Arizona Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

If you need to finalize, download, or generate valid document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Employ the site's user-friendly and efficient search tool to find the documents you need.

An assortment of templates for business and personal purposes is organized by categories and states or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal document and download it onto your device. Step 7. Complete, edit, and print or sign the Arizona Employee Evaluation Form for Sole Proprietor.

- Use US Legal Forms to locate the Arizona Employee Evaluation Form for Sole Proprietor in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the Arizona Employee Evaluation Form for Sole Proprietor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

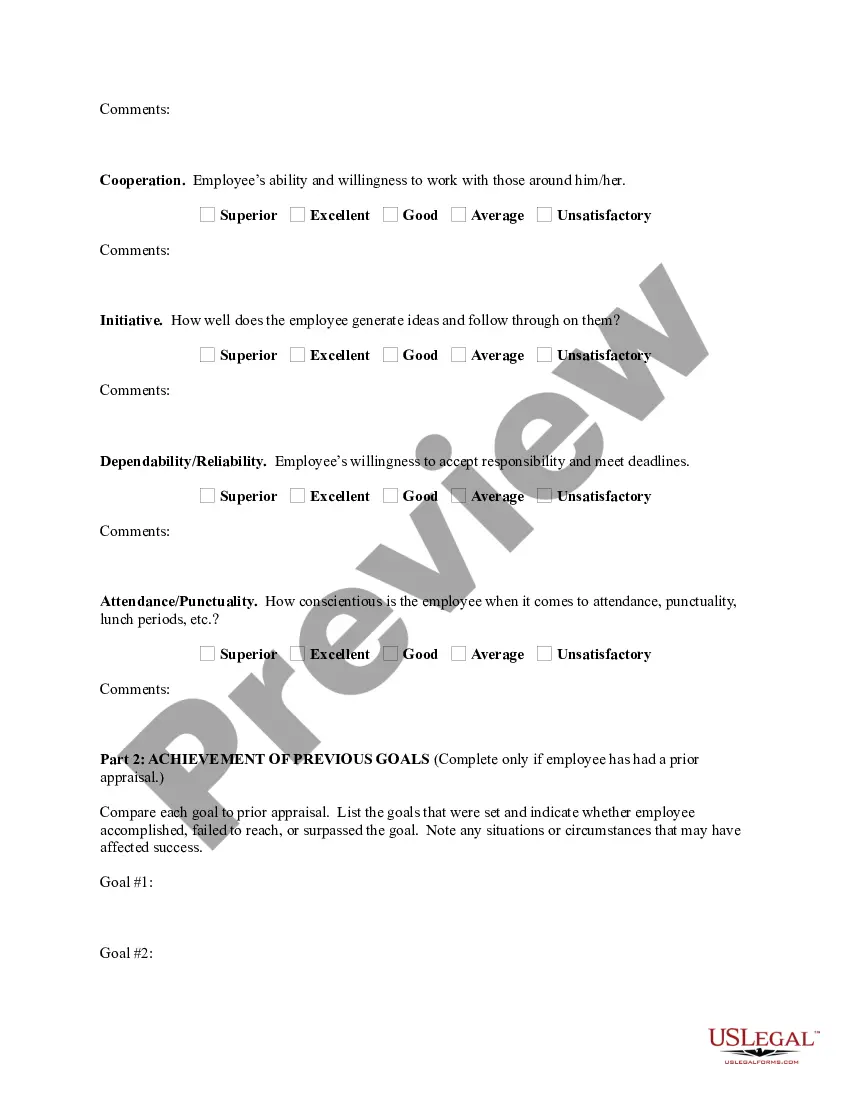

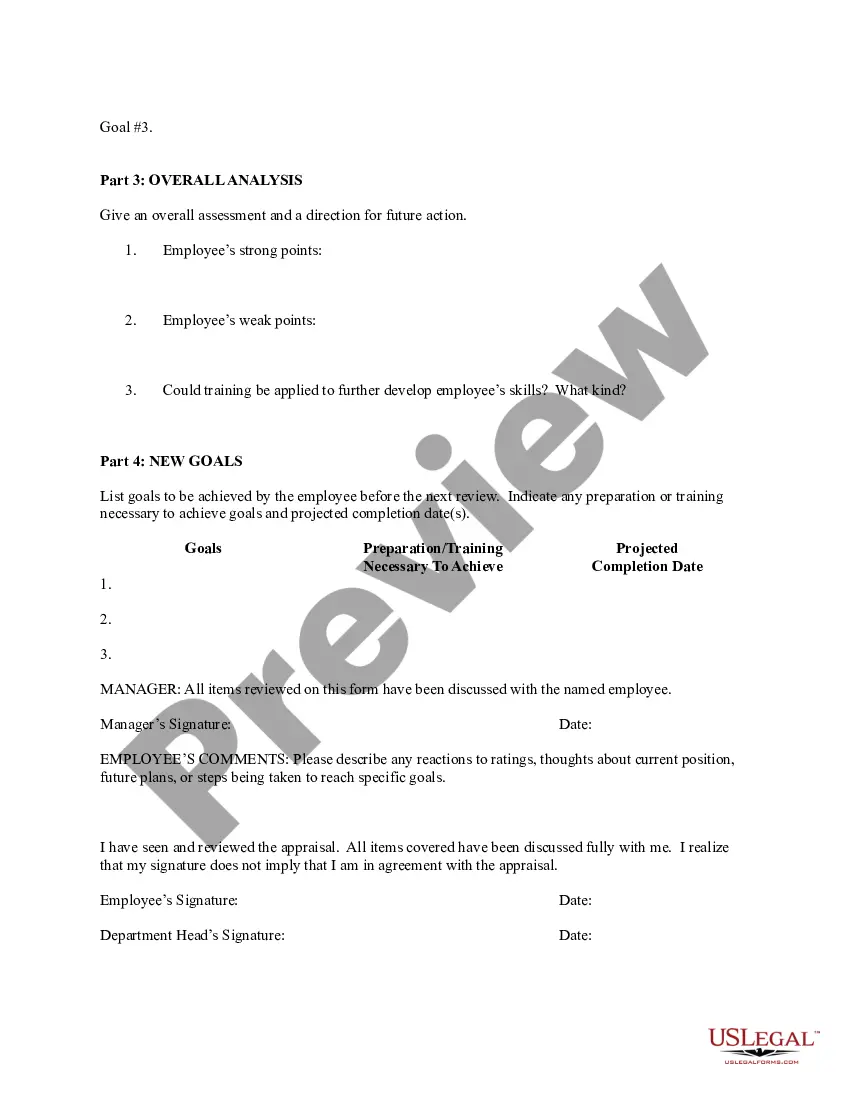

- Step 2. Utilize the Preview option to review the form's details. Don't forget to read over the information.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative types in the legal document template.

- Step 4. Once you have found the form you need, click on the Get Now button. Choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Earnings from a sole proprietorship are subject to the self-employment tax in addition to being subject to regular federal income tax.

As a sole proprietor you must report all business income or losses on your personal income tax return; the business itself is not taxed separately. (The IRS calls this "pass-through" taxation, because business profits pass through the business to be taxed on your personal tax return.)

