Arizona Breeder Agreement - Self-Employed Independent Contractor

Description

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

Discovering the right legal record template could be a have a problem. Needless to say, there are a variety of layouts accessible on the Internet, but how would you get the legal kind you require? Utilize the US Legal Forms web site. The services offers 1000s of layouts, for example the Arizona Breeder Agreement - Self-Employed Independent Contractor, that can be used for organization and private needs. Every one of the varieties are checked out by experts and fulfill federal and state specifications.

Should you be presently signed up, log in in your accounts and then click the Down load button to find the Arizona Breeder Agreement - Self-Employed Independent Contractor. Use your accounts to check throughout the legal varieties you have bought earlier. Check out the My Forms tab of your respective accounts and acquire one more version of your record you require.

Should you be a fresh consumer of US Legal Forms, here are simple instructions that you can comply with:

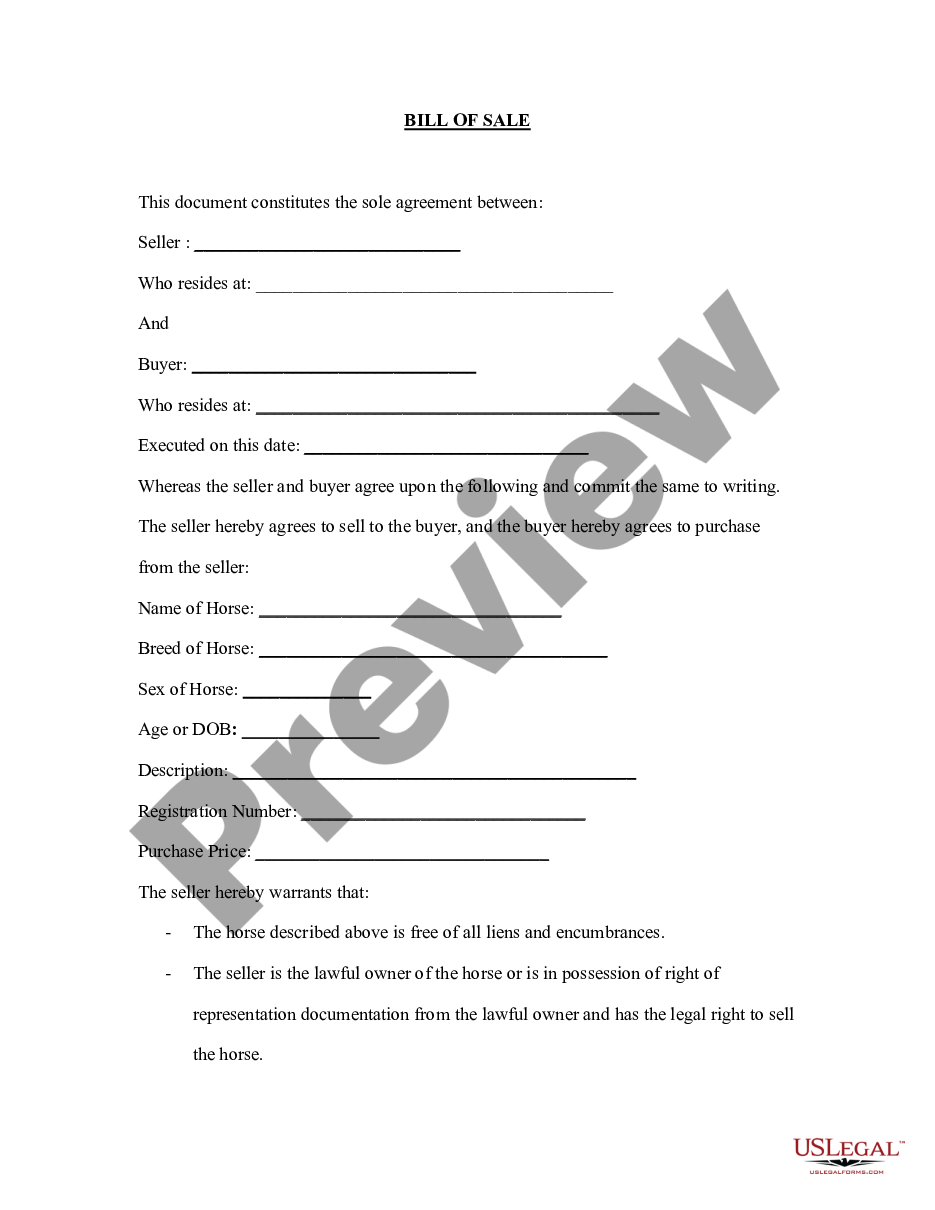

- Initial, ensure you have chosen the right kind to your area/county. You are able to look through the shape while using Review button and study the shape description to make sure this is the best for you.

- When the kind will not fulfill your needs, utilize the Seach discipline to get the correct kind.

- When you are certain the shape is suitable, click the Get now button to find the kind.

- Opt for the rates program you would like and type in the required information and facts. Build your accounts and purchase an order using your PayPal accounts or charge card.

- Pick the submit format and down load the legal record template in your product.

- Full, modify and printing and indication the received Arizona Breeder Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest local library of legal varieties where you can see different record layouts. Utilize the service to down load expertly-manufactured documents that comply with express specifications.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What can a broker require of his independent contractors? They must attend all sales meetings. They must have a signed a written work agreement.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.