Arizona Plan of Merger between two corporations

Description

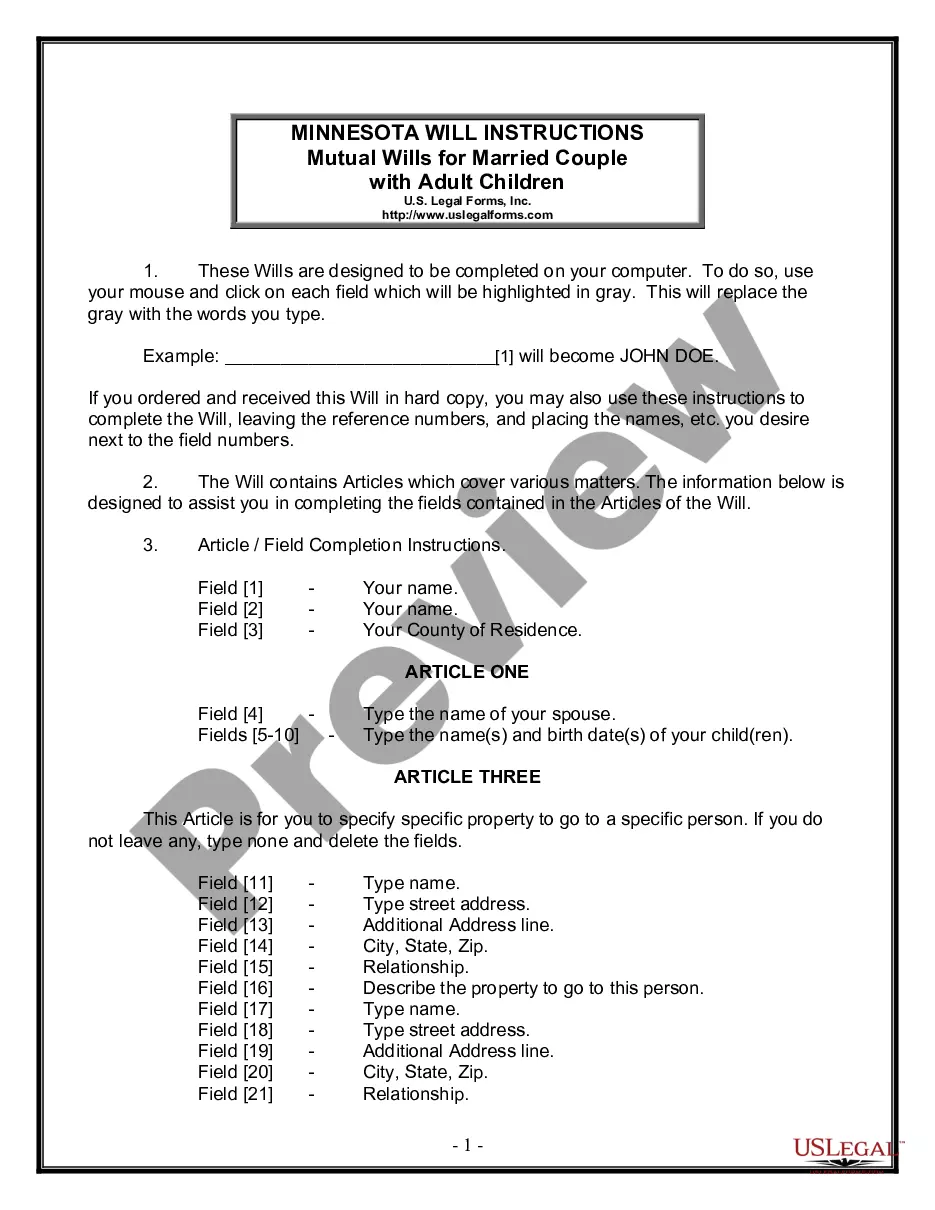

How to fill out Plan Of Merger Between Two Corporations?

You are able to commit time online attempting to find the legal record design that meets the state and federal requirements you need. US Legal Forms supplies 1000s of legal varieties that happen to be analyzed by experts. It is simple to acquire or print out the Arizona Plan of Merger between two corporations from my assistance.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Acquire key. Following that, it is possible to total, revise, print out, or sign the Arizona Plan of Merger between two corporations. Each and every legal record design you buy is the one you have permanently. To acquire yet another version of any purchased form, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website initially, follow the basic instructions below:

- First, make certain you have chosen the proper record design for your state/metropolis of your choice. Browse the form outline to make sure you have picked the correct form. If accessible, utilize the Preview key to appear with the record design at the same time.

- If you wish to discover yet another variation in the form, utilize the Research industry to discover the design that meets your requirements and requirements.

- Upon having discovered the design you desire, click Purchase now to carry on.

- Pick the pricing prepare you desire, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal accounts to fund the legal form.

- Pick the format in the record and acquire it in your device.

- Make modifications in your record if necessary. You are able to total, revise and sign and print out Arizona Plan of Merger between two corporations.

Acquire and print out 1000s of record web templates using the US Legal Forms Internet site, which offers the largest collection of legal varieties. Use specialist and condition-distinct web templates to deal with your business or personal demands.

Form popularity

FAQ

You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return. In some situations, your election to be taxed as an S-Corp might not be effective until the following tax year, so the rest of your tax return should reflect this fact if it applies.

Generally, businesses need a new EIN when their ownership or structure has changed.

You do not have to convert your LLC into a corporation. Instead, the LLC simply makes an election with the IRS to have the LLC taxed as an S corporation by having all members of the LLC sign an IRS Form 2553 and then file the signed Form 2553 with the IRS. See the Instructions to IRS Form 2553.

Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date. Do corporations have to file annual reports? Yes.

If a foreign entity wants to transact business or conduct affairs in Arizona, it must register with the Arizona Corporation Commission.

File Articles of Organization ? Conversion (Form LLC-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person. The filing fee is $150 if a California Corp is involved; and $70 for all others.

You do not have to convert your LLC into a corporation. Instead, the LLC simply makes an election with the IRS to have the LLC taxed as an S corporation by having all members of the LLC sign an IRS Form 2553 and then file the signed Form 2553 with the IRS.

How to File as an S Corp in Arizona in 7 Steps Step 1: Choose a Business Name. ... Step 2: Appoint Directors and a Registered Agent. ... Step 3: File Articles of Organization. ... Step 4: Create an S Corp Operating Agreement. ... Step 5: Publish Articles of Organization. ... Step 6: File Form 2553 for S Corporation Election.