This form is an official document from the California Judicial Council, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

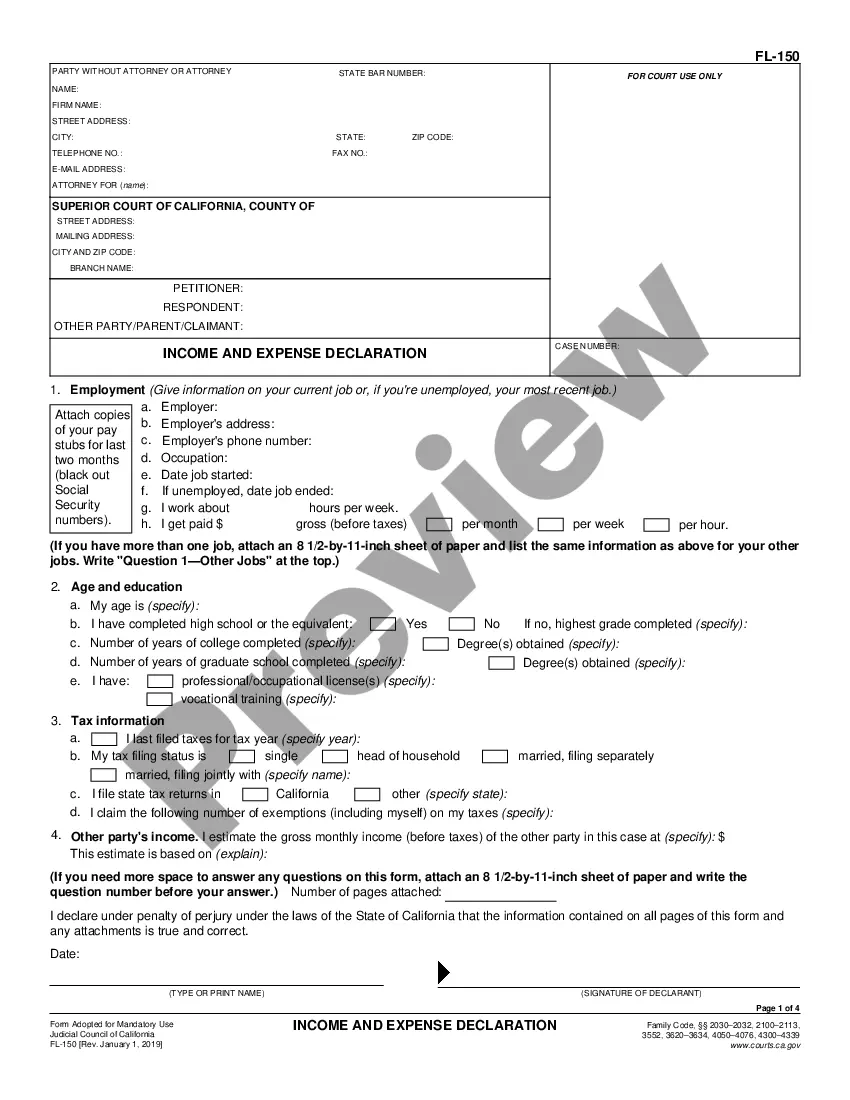

California Income and Expense Declaration - Spanish

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Income And Expense Declaration - Spanish?

If you're looking for precise California Income and Expense Declaration - Spanish forms, US Legal Forms is what you require; obtain documents created and verified by state-approved lawyers.

Using US Legal Forms not only protects you from issues associated with legal documents; you also conserve time and energy, as well as money! Downloading, printing, and submitting a professional template is considerably more affordable than hiring a lawyer for assistance.

And there you have it. With just a few simple clicks, you now possess an editable California Income and Expense Declaration - Spanish. After setting up your account, all future requests will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your account and click the Download option visible on the form’s page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort sifting through countless forms across different platforms. Purchase accurate templates from a single reliable source!

- To start, complete your registration process by providing your email address and creating a secure password.

- Follow the steps below to set up your account and locate the California Income and Expense Declaration - Spanish template to address your needs.

- Utilize the Preview feature or examine the document details (if available) to ensure that the template is the one you need.

- Verify its validity in your state.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay using a credit card or PayPal.

- Choose a suitable format and save the documents.

Form popularity

FAQ

A current Income and expense declaration in California is a vital document that outlines your latest financial circumstances relevant to family law. This declaration must be updated regularly to reflect any changes in your income or expenses. By submitting the California Income and Expense Declaration - Spanish, you can ensure your financial information is accessible to the court, promoting transparency and fairness.

The Income and expense statement is a detailed report of your financial situation, commonly used in family law proceedings. It includes all sources of income, monthly expenses, and other financial obligations. By providing this statement, you support your claims and requests in court. Using the California Income and Expense Declaration - Spanish ensures that Spanish-speaking households have equal access to the legal process.

FL150 refers to the form used for California Income and Expense Declaration - Spanish. This document provides a complete picture of an individual's income and expenses in family law cases. It helps the court understand your financial situation thoroughly, ensuring fair decisions are made. Completing FL150 accurately is essential for a successful outcome in your case.

The current Income and Expense declaration in California, commonly known as FL 150, outlines your financial details required by the court. This declaration gathers information about your income, expenses, assets, and liabilities, which helps in determining support amounts in legal cases. The California Income and Expense Declaration - Spanish is available for Spanish-speaking individuals to ensure all parties can participate fully in the process. Always keep yourself updated with the latest version of this form through reliable legal resources.

Yes, completing an Income and Expense declaration is often necessary when determining support amounts in California. The California Income and Expense Declaration - Spanish is specifically designed for individuals who are part of legal proceedings involving support issues. It allows the court to assess your financial situation accurately. It's important to submit the declaration to pursue any support claims efficiently.

The FL 150 form is filled out by individuals involved in family law cases, including both parents and spouses. If you are seeking child support or spousal support, you must provide your financial details in the California Income and Expense Declaration - Spanish. Each party will need to complete their own form, ensuring transparency in their financial situation. Utilizing resources from UsLegalForms can help simplify this process.

Yes, if you are going through a divorce or legal separation in California, you need to file the FL 150, also known as the California Income and Expense Declaration - Spanish, with the court. This form provides essential financial information to help determine support obligations. Filing is crucial for the court to make informed decisions regarding child support and spousal support. Make sure you complete the form accurately to avoid delays in your case.

Rule 3.766 pertains to the requirements for income and expense declarations in child custody and support cases in California. This rule ensures that both parties provide accurate financial details to inform the court's decisions. By utilizing platforms like uslegalforms, you can access these declarations in Spanish and navigate the process more easily.

Rule 222.1 concerns the electronic filing and service of documents in California courts, including the Income and Expense Declaration. This rule facilitates the submission and sharing of financial information digitally, ensuring efficiency in legal proceedings. For those needing forms tailored for electronic submission and in Spanish, consider exploring services like uslegalforms.

To serve an Income and Expense Declaration, you must deliver a copy to the other party in your case, following specific service rules outlined by California law. Ensure that you use a proper method of service, such as personal delivery or mail. If you require assistance with serving documents, uslegalforms offers user-friendly tools to help streamline the process, including in Spanish.