Arizona Sample Letter for Loan

Description

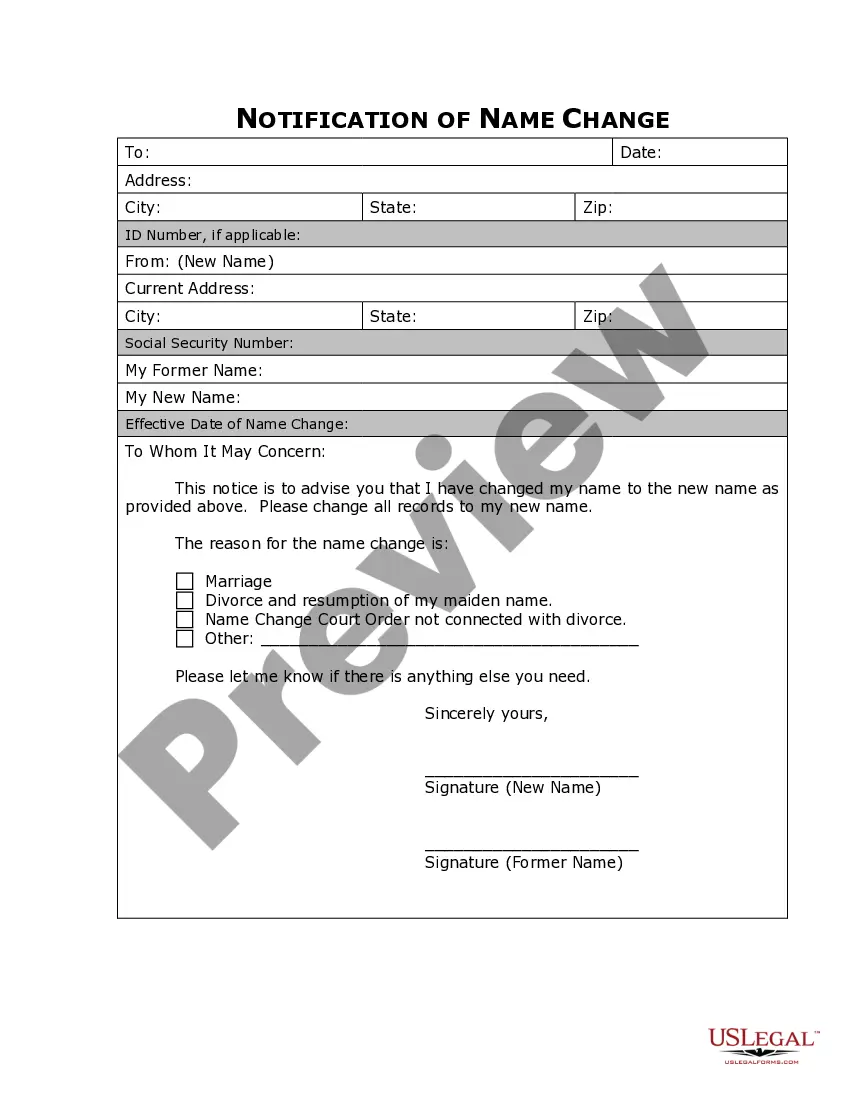

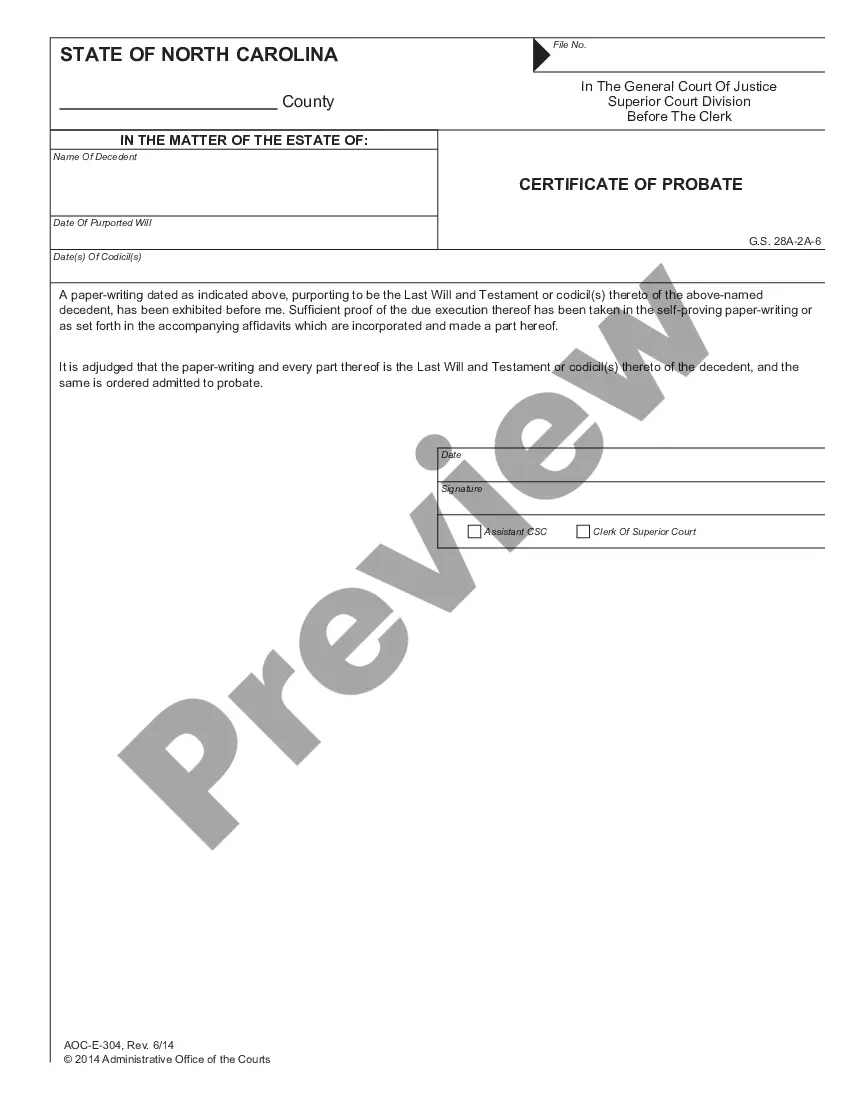

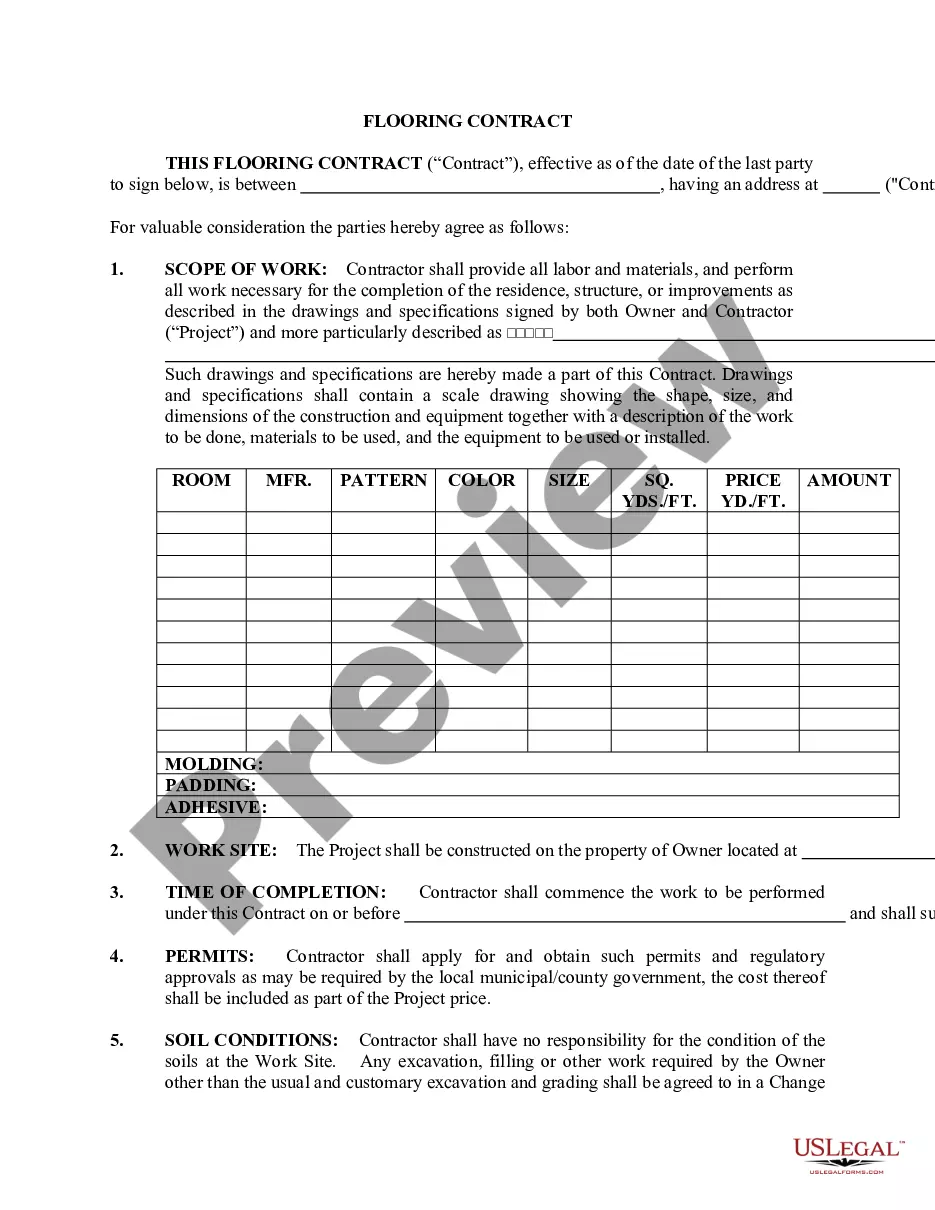

How to fill out Sample Letter For Loan?

It is feasible to invest time online trying to locate the legal document template that fulfills the state and federal stipulations you will require.

US Legal Forms offers a vast array of legal forms that have been assessed by experts.

You can effortlessly download or print the Arizona Sample Letter for Loan from the service.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Arizona Sample Letter for Loan.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document template for the state/city that you select.

- Check the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Here are the important elements that your letter should include:Facts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again.

The explanation asked for can be as simple as late payments to something as big as discrepancies in your accounts. You may also have to provide a letter of explanation in situations such as: if you had a late payment on your house. if you had a late payment on your rent.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

How to write a letter of explanationThe date you're writing the letter.The lender's name, mailing address, and phone number.Your full legal name and loan application number.Your explanation, with references to any supporting documents you're including.Your mailing address and phone number.01-Mar-2022

Begin the letter with the date, a salutation, and an introduction of the incident or issue. Provide a short but detailed description without having to add unnecessary terms and phrases. Provide an explanation of the steps you've taken to rectify the error or to complete the missing information.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

Derogatory marks are negative, long-lasting indications on your credit reports that generally mean you didn't pay back a loan as agreed. For example, a late payment or bankruptcy appears on your reports as a derogatory mark.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Derogatory marks are negative, long-lasting indications on your credit reports that generally mean you didn't pay back a loan as agreed. For example, a late payment or bankruptcy appears on your reports as a derogatory mark.