California Grant Deed - Parents to Child with Reservation of Life Estate

Definition and meaning

A California Grant Deed is a legal document used to transfer ownership of real estate from one party to another. This particular type of deed, known as a Grant Deed from Parents to Child with Reservation of Life Estate, allows parents to transfer property to their child while retaining the right to live in the property until their death. This arrangement ensures that the parents can continue to enjoy the property, while the child secures ownership.

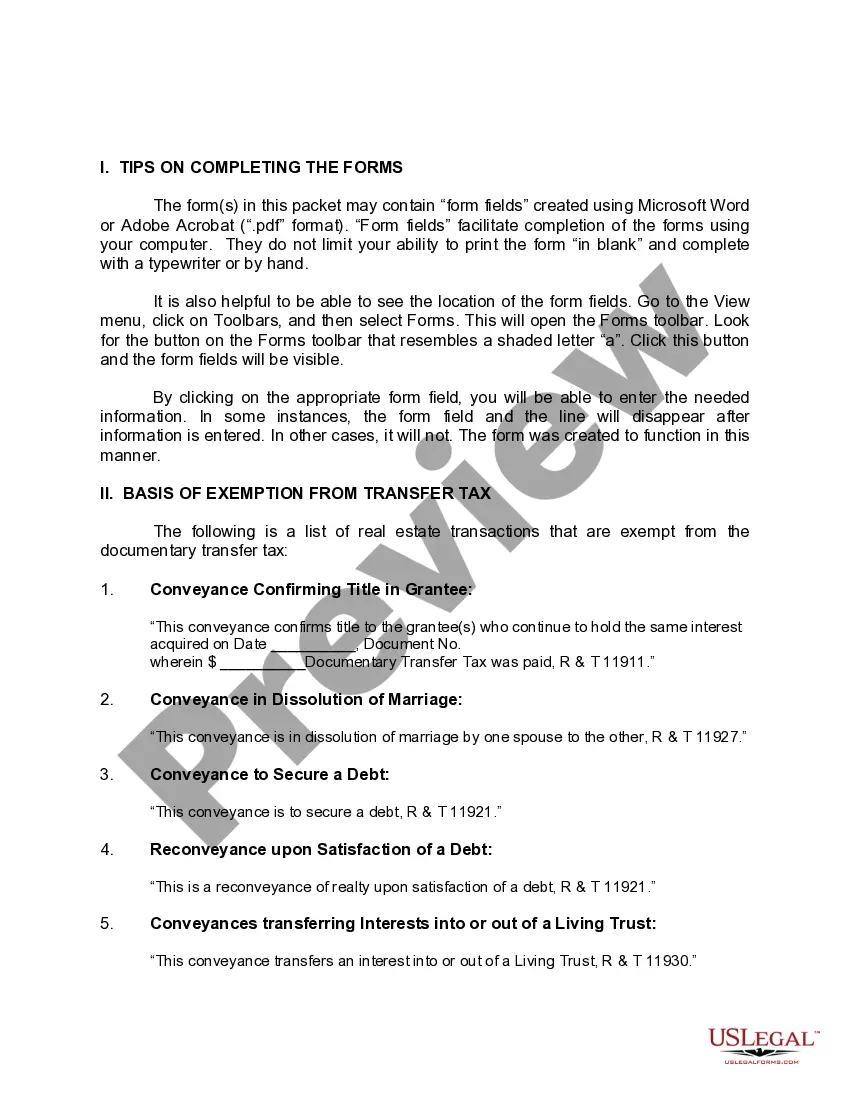

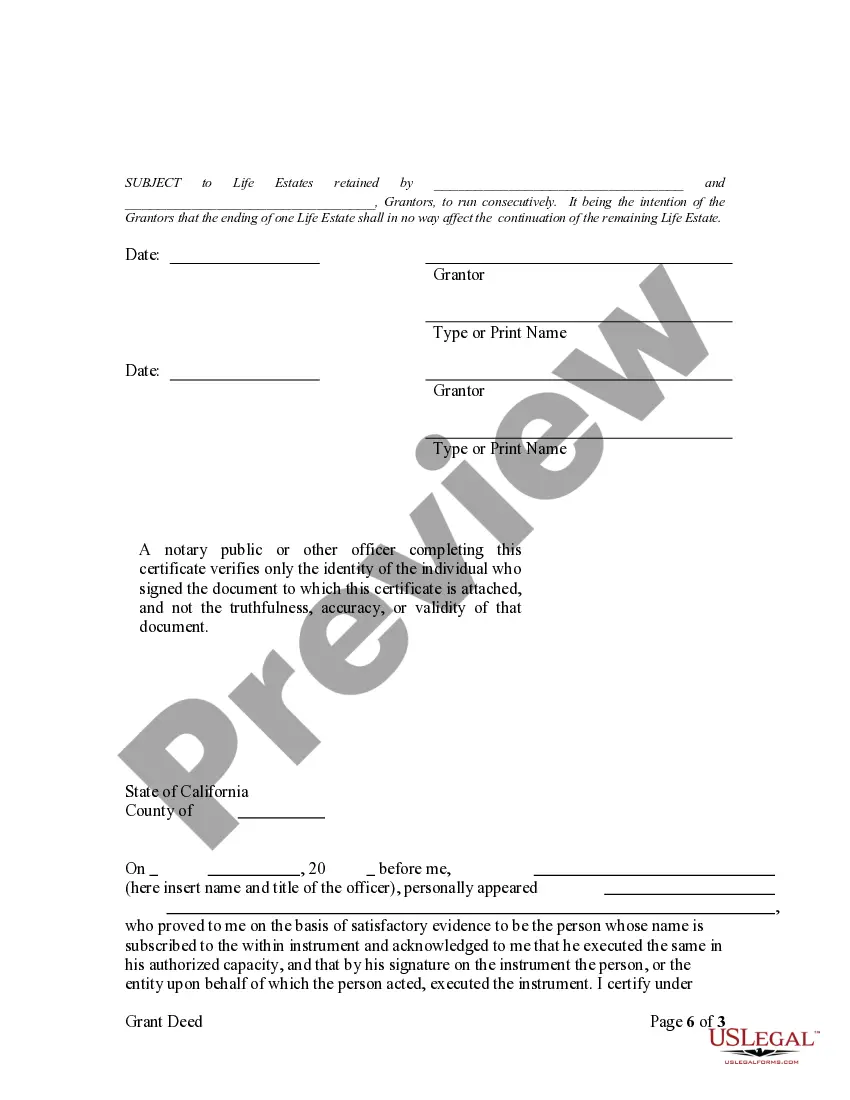

How to complete a form

Completing the California Grant Deed involves a few key steps:

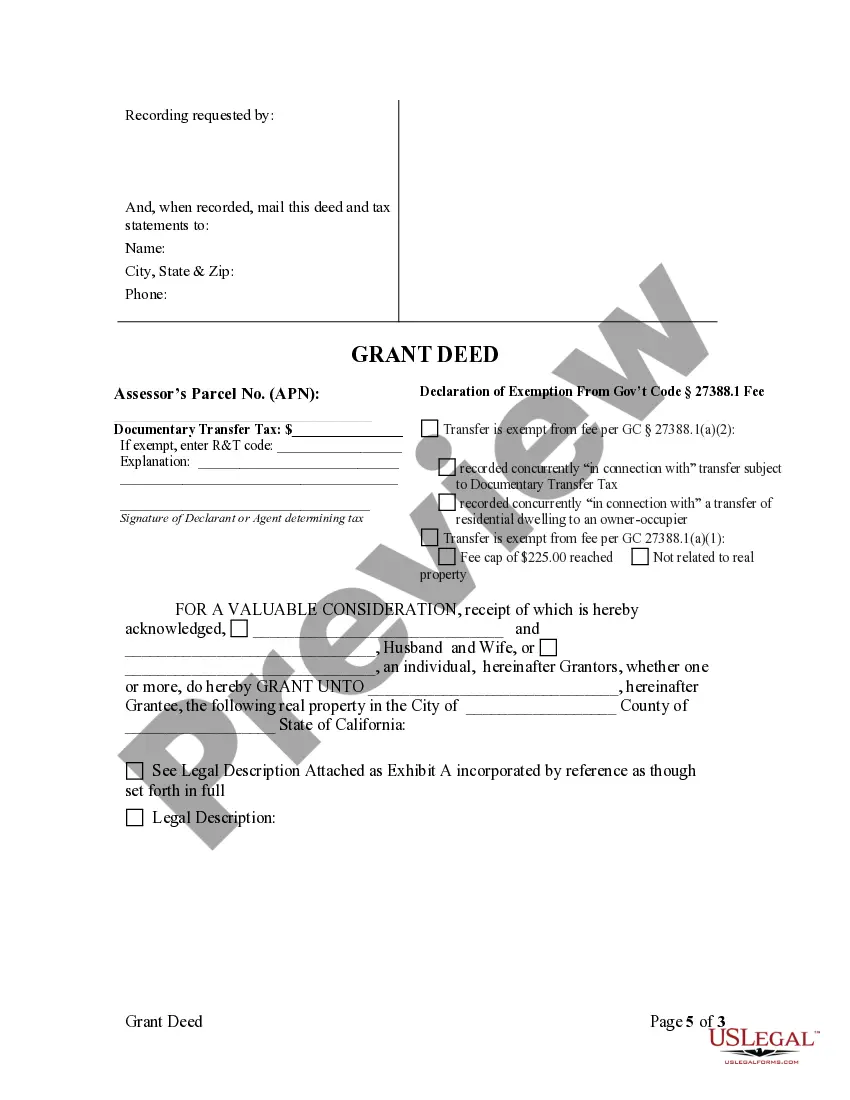

- Enter the names of the grantors (parents) and the grantee (child).

