Arizona Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

It is feasible to spend time online attempting to locate the sanctioned document template that aligns with the federal and state criteria you require.

US Legal Forms provides thousands of legal forms that are vetted by professionals.

You can easily download or print the Arizona Monthly Retirement Planning from our service.

If available, use the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download option.

- Subsequently, you can complete, modify, print, or sign the Arizona Monthly Retirement Planning.

- Every legal document template you obtain is yours forever.

- To acquire another copy of a purchased form, navigate to the My documents tab and click the appropriate option.

- If you are utilizing the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure that you have selected the correct document template for your desired area or jurisdiction.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

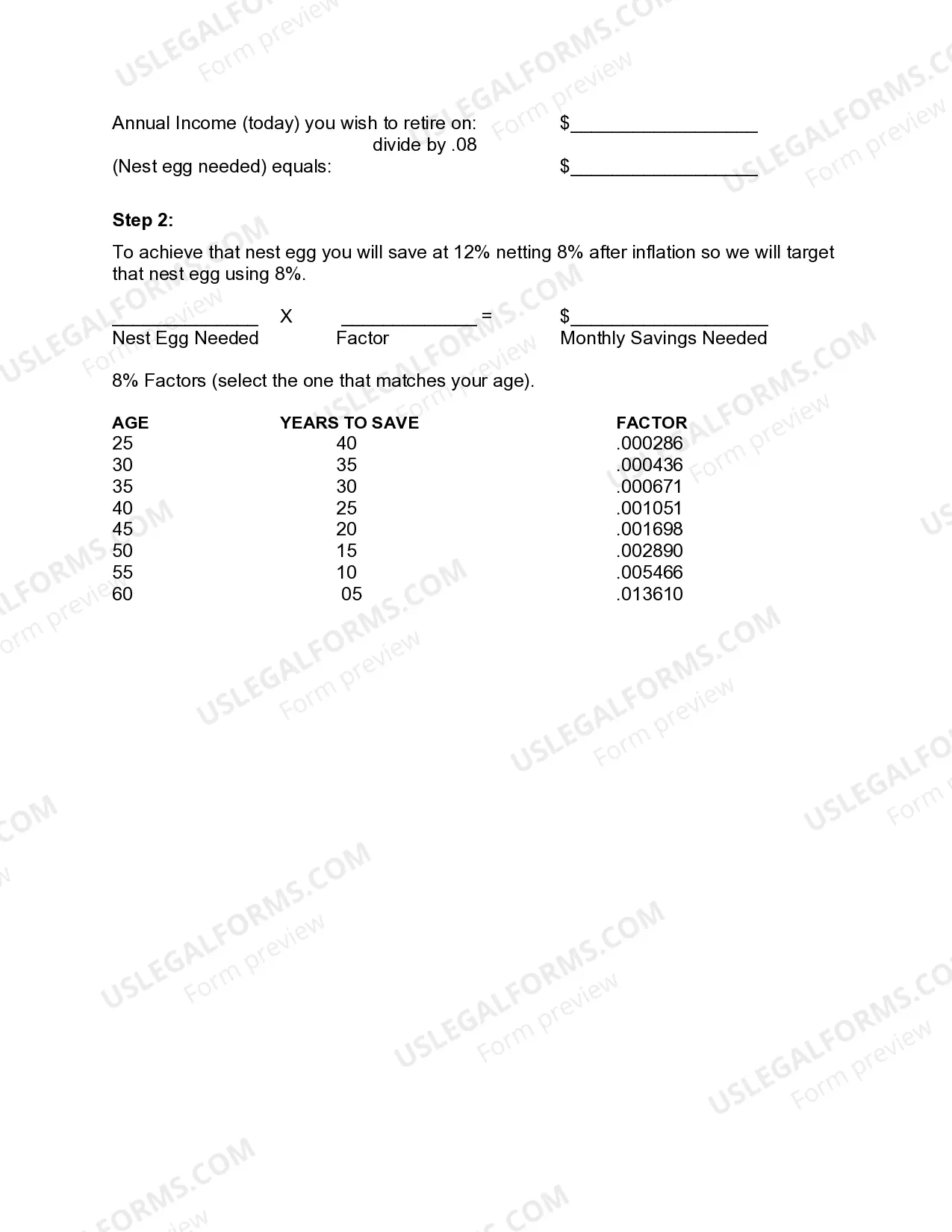

Once you reach retirement, a common estimate is that $600,000 could generate around $24,000 to $30,000 annually if you follow the 4% rule. This income can provide a solid foundation for your retirement lifestyle. Incorporating this amount into your Arizona monthly retirement planning will help you evaluate if it meets your financial goals and needs. Always consider consulting a financial planner to ensure you maximize your retirement income.

How much do you need to retire in Arizona? To retire comfortably in Arizona you should have about $1.2 million in savings, slightly higher than national average, but in line with other hot retirement destinations like Florida.

For starters, the ASRS is what's called a Defined Benefit Plan. In technical terms, it's a 401(a) plan that is governed by Arizona statute and IRS rules. A more simple explanation: it's a mandatory-participation retirement plan that provides ASRS retirees with benefit payments for the rest of their life.

The ASRS plan type is a 401(a) defined benefit plan which does not allow for loans against the fund's balance. IRS regulations do not provide allowances for borrowing against your retirement such as you might be able to with other plan types.

The longer you work and accrue service credit, the closer your retirement benefit is to your final monthly salary. Multiplying your Years of Service by the appropriate multiplier will provide you with the percentage of your average monthly compensation that will be paid as a monthly retirement benefit.

Investments & ASRS PerformanceThe ASRS has outperformed the assumed earnings rate of 7.5% six of the last 10 years, with a 10-year average return of 8.9%, adding significant additional value to the trust fund over time.

When it comes to retirement, ASRS members are vested from the date their first contribution is received. Members may keep their funds on account with ASRS until they meet their normal retirement criteria, at which point they can retire, even with only 1 month of service.

The ASRS has outperformed the assumed earnings rate of 7.5% six of the last 10 years, with a 10-year average return of 8.9%, adding significant additional value to the trust fund over time.

Your ASRS pension is a cost sharing model: you and your ASRS employer contribute equally toward your retirement. Your personal contributions fund only a relatively small part of your benefit. When you retire, you will recoup your own contributions within three to five years from the start of your benefit payments.

The member must submit an application for retirement as with any retirement situation. Normal retirement is defined as either (1) reaching age 65, (2) reaching age 62 along with at least 10 years of ASRS service credit, or (3) earning at least 80 points.