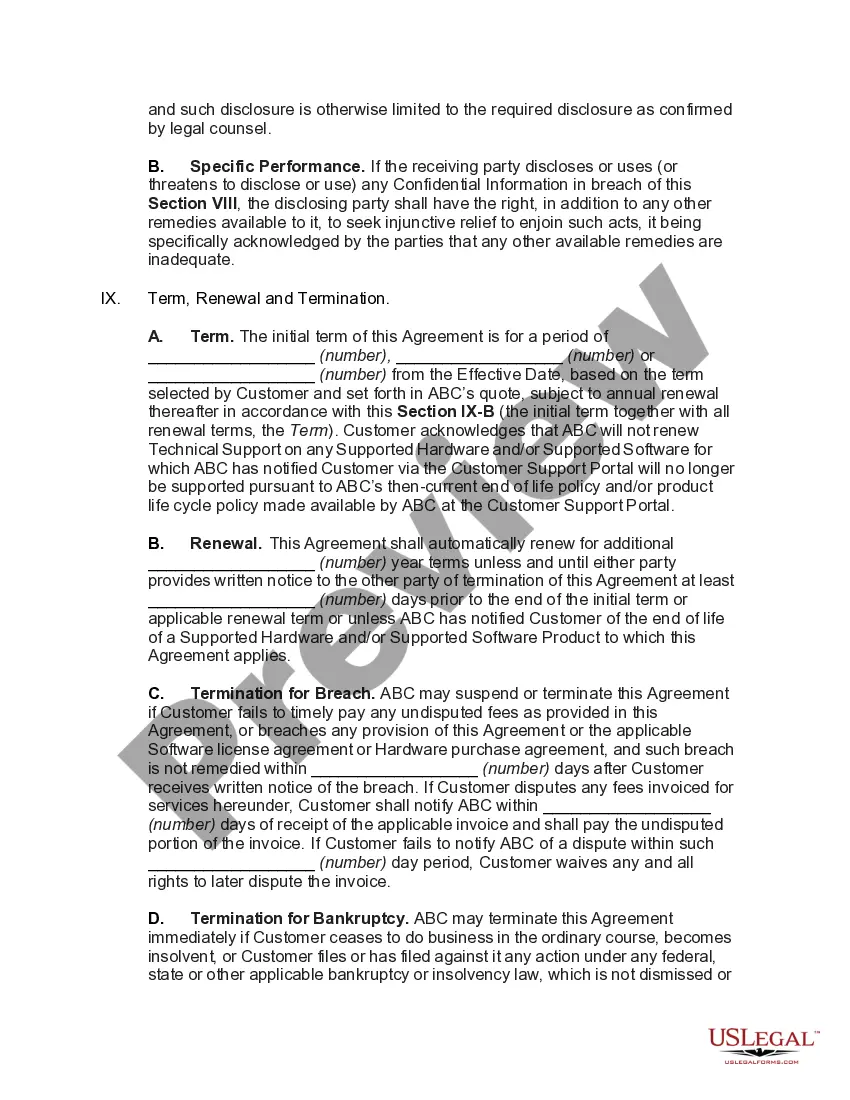

Arizona Software and Hardware Maintenance and Technical Support Agreement

Description

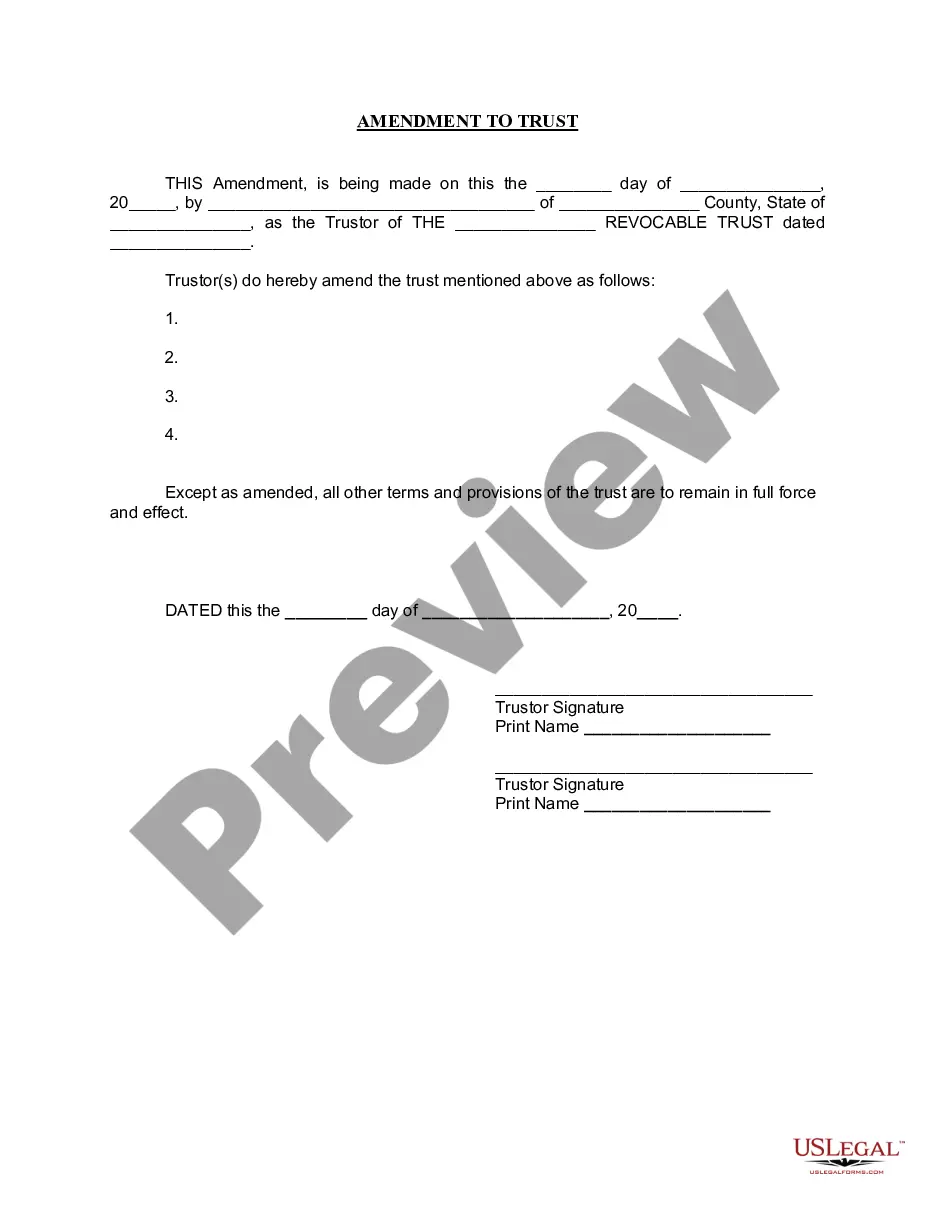

How to fill out Software And Hardware Maintenance And Technical Support Agreement?

Have you ever found yourself in a circumstance where you consistently require documents for both business and personal purposes.

There is a multitude of authentic template documents accessible online, but finding ones you can rely on is not straightforward.

US Legal Forms offers a plethora of form templates, such as the Arizona Software and Hardware Maintenance and Technical Support Agreement, which are designed to comply with federal and state requirements.

Once you identify the correct form, click Get now.

Select the pricing plan you want, complete the required information to create your account, and process the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Arizona Software and Hardware Maintenance and Technical Support Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Utilize the Review button to evaluate the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you seek, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Purchases of physical property like furniture, home appliances, and motor vehicles, are subject to sales tax in Arizona. Arizona does not charge sales tax on the purchase of groceries, prescription medicine, or gasoline.

In the state of Arizona, the agreement is required to be sold as a separate and distinct item and separately stated on sales invoice. Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in Arizona.

Taxpayer's proceeds from software maintenance is subject to tax under A.R.S. § 42-5061 unless an exemption applies.

Support and Maintenance Agreement means any of Software AG's or Partner's standard forms of written contract setting out the terms and conditions under which the Customer may obtain software support and maintenance services on terms identical to Software AG's Product Support and Maintenance Service Terms and Conditions

Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in Arizona.

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Traditional Goods or ServicesPurchases of physical property like furniture, home appliances, and motor vehicles, are subject to sales tax in Arizona. Arizona does not charge sales tax on the purchase of groceries, prescription medicine, or gasoline.

Under Arizona's statutory sales tax structure, prime contractors are liable for sales tax on their gross contracting receipts minus the standard 35% labor deduction. Subcontractors, if they can establish that they were working for a taxable prime contractor, will be exempt from the sales tax.

Sales tax applies to the retail sales of hardware, miscellaneous supplies, repair parts, and pre-written and sub-licensed software. Sales tax also applies if the client is required to purchase a maintenance contract or the hotline support service.