- Provide the legal description of the property being transferred, which can often be found in previous property documents.

- Indicate any retained rights, such as a life estate.

- Sign the document in the presence of a notary public to validate the deed.

Be sure to double-check all information for accuracy before finalizing the deed.

Who should use this form

This form is primarily used by parents who wish to transfer real estate ownership to their child while retaining the right to live in the property. It is ideal for families looking to ensure that the property remains in the family for future generations, or for parents wishing to provide a financial benefit to their child while maintaining their lifestyle.

Key components of the form

Important components of the California Grant Deed include:

- Grantors: The individuals transferring ownership (usually the parents).

- Grantee: The individual receiving the property (the child).

- Legal Description: A detailed description of the property being transferred.

- Life Estate Clause: A provision that allows the grantors to retain rights to the property for their lifetime.

These elements are crucial for the validity of the deed and should be completed carefully.

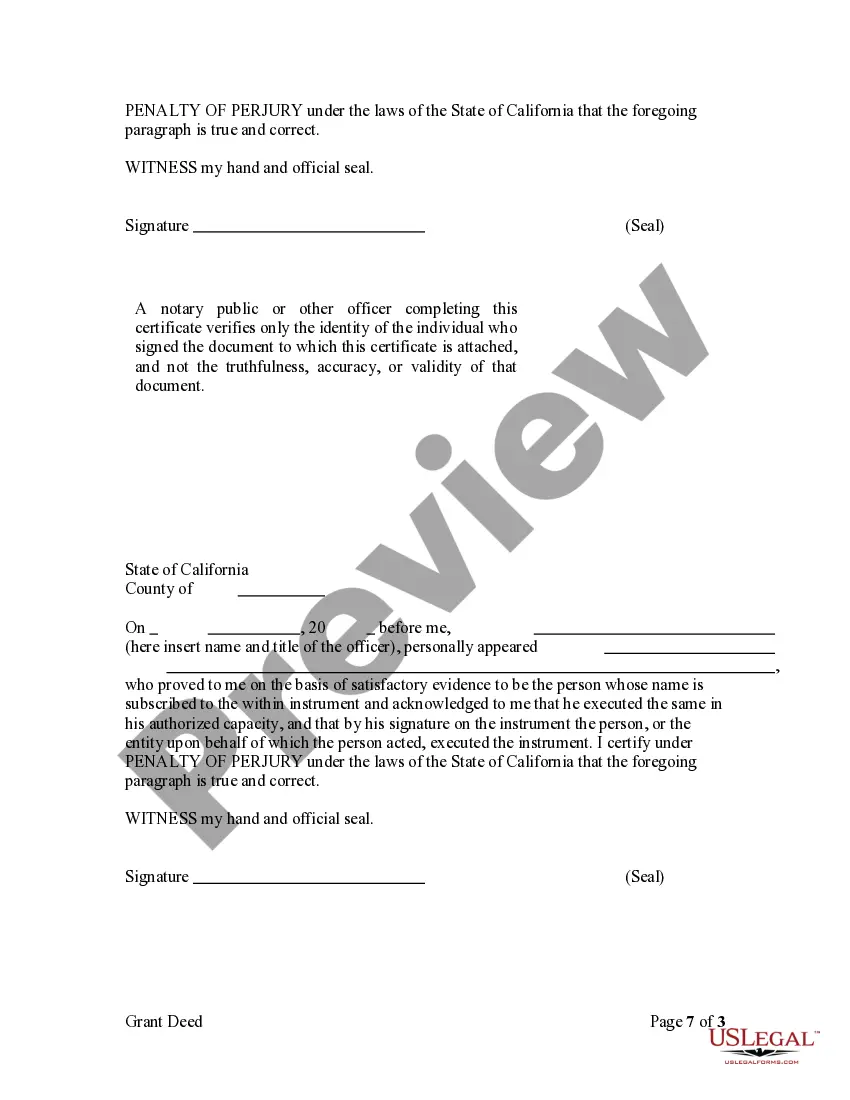

What to expect during notarization or witnessing

Notarization is a critical step in securring the validity of the California Grant Deed. Expect the following:

- You and any other grantors will need to appear before a notary public.

