Arizona Agreement and Assignment of Judgment for Collection to Collection Agency

Description

How to fill out Agreement And Assignment Of Judgment For Collection To Collection Agency?

You may invest time on the Internet attempting to find the authorized papers design that meets the federal and state specifications you will need. US Legal Forms gives a large number of authorized varieties that happen to be examined by pros. It is possible to download or produce the Arizona Agreement and Assignment of Judgment for Collection to Collection Agency from my service.

If you already possess a US Legal Forms profile, you are able to log in and then click the Acquire switch. Afterward, you are able to complete, edit, produce, or signal the Arizona Agreement and Assignment of Judgment for Collection to Collection Agency. Each authorized papers design you acquire is your own for a long time. To obtain yet another duplicate of the acquired kind, check out the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms site the very first time, keep to the basic guidelines under:

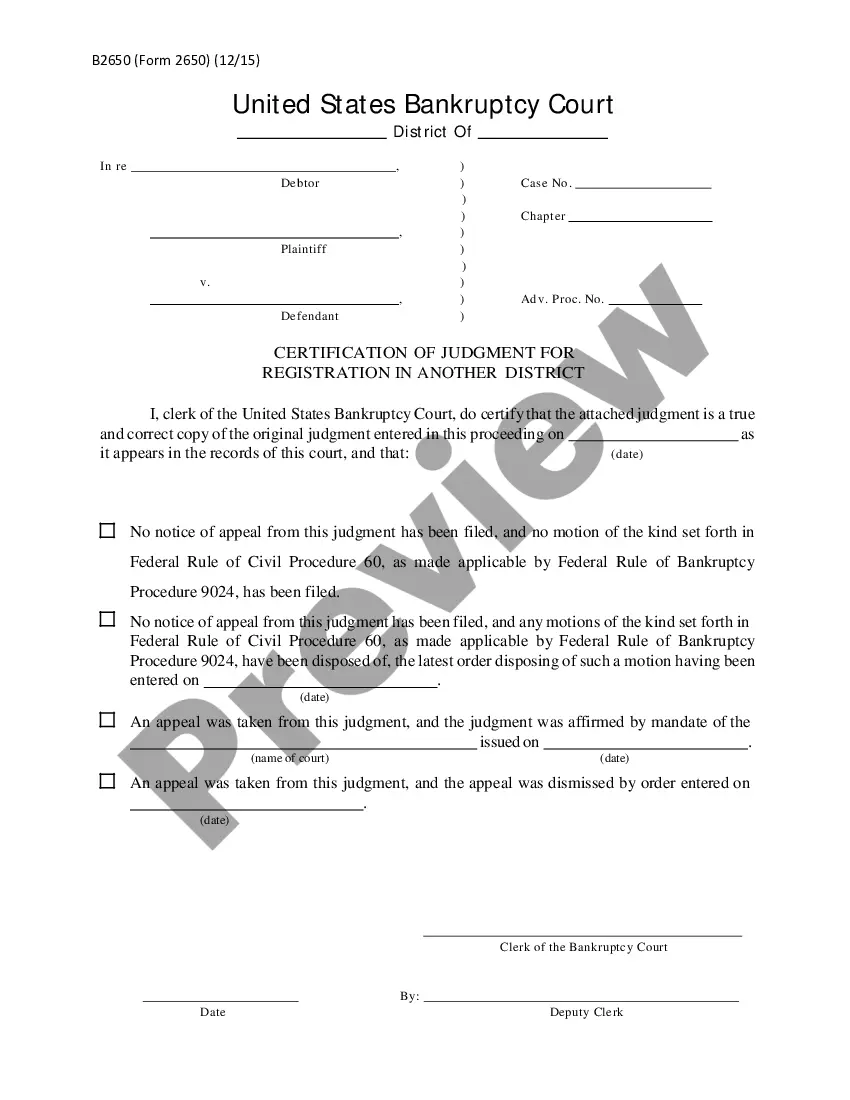

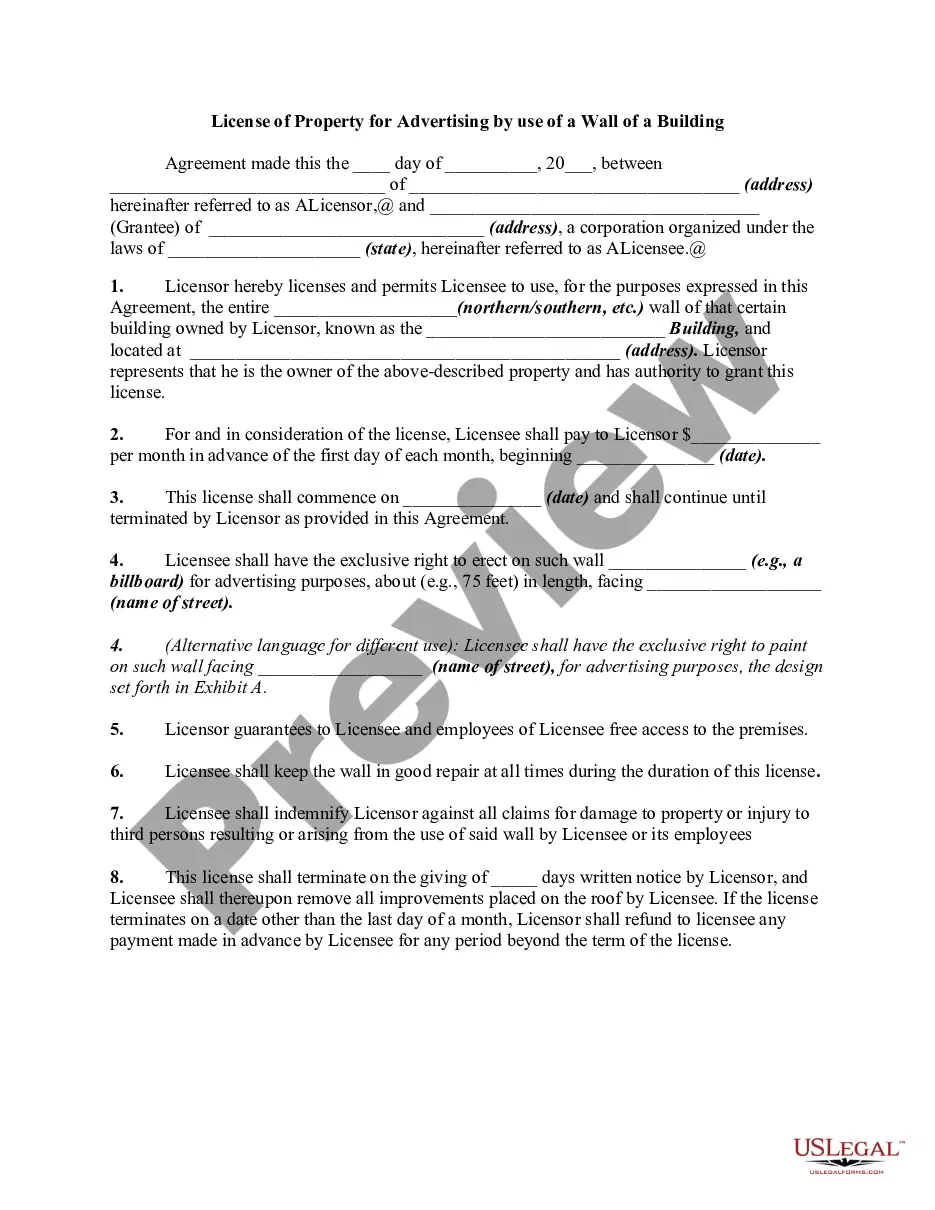

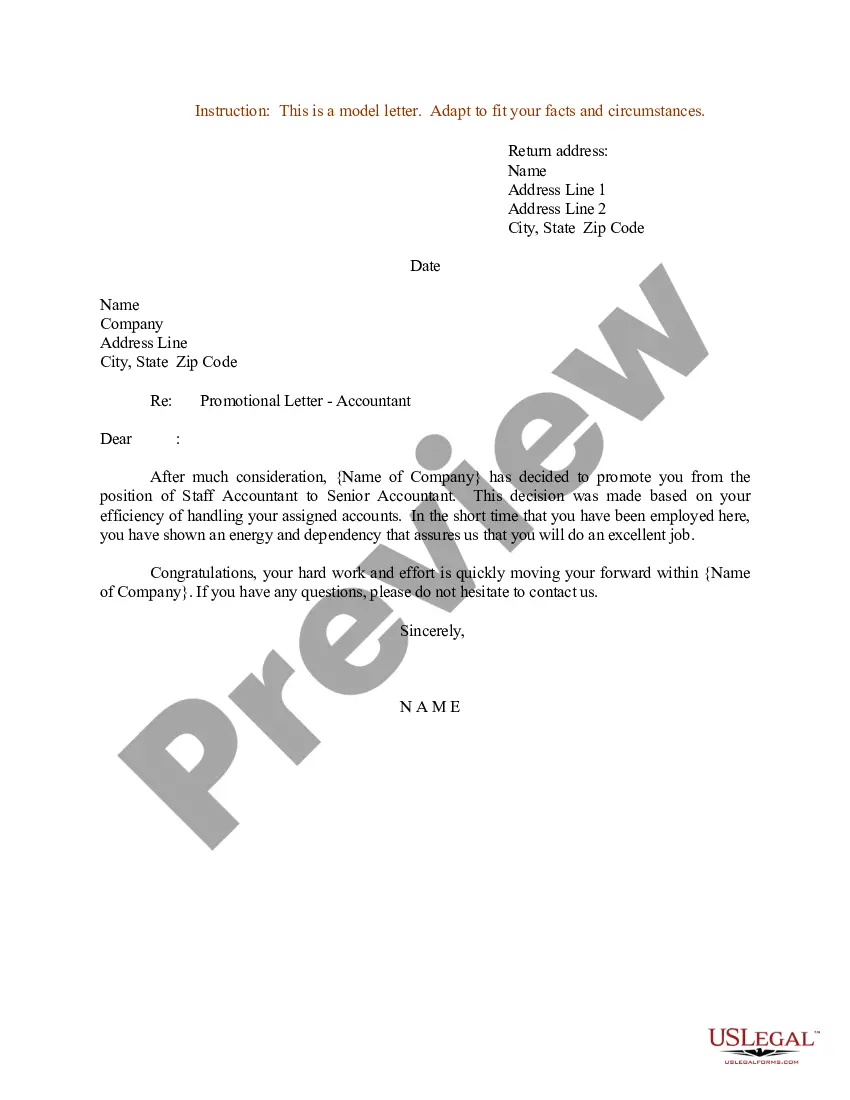

- Very first, be sure that you have chosen the correct papers design for that state/city of your liking. Look at the kind outline to ensure you have selected the correct kind. If readily available, make use of the Review switch to check throughout the papers design at the same time.

