The Schedule for the Distributions of Earnings to Partners assures that all factors to be considered are spelled out in advance of such decisions. It lists the minimun participation amounts and defines what the term "normal participation" means. It also discuses fees and benefits for each partner.

Arizona Recommendation for Partner Compensation

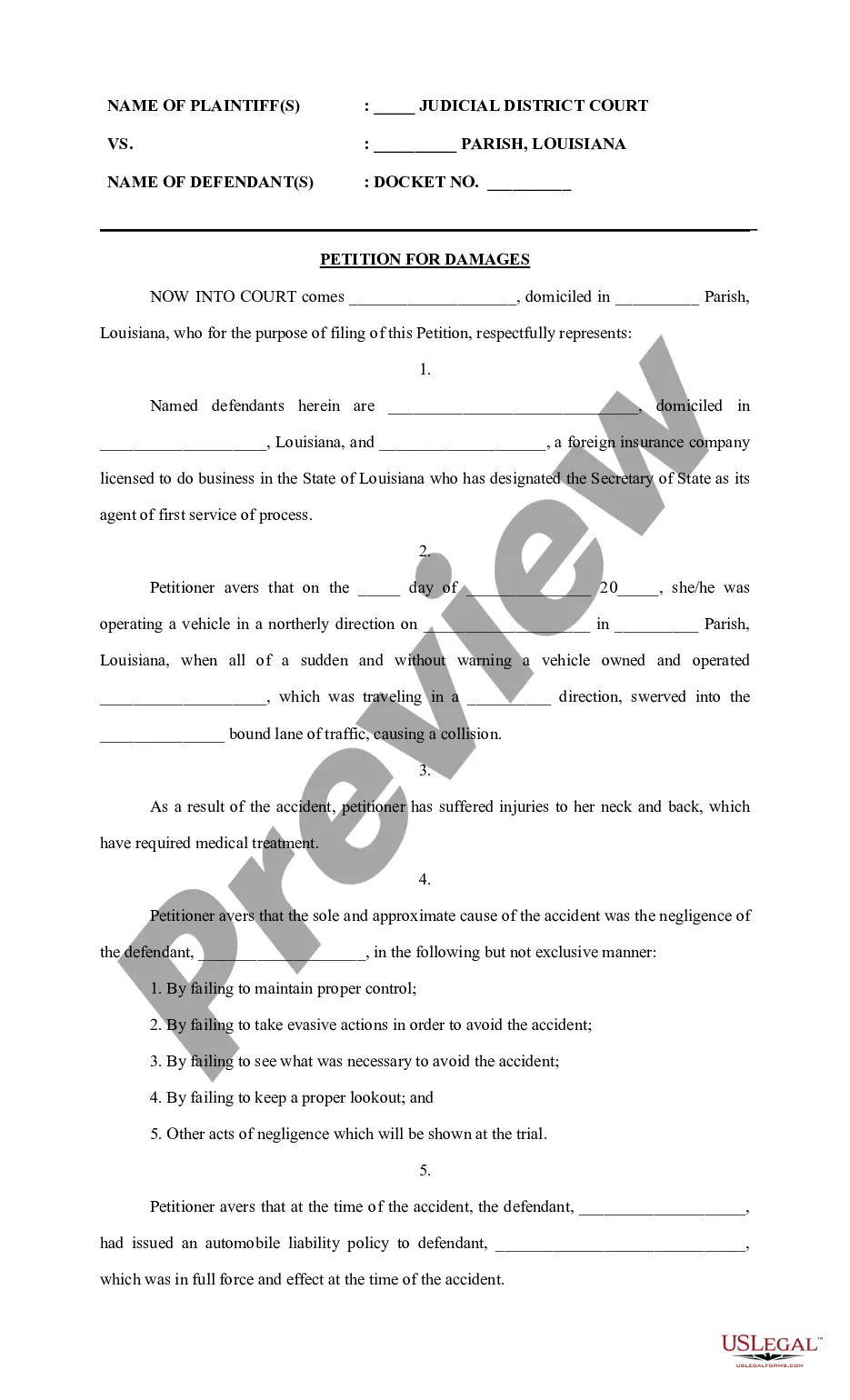

Description

How to fill out Recommendation For Partner Compensation?

If you need to comprehensive, download, or print authorized record web templates, use US Legal Forms, the largest collection of authorized types, that can be found on-line. Take advantage of the site`s basic and hassle-free lookup to obtain the paperwork you require. Various web templates for enterprise and individual purposes are sorted by classes and says, or key phrases. Use US Legal Forms to obtain the Arizona Recommendation for Partner Compensation in a number of clicks.

Should you be presently a US Legal Forms client, log in in your accounts and click the Download button to have the Arizona Recommendation for Partner Compensation. You can even access types you earlier delivered electronically within the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that correct city/country.

- Step 2. Utilize the Preview solution to look over the form`s content. Do not neglect to learn the outline.

- Step 3. Should you be not happy with the develop, make use of the Research area towards the top of the monitor to get other variations from the authorized develop format.

- Step 4. When you have found the shape you require, select the Get now button. Opt for the prices plan you choose and put your references to sign up for the accounts.

- Step 5. Method the transaction. You can utilize your bank card or PayPal accounts to complete the transaction.

- Step 6. Choose the structure from the authorized develop and download it on the gadget.

- Step 7. Total, change and print or signal the Arizona Recommendation for Partner Compensation.

Each and every authorized record format you acquire is your own property for a long time. You may have acces to each and every develop you delivered electronically with your acccount. Select the My Forms area and decide on a develop to print or download yet again.

Be competitive and download, and print the Arizona Recommendation for Partner Compensation with US Legal Forms. There are many professional and state-specific types you can use to your enterprise or individual requires.

Form popularity

FAQ

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.

¶11-520, Apportionment The double-weighted sales factor formula is a fraction consisting of the sum of the property factor, the payroll factor, and two times the sales factor, divided by four.

If your amended federal return was filed as a paper return, or if electronic filing is unavailable, mail Arizona Form 120S to: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079 ? If the S Corporation was required to make its tax payments for the 2022 taxable year by electronic funds transfer (EFT), it ...

The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828. (See EY Tax Alert 2022-1645.)

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

Arizona Governor Doug Ducey announced that due to the state's surging economy, a letter was issued to the Arizona Department of Revenue with instructions to implement a 2.5% flat tax in tax year 2023, not in 2024 as originally anticipated.