Arizona Assignment of Promissory Note

Form popularity

FAQ

Terminating a promissory note means formally ending the obligations outlined in the document. Typically, you must complete any required payments and receive termination documentation from the lender. If you are unsure how to proceed, consider utilizing US Legal Forms for assistance with your Arizona Assignment of Promissory Note, helping you complete the necessary steps with confidence.

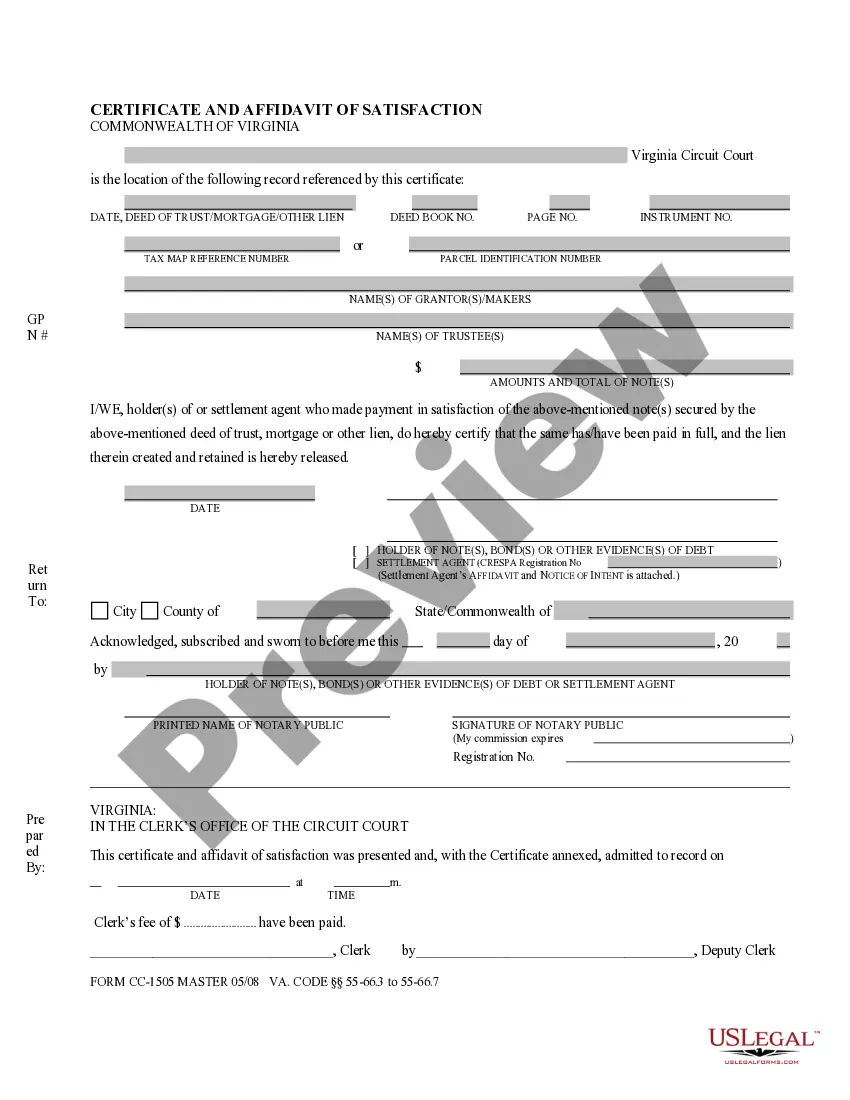

To release a promissory note, you ensure that all obligations, repayment terms, and conditions are met. Once payment or terms are fulfilled, it is important to receive a release document from the lender, marking the note as settled. Using US Legal Forms as a resource can help you obtain correct templates for your Arizona Assignment of Promissory Note and make this process seamless.

Releasing a promissory note involves formally declaring that the debt is settled. You generally need to provide a release document, confirming the lender's acknowledgment of payment. Avoid potential issues by using platforms like US Legal Forms, which offer tailored resources for completing your Arizona Assignment of Promissory Note properly.

To discharge a promissory note, you must fulfill the terms outlined in the note, such as repaying the owed amount. Once you complete these terms, the lender should provide a discharge document that confirms the obligation is satisfied. Engaging with credible services like US Legal Forms can streamline this process and provide necessary templates, ensuring that your Arizona Assignment of Promissory Note is properly discharged.

To obtain your promissory note, first, ensure you have a clear agreement with the borrower regarding the note's terms. If you used a formal process or legal service, you can request the document from them. For assistance, consider using platforms like UsLegalForms to help you draft and retrieve an Arizona Assignment of Promissory Note seamlessly.

