Arizona Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

If you need to download, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Take advantage of the site’s user-friendly and efficient search to find the documents you require.

Various templates for business and personal uses are organized by categories and recommendations, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Arizona Promissory Note related to the Sale and Purchase of a Mobile Home in just a few clicks.

- If you are already a customer of US Legal Forms, sign in to your account and then click the Download button to obtain the Arizona Promissory Note related to the Sale and Purchase of a Mobile Home.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct area/state.

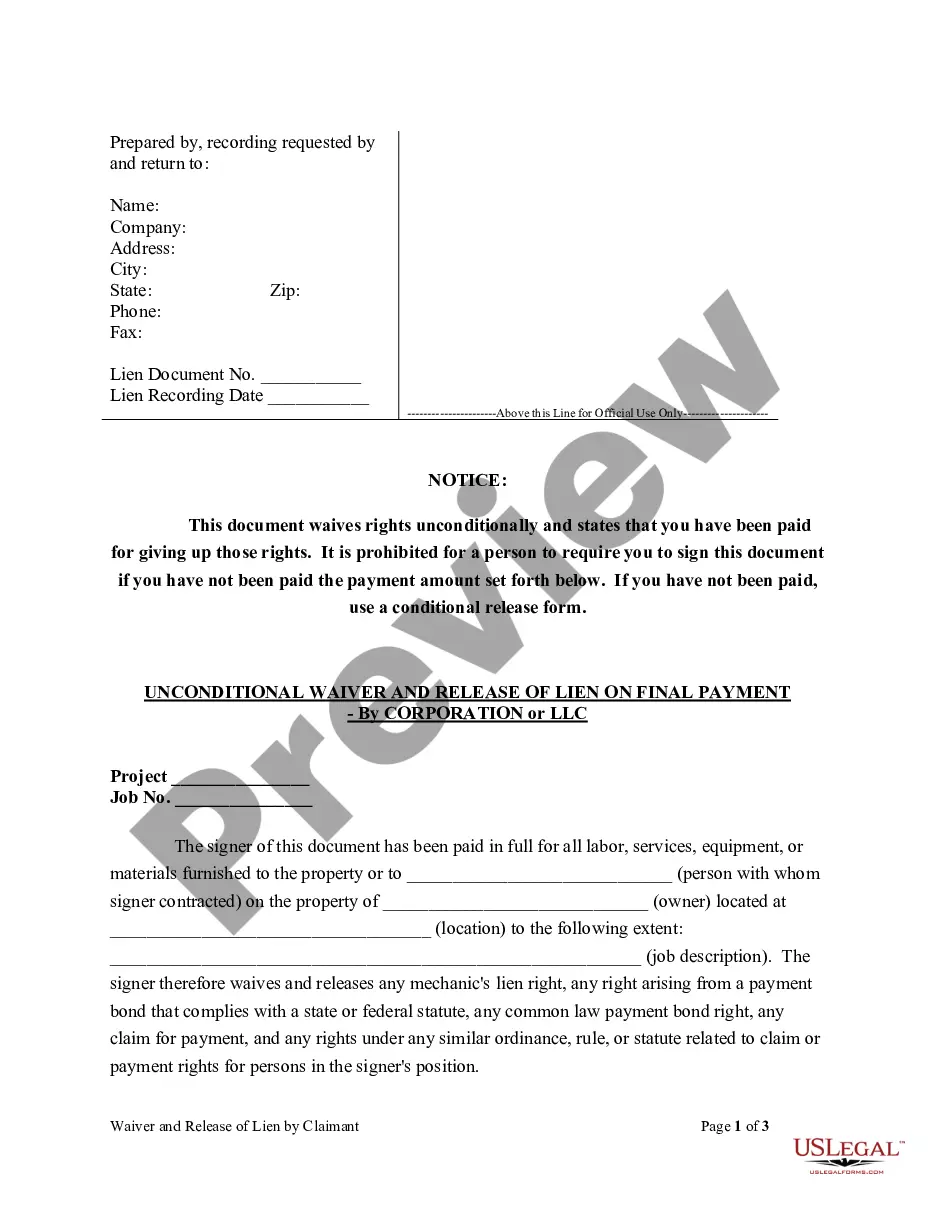

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Acceptance is not an essential requirement of a valid promissory note.

A Promissory note is a contract, which means that it is legally binding. However, it must include certain conditions to ensure it is enforceable.

Characteristics of promissory note:It is a written legal document. There must be a clear, point to point and unconditional promise of paying a certain amount to a specified person. It should be drawn and signed by the maker. It should be stamped properly. It specifically identifies the name of the maker and payee.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note is enforceable for up to 6 years after the due date of the payment, according to Arizona state law. If no action has been taken to collect payment prior to 6 years, the statute of limitations has run out and the contract can no longer be enforced through legal action.