Arizona Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse selection of legal template forms that you can download or print.

By utilizing the website, you can access thousands of forms for professional and personal purposes, categorized by type, state, or keyword. You can locate the most current versions of documents like the Arizona Employee Payroll Records Checklist in mere moments.

If you already hold a monthly membership, Log In and retrieve the Arizona Employee Payroll Records Checklist from the US Legal Forms library. The Download button will appear on every document you view. You have access to all previously owned forms within the My documents section of your profile.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the document onto your device.Make edits. Fill in, modify, and print and sign the acquired Arizona Employee Payroll Records Checklist. Each template you save to your account has no expiration date and is yours forever. Therefore, to download or print another copy, just head to the My documents area and click on the document you need. Access the Arizona Employee Payroll Records Checklist with US Legal Forms, the most extensive collection of legal record templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, follow these simple guidelines to get started.

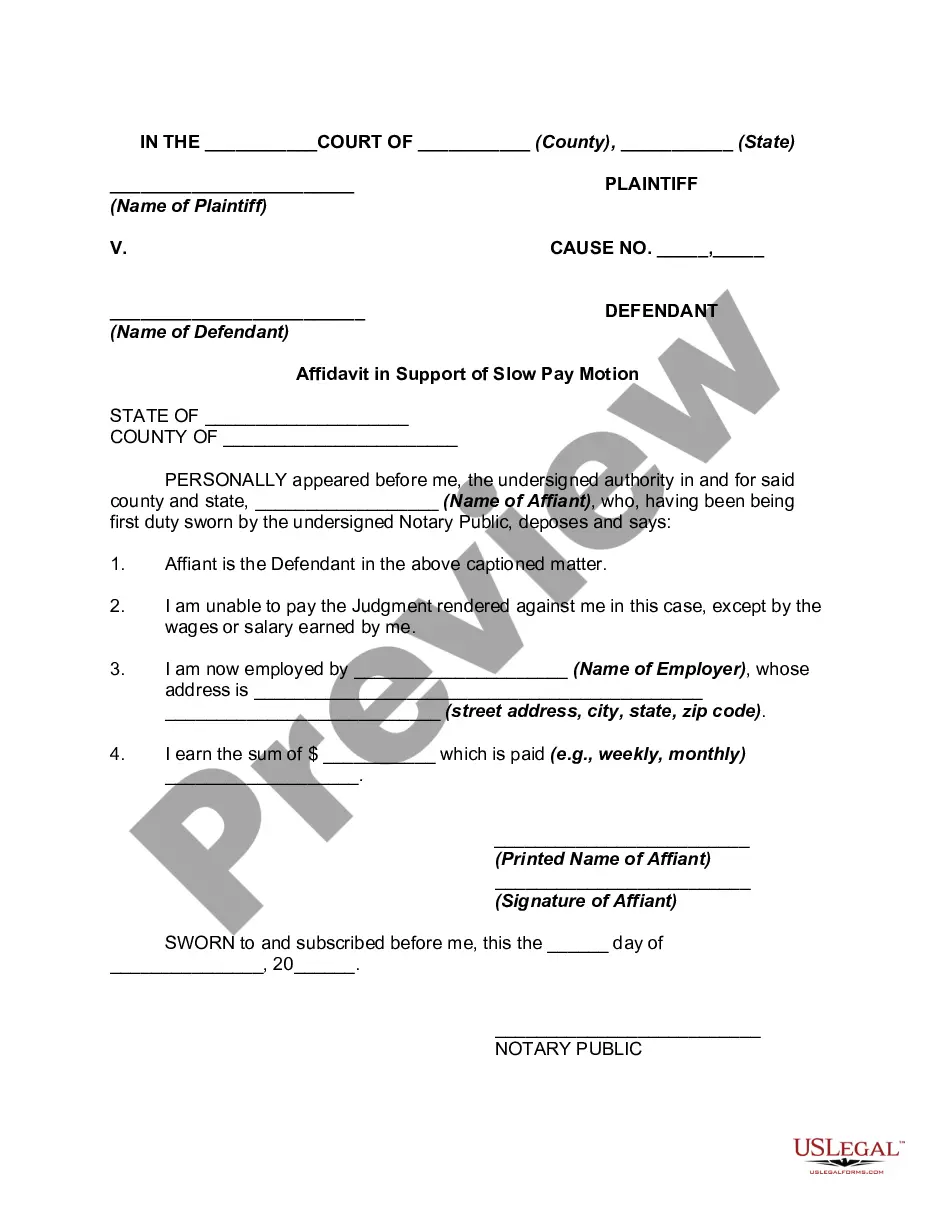

- Confirm that you have selected the correct document for your location. Click the Preview button to review the document's details.

- Examine the document summary to ensure that you have chosen the correct document.

- If the document does not meet your requirements, utilize the Search box at the top of the page to find the one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Buy Now button.

- Then, select your preferred payment plan and provide your credentials to create an account.

Form popularity

FAQ

States that require employers to give employees access to pay stubs: Alaska. Arizona. Idaho.

Seven Types of Records an Employer Should Keep Under Fair Work LegislationGeneral Records.Wages & Pay Records.Payslip Records.Hours of Work Records.Leave Records.Superannuation Records.Termination Records.Recordkeeping with Cloud Payroll.

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

Arizona has no laws that prohibit an employer from requiring an employee to pay for a uniform, tools, or other items necessary for employment for the employer. However, an employee must consent in writing to any deduction from wages to pay for the uniform.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Arizona law requires all employers, whether or not they have been determined liable to pay unemployment taxes, to keep the following records for the most recent four calendar years. Check stubs and canceled checks for all payments.

Payroll records contain information about the compensation paid to employees and any deductions from their pay. These records are needed by the payroll staff to calculate gross pay and net pay for employees. Payroll records typically include information about the following items: Bereavement pay. Bonuses.

A payroll register is tool that records wage payment information about each employee gross pay, deductions, tax withholding, net pay and other payroll-related information for each pay period and pay date.

Employers are required to make and keep employment records for seven (7) years.

In Arizona, you will need to register with the Arizona Department of Revenue. To do so, fill out the Arizona Joint Tax Application (Form JT-1). This combined form is used to register for withholding tax, transaction privilege tax, use tax, and unemployment insurance.