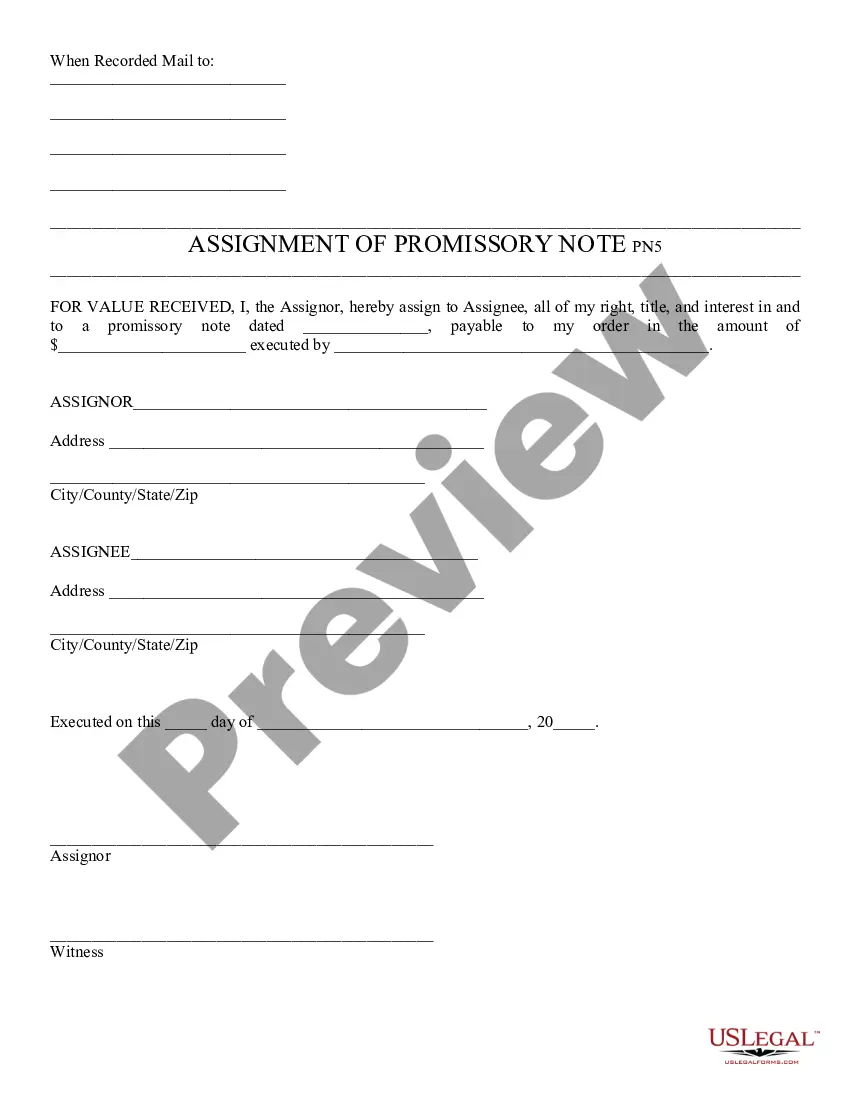

To present a promissory note effectively, ensure it includes all necessary details like the amount, terms, and both parties' signatures. Present it in a clear, professional format, preferably in writing to avoid misunderstandings. Utilizing platforms like UsLegalForms can help you create a well-structured Arizona Assignment of Promissory Note, streamlining the process and minimizing errors.

Promissory notes must include essential elements such as the amount borrowed, interest rate, and repayment terms. In addition, they should be signed by the borrower to be legally enforceable. Understanding these rules is crucial for anyone creating an Arizona Assignment of Promissory Note, ensuring that your document is valid and clear.

Absolutely, a promissory note can be made payable to a specific person or entity. This provision specifies who receives the payment and ensures clarity in the transaction. When dealing with an Arizona Assignment of Promissory Note, making it payable protects both parties and establishes clear expectations for the payment.

The format of a promissory note generally includes the title at the top, followed by the parties' names, amount borrowed, repayment terms, interest rate, and any specific conditions. It is essential to maintain a clear and structured layout, as this makes the document legally sound and easier to understand, especially in relation to the Arizona Assignment of Promissory Note.

The entry of a promissory note typically refers to the recording of the agreement in accounting books. It usually appears as a liability on the borrower's side and an asset on the lender's side. Understanding this concept is crucial for effective management and for exploring options like the Arizona Assignment of Promissory Note.