Arizona Order of Approval of Final Accounting

Description

How to fill out Arizona Order Of Approval Of Final Accounting?

Managing official documentation necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals across the country in achieving this for 25 years, so when you select your Arizona Order of Approval of Final Accounting template from our platform, you can rest assured it complies with federal and state regulations.

Engaging with our service is straightforward and swift. To acquire the required document, all you need is an account with an active subscription. Here’s a brief guide for you to obtain your Arizona Order of Approval of Final Accounting in minutes.

All documents are designed for multiple uses, such as the Arizona Order of Approval of Final Accounting displayed on this page. If you require them later, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and complete your business and personal documentation swiftly and in complete legal compliance!

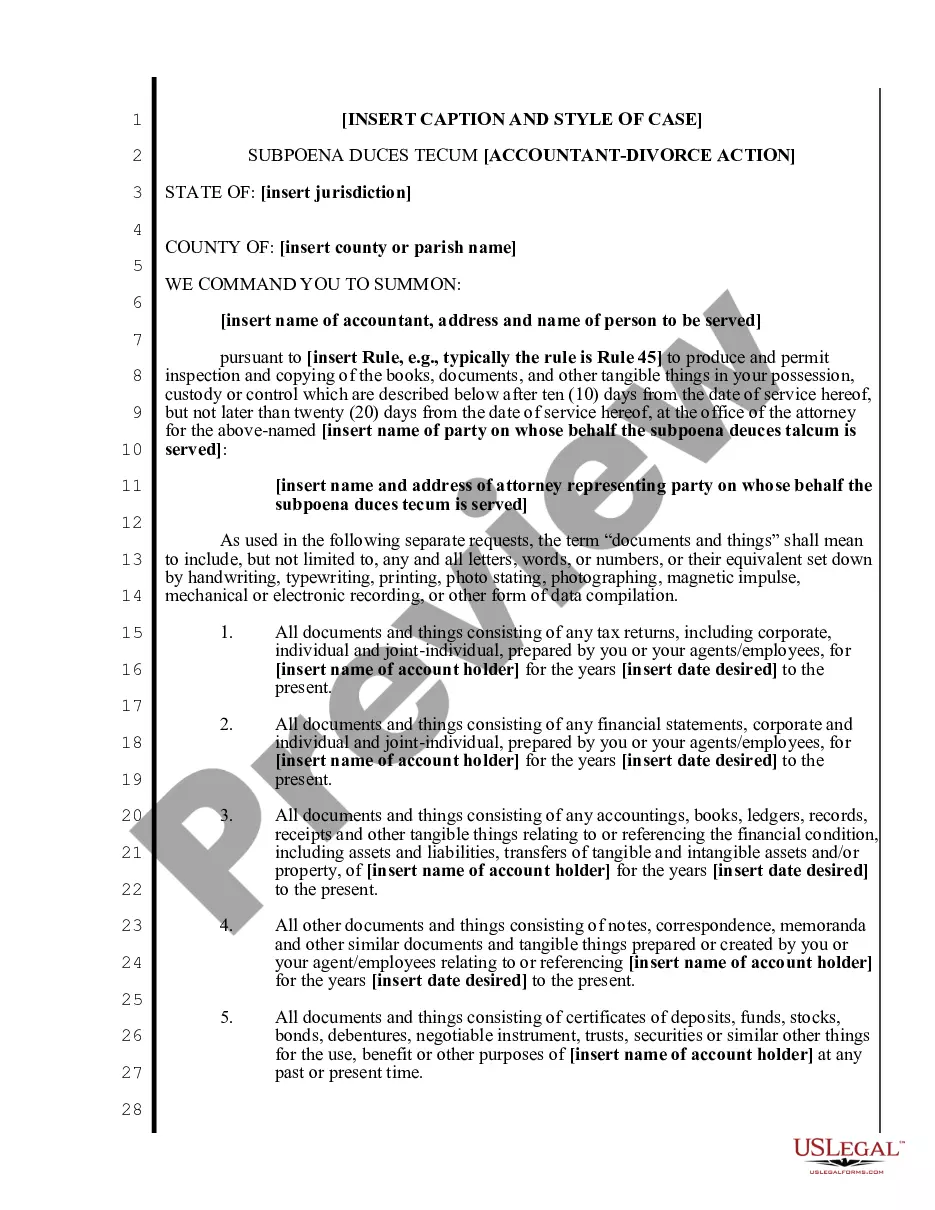

- Ensure you thoroughly review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Search for an alternative official template if the one you opened does not meet your circumstances or state laws (the tab for that is located at the top page corner).

- Click Log In to your account and save the Arizona Order of Approval of Final Accounting in your desired format. If this is your first experience with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and complete your payment using your credit card or PayPal account.

- Choose the format in which you wish to receive your document and click Download. Either print the template or incorporate it into a professional PDF editor for electronic submission.

Form popularity

FAQ

To complete final accounting in Arizona, start by gathering all financial records related to the estate. Ensure all income, expenses, and distributions are accurately documented. After that, prepare the necessary paperwork, including the Arizona Order of Approval of Final Accounting, which must be filed with the court. Using US Legal Forms can simplify this process by providing templates and guidance tailored to Arizona law, helping you navigate each step confidently.

The most common type of deed used in Arizona is the warranty deed, which guarantees that the seller holds clear title to the property and has the right to transfer it. When dealing with estate properties, the warranty deed is often employed to convey ownership after securing an Arizona Order of Approval of Final Accounting. This type of deed provides assurance and protection for the buyer against any future claims to the property.

To become a personal representative for an estate in Arizona, you typically must be named in the deceased's will or apply to the court if there is no will. Once appointed, you will need to submit an Arizona Order of Approval of Final Accounting after settling the estate's debts and distributing assets. This process may involve filing certain documents with the probate court, so consulting a legal expert can help ensure compliance with state laws.

To avoid probate in Arizona, consider creating living trusts, designating beneficiaries on your accounts, and utilizing joint tenancy for property ownership. Each of these strategies bypasses the need for probate court, simplifying the transfer of assets to heirs. However, understanding these options thoroughly is important, and platforms like uslegalforms can guide you in preparing the right documentation to implement these strategies effectively.

A deed of distribution in Arizona acts as a formal means of transferring real estate from an estate to the heirs. After an Arizona Order of Approval of Final Accounting is secured, this deed can facilitate the distribution by providing clear evidence of the transfer. This step is vital for ensuring that beneficiaries' rights are protected and properly formalized.

A deed of distribution in Arizona is a legal document that signifies the transfer of property from an estate to its beneficiaries. This deed is often utilized once the Arizona Order of Approval of Final Accounting is obtained, ensuring that assets are distributed according to the will or state law. It's important to file this document with the county recorder to officially update ownership records.

The final account of the executor is a detailed report that outlines the financial activities of the estate, including all assets, debts, income, and distributions made to beneficiaries. After handling the estate's affairs, the executor must seek the Arizona Order of Approval of Final Accounting from the court, ensuring that all transactions are transparent and justified. This account is crucial for closing the estate legally and appropriately.

To transfer a house title after death in Arizona, the first step is to determine if the property is part of a will or if it was held in joint tenancy. If there is a will, you will need to follow the probate process and obtain an Arizona Order of Approval of Final Accounting. If the property was jointly owned, the title can transfer to the surviving owner directly. Consulting with a legal professional can help simplify this process.