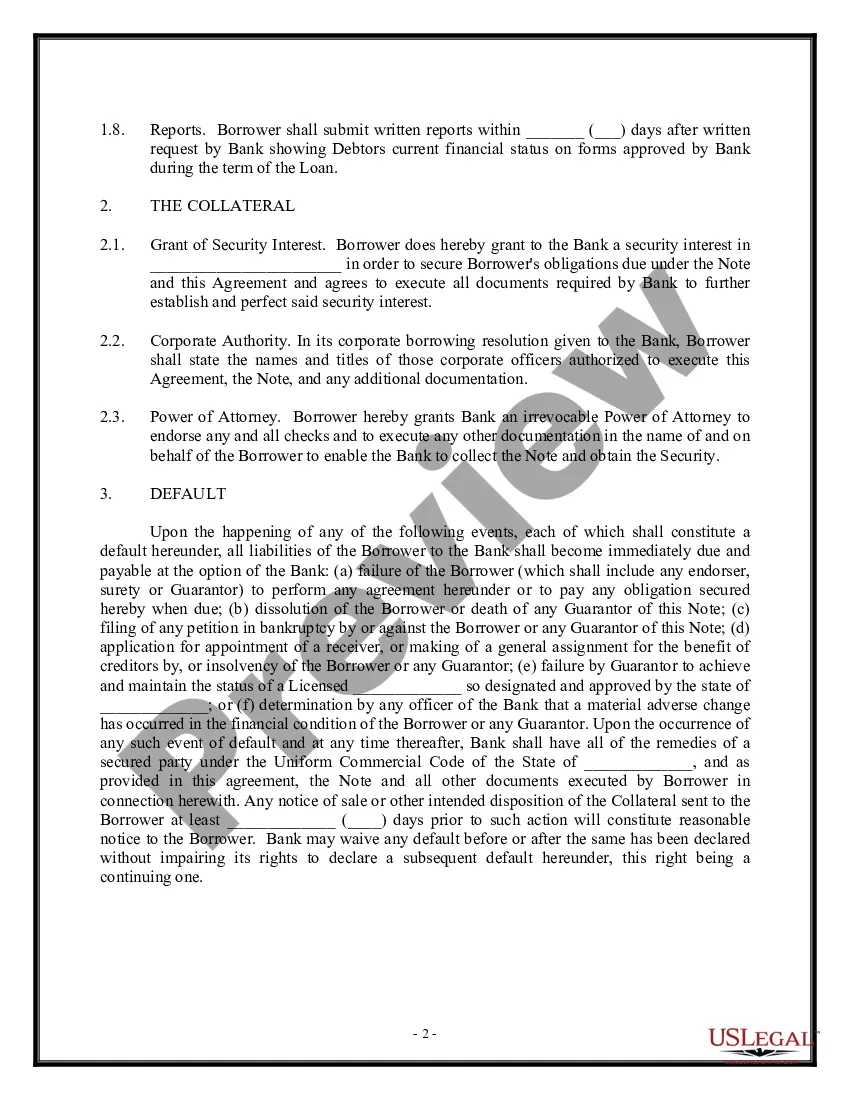

How To Write a Loan Agreement Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate. ... Step 7 ? Include Late Fees (Optional)

A loan agreement may be called a number of different things, including a loan contract, a credit agreement, a financing agreement, and in some cases, a promissory note.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

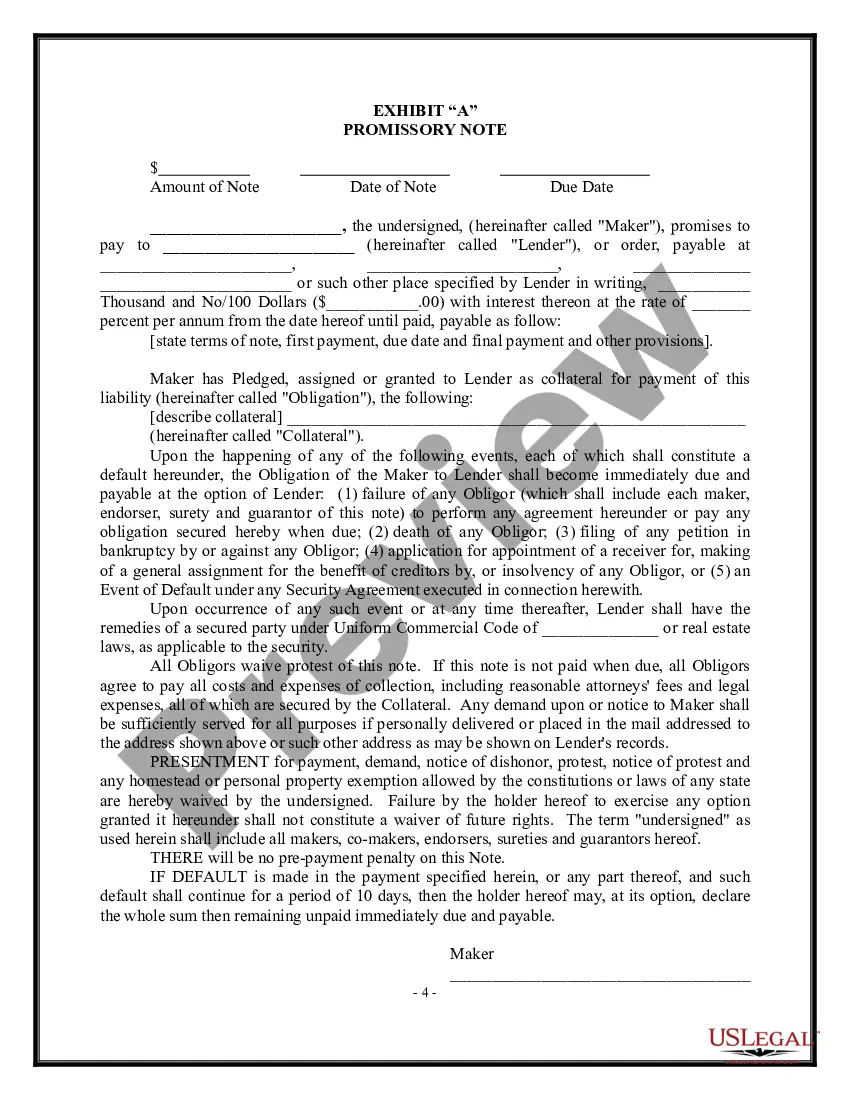

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.