- Bring valid identification to prove your identity.

- The notary will verify your identity and witness your signing of the deed.

- The notary will then affix their seal to the document, confirming it has been properly executed.

This process protects all parties involved and helps prevent fraud.

Common mistakes to avoid when using this form

To ensure proper execution of the California Grant Deed, avoid the following mistakes:

- Leaving out necessary details, such as the legal description of the property.

- Failing to sign the deed in front of a notary public.

- Not specifying the life estate in the deed, which can lead to legal disputes.

- Using incorrect names or misspellings that could complicate ownership transfer.

By paying attention to these details, you can help ensure a smooth transfer of ownership.

Benefits of using this form online

Utilizing an online service for your California Grant Deed offers numerous advantages:

- Convenience: Complete your form from the comfort of your home at your own pace.

- Accuracy: Pre-formatted templates help reduce errors and ensure compliance with legal requirements.

- Accessibility: Easily access your documents and support resources whenever needed.

This streamlined approach can save time and reduce stress during the property transfer process.

Form popularity

FAQ

Yes, parents can transfer a home to their child in California using a California Grant Deed - Parents to Child with Reservation of Life Estate. This deed allows parents to maintain their rights to live in the property while transferring ownership to their child. Such a process helps reduce estate taxes and can provide a smoother inheritance. For assistance in creating this deed, consider using the US Legal Forms platform, which offers easy-to-use templates tailored for your needs.

Selling a home that has a life estate deed, such as the California Grant Deed - Parents to Child with Reservation of Life Estate, can be complicated but is not impossible. The parents, as life tenants, typically need the child's agreement to sell because they have a vested interest in the property. If both parties agree, the sale can proceed. However, it is wise to consult a legal expert to navigate the nuances and ensure compliance with laws.

While a life estate provides benefits, it can also come with drawbacks. For example, the parents may find it difficult to sell the property without the child's consent since they hold a reversionary interest in the California Grant Deed - Parents to Child with Reservation of Life Estate. Additionally, responsibilities related to property maintenance and taxes may burden the parents. Understanding these factors is crucial before setting up this type of real estate arrangement.

People often create life estates, such as the California Grant Deed - Parents to Child with Reservation of Life Estate, to provide a secure way to transfer property while retaining certain rights. This arrangement allows parents to live in the home for the rest of their lives, ensuring their needs are met. It also helps avoid probate, making the transfer of property smoother for the child once the parents pass away. Overall, it offers peace of mind for both parties involved.

When a life estate is reserved, it means that the original property owner retains the right to live in and use the property for their lifetime after transferring ownership to their child. This provision allows parents to secure their living arrangements while ensuring that their child ultimately receives full ownership of the property after their passing. Choosing a California Grant Deed - Parents to Child with Reservation of Life Estate is an effective way to navigate this complex process while protecting both parties' interests.

Filling out a California grant deed requires careful attention to detail and adherence to state laws. First, you need to identify the grantor, who is the current property owner, and the grantee, who is the child receiving the property. Next, include a legal description of the property, state the reservation of life estate, and ensure that both parties sign the document. For assistance with forms, US Legal Forms provides easy-to-follow templates that simplify the process of completing a California Grant Deed - Parents to Child with Reservation of Life Estate.

A deed reserving life estate is a specific type of transfer document that grants ownership of real estate to another party, typically a family member, while the original owner keeps the right to use the property for their lifetime. This type of deed provides flexibility for property owners and can ease the transition of assets to future generations. When utilizing a California Grant Deed - Parents to Child with Reservation of Life Estate, families benefit from a straightforward process that clarifies ownership and usage rights.

A reserving life estate deed is a legal document that allows property owners, such as parents, to transfer ownership of their property to their child while retaining the right to live there for the rest of their lives. This arrangement ensures that parents can maintain control over their home while also providing an efficient way to pass on property. The California Grant Deed - Parents to Child with Reservation of Life Estate is a popular option for families wanting to facilitate inheritance and transfer property seamlessly.

In a life estate in California, ownership is divided between the life tenant and the remainderman. The life tenant has the right to occupy and use the property during their lifetime, while the remainderman gains full ownership once the life tenant passes away. Understanding this dynamic is crucial when dealing with a California Grant Deed - Parents to Child with Reservation of Life Estate, ensuring all parties are aware of their rights and responsibilities.

Selling a house with a life estate deed can be complex. The life tenant holds a right to live in the property for life, but any sale requires agreement from both the life tenant and the remainderman. Engaging with a knowledgeable legal service, such as uslegalforms, can provide the necessary guidance to ensure all legalities are properly managed.