Filing as a single person in Arizona, you will get taxed at a rate of 2.59% on your first $27,272 of taxable income; 3.34% up to $54,544; 4.17% up to $163,632; and 4.50% on income beyond $163,632. Note that these are marginal tax rates, so the rate in question only applies to the income that falls within that bracket.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

Sole proprietor: If you are a sole proprietor, your business income and expenses should be reported on Schedule C. You'll be responsible for paying self-employment taxessuch as Social Security and Medicare.

If you have decided to form a sole proprietorship business, be aware that you do not need to register with the state. However, the business will assume the personal identity of the owner. It is also important to note that Arizona recognizes businesses form by a husband and wife as a sole proprietorship.

Workers who are considered self-employed include sole proprietors, freelancers, and independent contractors who carry on a trade or business. Individuals who are self-employed and earn less than $400 a year (or less than $108.28 from a church) are exempt from paying the self-employment tax.

If the employee does not complete the form, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

Operating as a sole trader is the simplest and cheapest business structure you can set up. You control and manage the business, and although you 'trade' on your own, you can still employ people to work for you. To set up as a sole trader, you need to: register a business name.

It depends on how much a person makes. We want to shoot for withholding at the 18.5% effective rate so a person won't owe much money or have a large refund, but each person's employer has to rely on the Form W-4 (Employee's Withholding Allowance Certificate) he completed when he was hired.