- If you want to locate yet another variation from the kind, make use of the Search field to discover the design that meets your requirements and specifications.

- Once you have identified the design you desire, click Get now to carry on.

- Select the pricing prepare you desire, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal profile to fund the authorized kind.

- Select the format from the papers and download it in your gadget.

- Make changes in your papers if required. You may complete, edit and signal and produce Arizona Agreement and Assignment of Judgment for Collection to Collection Agency.

Acquire and produce a large number of papers templates while using US Legal Forms site, that offers the most important variety of authorized varieties. Use specialist and express-distinct templates to handle your company or specific requires.

Form popularity

FAQ

When a creditor or lender no longer wants to be responsible for attempting to collect your debt, they will sell your debt to a third party. When this occurs, a Notice of Assignment (NOA) is sent out to you. This should inform you of who is responsible for collecting the rest of your loan or debt.

Even if a debt has passed into collections, you may still be able to pay your original creditor instead of the agency. Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan.

If you're able to do so, pay the original creditor before your debt goes to collections. Having a debt sent to collections will damage your credit score and may limit your options for repayment. In most cases, the original creditor will offer better repayment options than a debt collector will.

A collection lawsuit submits the issue to a judge who decides whether you owe money to the creditor and, if so, the exact amount due. A judgment is the court's final decision as to the outcome of litigation. This signals the end of the case and provides the last word on liability.

Statute of Limitations on Debt in Arizona Debt TypeDeadlineAuto Loan6 yearsMortgage6 yearsPersonal Loan6 yearsJudgment10 years4 more rows ?

The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly ? preferably before it's sent to a collection agency.

Both the original creditor and collection agency will be listed on your credit reports. That's strike number two against you. It's frustrating, but it's not illegal.

Paying is often a good idea, not only because you presumably owe the debt they're seeking or even because it will get the bill collectors off your back. There's a chance, if no guarantee, that paying off an account in collections could benefit your credit score.