This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Locating the appropriate legal document template can be challenging.

It goes without saying that there are numerous templates accessible online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website.

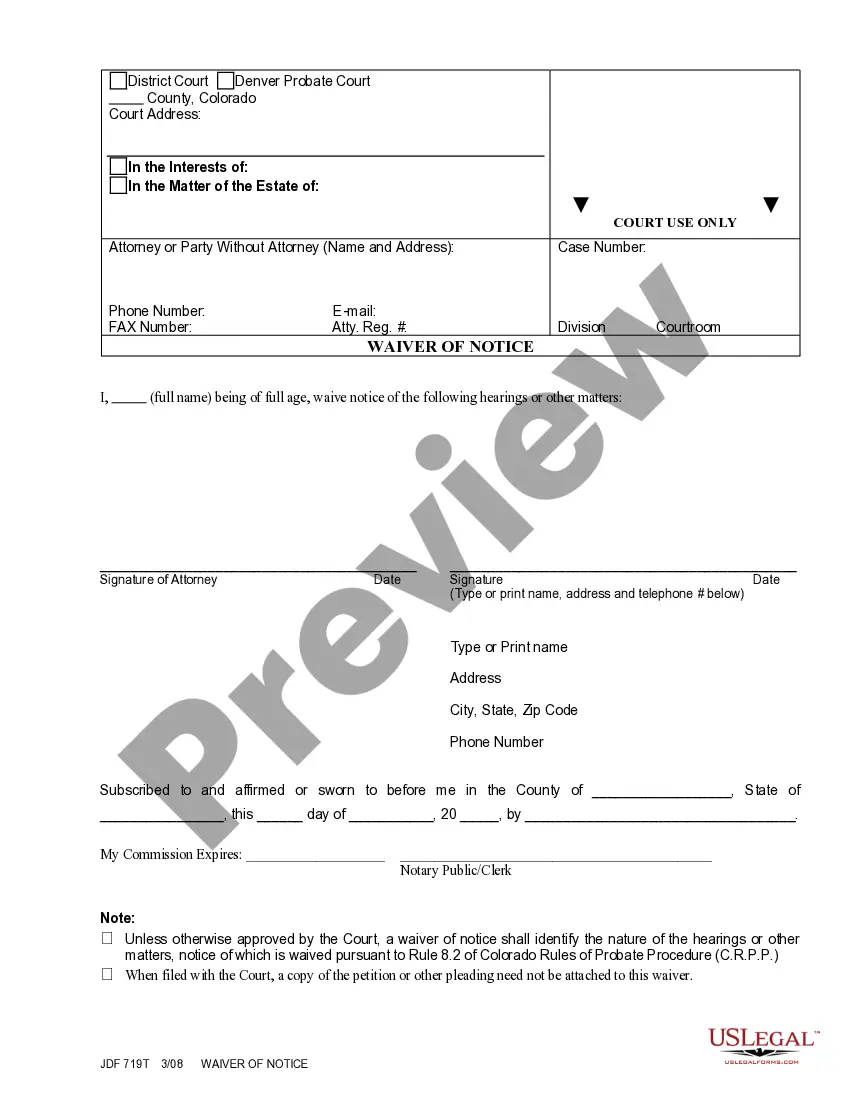

First, ensure you have selected the correct form for your locality/state. You can preview the document using the Review button and read the document description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Buy now button to acquire the form. Choose the payment plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- The service offers thousands of templates, including the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure, suitable for business and personal purposes.

- All documents are vetted by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Download button to obtain the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure.

- Use your account to browse the legal documents you have previously acquired.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps for you to follow.

Form popularity

FAQ

The IRS 7 year rule refers to the period during which the IRS can collect tax debts through liens and levies. After seven years, the IRS must remove tax liens from property titles as long as the debts are settled. If you face issues related to property redemption after foreclosure, understanding this rule can be vital. Using the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure can help you address these complexities and protect your property rights.

The right to redeem property after a foreclosure generally allows the original owner to reclaim their property by paying off owed debts within a specified period. This right can provide a second chance for homeowners to recover their homes and avoid permanent loss. Utilizing the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure can simplify this process and ensure you have the proper legal backing to protect your rights.

The IRS right to redeem foreclosure allows the IRS to reclaim a property that has been foreclosed upon if the owner owes federal taxes. This right typically lasts for 120 days after the foreclosure sale. Understanding this right is crucial, especially if you plan to file the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure, as it can impact your ability to regain ownership.

Foreclosure redeemed refers to the process where a property owner pays off their outstanding mortgage or tax debts, thereby reclaiming their property from foreclosure. This action stops the sale of the property and restores ownership to the original owner. To facilitate this, you may need the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure, which ensures you have the necessary documentation to complete the process.

In Arizona, the tax lien redemption period typically lasts for three years. During this time, property owners can settle their tax debts to reclaim their properties. If you are looking to navigate this process, the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure is essential. This application allows you to formally request the release of your redemption rights.

The IRS right of redemption allows the IRS to reclaim a property after foreclosure, under certain conditions. If the IRS has a lien against your property, they can recover the amount owed by taking possession during the redemption period. This right can complicate the foreclosure process, making it essential to understand your options. You might consider using the Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure to address any IRS liens effectively.

To obtain a lien release from the IRS, you generally need to file Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. This form allows you to request the IRS to remove the lien, especially if you have satisfied the obligations or entered into a payment agreement. Be sure to follow up on your application to ensure timely processing. After receiving the lien release, you can proceed with your Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure.

In Arizona, the redemption period for foreclosures typically lasts six months from the date of the trustee's sale. During this time, the homeowner can reclaim their property by paying the full amount owed. It's crucial to understand this timeline, as it directly affects your rights. You may need to submit an Arizona Application for Release of Right to Redeem Property from IRS After Foreclosure if the IRS has placed a lien on your property.