Arizona Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

You are able to commit hrs on the web looking for the legal record web template that fits the federal and state needs you require. US Legal Forms supplies a huge number of legal kinds that are reviewed by experts. You can easily download or produce the Arizona Jury Instruction - Failure To File Tax Return from my services.

If you currently have a US Legal Forms bank account, you may log in and click the Acquire option. Afterward, you may complete, edit, produce, or indication the Arizona Jury Instruction - Failure To File Tax Return. Every legal record web template you get is your own property eternally. To acquire another copy of any bought kind, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms site the very first time, keep to the straightforward instructions listed below:

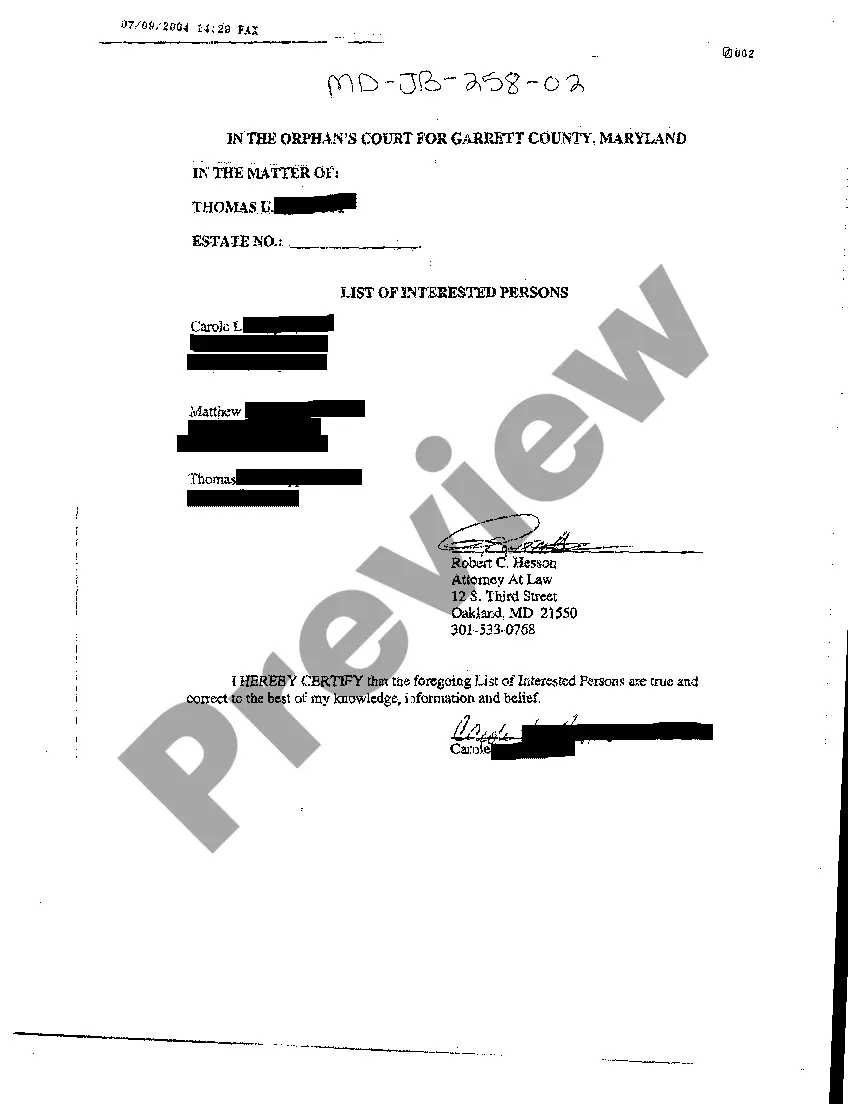

- Very first, make sure that you have chosen the proper record web template for that area/town of your choice. Browse the kind outline to make sure you have chosen the appropriate kind. If readily available, make use of the Review option to appear from the record web template also.

- If you would like locate another model from the kind, make use of the Lookup field to find the web template that suits you and needs.

- Upon having found the web template you would like, click on Buy now to carry on.

- Pick the costs prepare you would like, key in your references, and register for an account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal bank account to fund the legal kind.

- Pick the file format from the record and download it in your product.

- Make alterations in your record if needed. You are able to complete, edit and indication and produce Arizona Jury Instruction - Failure To File Tax Return.

Acquire and produce a huge number of record themes using the US Legal Forms website, that provides the most important variety of legal kinds. Use expert and state-certain themes to take on your small business or person requirements.

Form popularity

FAQ

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Individuals who fall below the minimum may still have to file a tax return under certain circumstances; for instance, if you had $400 in self-employment earnings, you'll have to file and pay self-employment tax. If you have no income, however, you aren't obligated to file.

The minimum income amount depends on your filing status and age. In 2022, for example, the minimum for single filing status if under age 65 is $12,950. If your income is below that threshold, you generally do not need to file a federal tax return.

You must attach Schedule S, Other State Tax Credit, and a copy of your tax return(s) filed with the other state(s) to your California tax return.

Determining Filing Status for Nonresidents and Part-Year Residents. Individuals who move to Arizona or live in the state temporarily also have tax filing requirements. Nonresident individuals must file income tax returns in both Arizona and their home state.

Income Tax Filing Requirements Individuals must file if they are:AND gross income is more than:Single$12,950Married filing joint$25,900Married filing separate$12,950Head of household$19,400

If you make $60,000 a year living in the region of Arizona, USA, you will be taxed $12,178. That means that your net pay will be $47,822 per year, or $3,985 per month.

Arizona does not tax Social Security retirement benefits. The state does, however, tax other types of retirement income, like distributions from an IRA or a 401(k). Arizona's property taxes are relatively low, but sales taxes are fairly high.