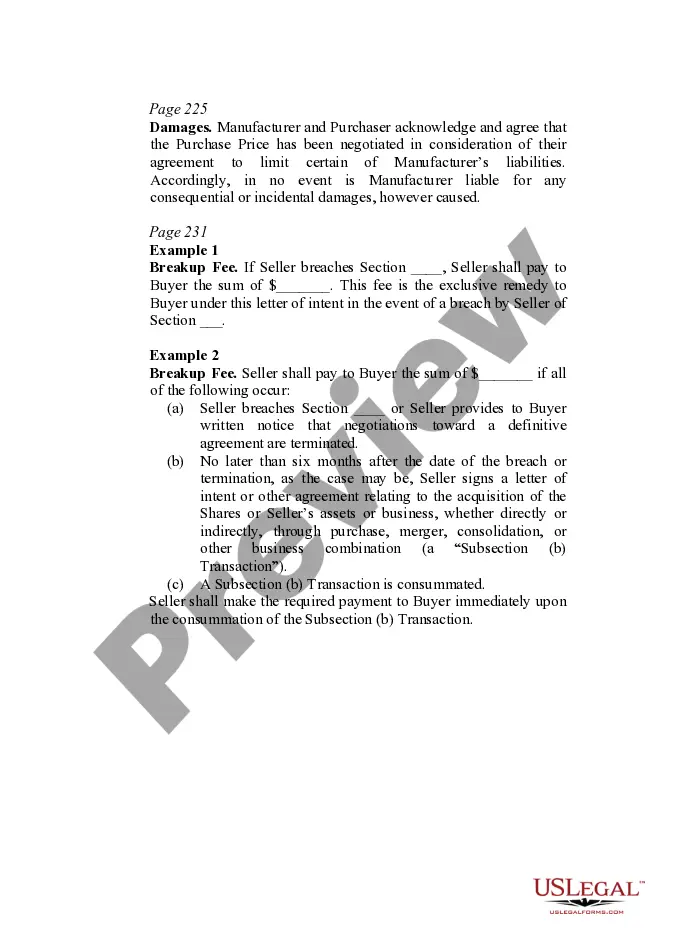

This form provides boilerplate contract clauses that limit the remedies available to the parties both under and outside the terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Arizona Limitation of Remedies and Damages Provisions

Description

How to fill out Limitation Of Remedies And Damages Provisions?

You may devote time on-line looking for the lawful record design that meets the federal and state demands you need. US Legal Forms offers a large number of lawful varieties that happen to be analyzed by experts. It is possible to download or produce the Arizona Limitation of Remedies and Damages Provisions from my support.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Down load option. Next, it is possible to complete, revise, produce, or signal the Arizona Limitation of Remedies and Damages Provisions. Each and every lawful record design you acquire is your own property forever. To get one more duplicate associated with a purchased form, visit the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms website initially, follow the straightforward instructions beneath:

- Very first, make sure that you have selected the right record design for the region/area of your choice. Look at the form information to ensure you have selected the right form. If available, make use of the Preview option to check throughout the record design at the same time.

- In order to discover one more version from the form, make use of the Look for discipline to discover the design that meets your needs and demands.

- Once you have discovered the design you would like, simply click Purchase now to continue.

- Select the costs plan you would like, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal profile to pay for the lawful form.

- Select the formatting from the record and download it to the product.

- Make modifications to the record if required. You may complete, revise and signal and produce Arizona Limitation of Remedies and Damages Provisions.

Down load and produce a large number of record templates making use of the US Legal Forms website, which provides the greatest collection of lawful varieties. Use skilled and condition-distinct templates to take on your business or person requires.

Form popularity

FAQ

Administrative Procedure for Recovery The claim must be filed within the relevant two-year statute of limitations, which is within two years after all proceedings, reviews and appeals connected with the Registrar's final order terminate per A.R.S. § 32-1133.01(G).

General Limits Petty offenses have a six-month statute of limitations. Misdemeanors are allowed one year to file a claim. Felonies in classes two through six have a seven-year statute of limitations.

It is important to note that if you begin paying your debt, the clock on the statute of limitations will restart. This means that if you pay even a small payment for your debt, you may start the clock all over again.

For closed installment accounts, the statute of limitations runs 6 years after the final payment date. For open accounts, such as credit cards, the statute of limitations begins 6 years from the first uncured missed payment, whether or not there is an acceleration clause.

You'll find this law spelled out at Arizona Revised Statutes section 12-542. The statute of limitations "clock" starts running on the day the property damage occurs. That means an Arizona property owner has two years from that date to get any civil lawsuit filed against the person who caused the damage or destruction.

Statute of Limitations in Arizona The statute of limitations for credit card debt is three years. For car loans, mortgages and medical debts it's six years, and for unpaid taxes it's 10 years. The timeframe indicates the amount of time a debt collector has to collect a debt.

Although the unpaid debt will go on your credit report and have a negative impact on your score, the good news is that it won't last forever. After seven years, unpaid credit card debt falls off your credit report. The debt doesn't vanish completely, but it'll no longer impact your credit score.

Fair Debt Collection Practices Act (FDCPA) § 1692-1692p). Third-party debt collectors are prohibited from engaging in unfair, deceptive, or abusive practices while collecting these debts. Under the FDCPA, third-party debt collectors: may contact a person only between a.m. and p.m. at home or work.