Arizona Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Finding the appropriate valid document template can be a challenge.

Naturally, there are countless templates available online, but how can you obtain the valid form you need.

Take advantage of the US Legal Forms site. This service provides thousands of templates, including the Arizona Bill of Sale by Corporation of all or Nearly all of its Assets, which you can utilize for business and personal purposes.

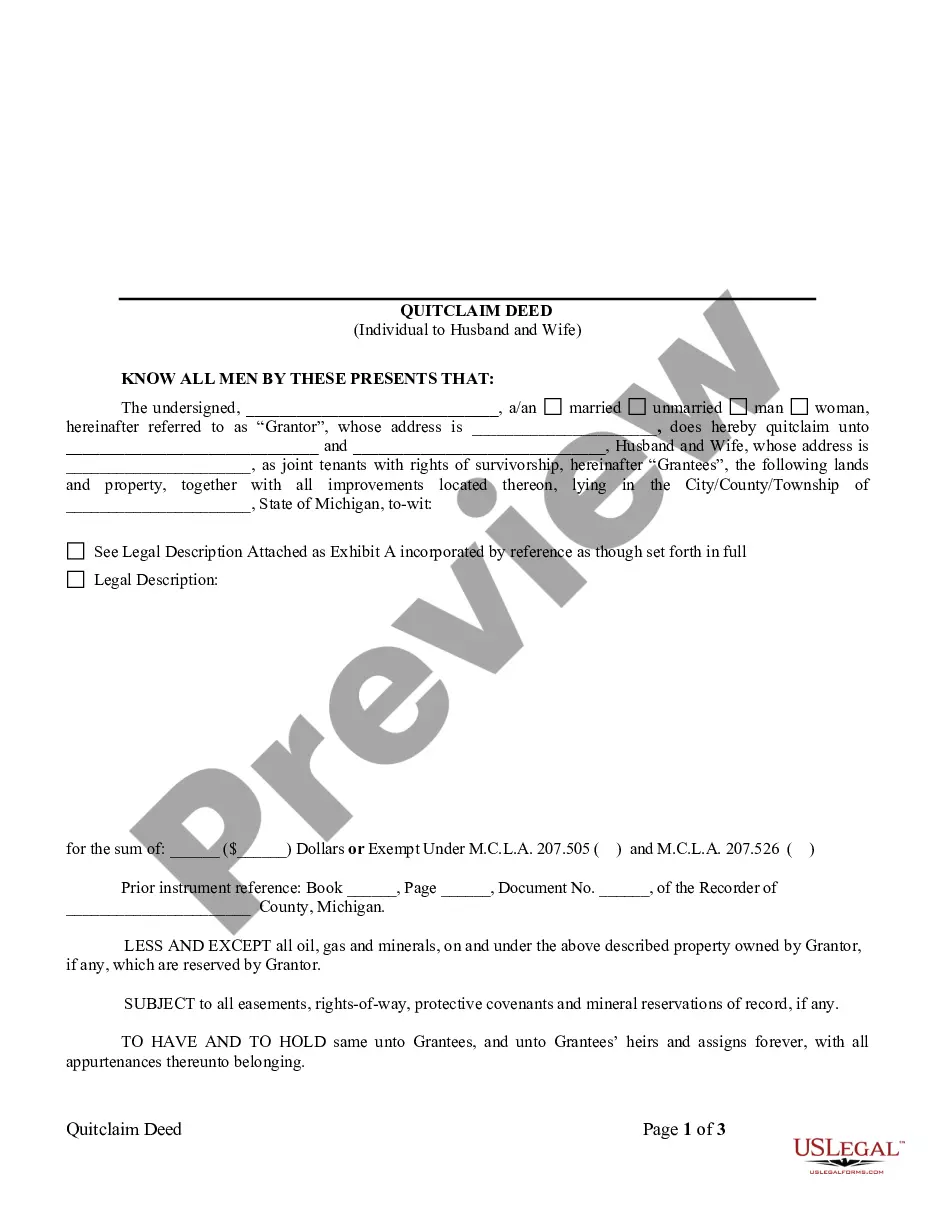

You can browse the form using the Preview button and read the form description to confirm it is the right one for you.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Arizona Bill of Sale by Corporation of all or Nearly all of its Assets.

- Use your account to search through the legal forms you have previously acquired.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, make sure you have chosen the correct form for your local area/county.

Form popularity

FAQ

The sale of all or substantially all of the assets involves transferring a significant majority of a corporation's assets, indicating a transformative change. This type of transaction can have profound implications for both the selling and purchasing parties. To ensure the sale is conducted smoothly and legally, use the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets to safeguard your interests.

A sale of substantially all assets refers to a transaction where a corporation sells most of its significant assets, potentially leading to a shift in control. This type of sale can impact operations and shareholder interests. To facilitate this process, consider utilizing the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets for proper documentation and legal protection.

A sale of substantially all assets typically includes transactions where a corporation sells a majority of its key assets. These assets could range from physical equipment to intangible properties. To ensure compliance with legal standards, it's advisable to use the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets when conducting such significant transactions.

All or substantially all means that the sale encompasses the majority of a corporation's operational assets. It signifies a significant change in ownership or control, possibly impacting the business's future. This concept is vital when drafting legal documents, such as the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets.

A substantial sale of assets involves transferring a large part of a corporation's assets to another entity. This could include selling equipment, inventory, and other significant properties of the business. Utilizing the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets can help formalize and document this important transaction.

All or substantially all of the business refers to a situation where a corporation sells a significant portion of its assets. This often means transferring the majority of the operational aspects, effectively changing the control of the company. Understanding this definition is crucial when utilizing the Arizona Bill of Sale by Corporation of all or Substantially all of its Assets.

While a Bill of Sale is not mandatory in every transaction in Arizona, it is strongly advised to have one for both parties' protection. This document serves as a record of the transaction and details the terms of the sale. For those transferring significant assets, using an Arizona Bill of Sale by Corporation of all or Substantially all of its Assets helps clarify responsibilities and can ease the legal process in the future.

Yes, you can use a handwritten Bill of Sale, but it is important to include all necessary details to make it legally binding. While a handwritten document can be acceptable, using a professionally prepared Arizona Bill of Sale by Corporation of all or Substantially all of its Assets ensures that you cover every detail required by law. This is especially crucial when transferring significant assets, as it minimizes the risk of confusion or disputes later.

To sell a car privately in Arizona, you need the vehicle title and a completed Arizona Bill of Sale by Corporation of all or Substantially all of its Assets. You must also provide valid identification and ensure that the vehicle has passed any necessary emissions tests. Having these documents ready will streamline the process and make it easier for both you and the buyer.

In Arizona, a Bill of Sale is not strictly required for all transactions, but it is highly recommended. This document helps to ensure that both the seller and buyer understand the terms of the sale. When dealing with substantial assets, creating an Arizona Bill of Sale by Corporation of all or Substantially all of its Assets can prevent future disputes and safeguard your interests.