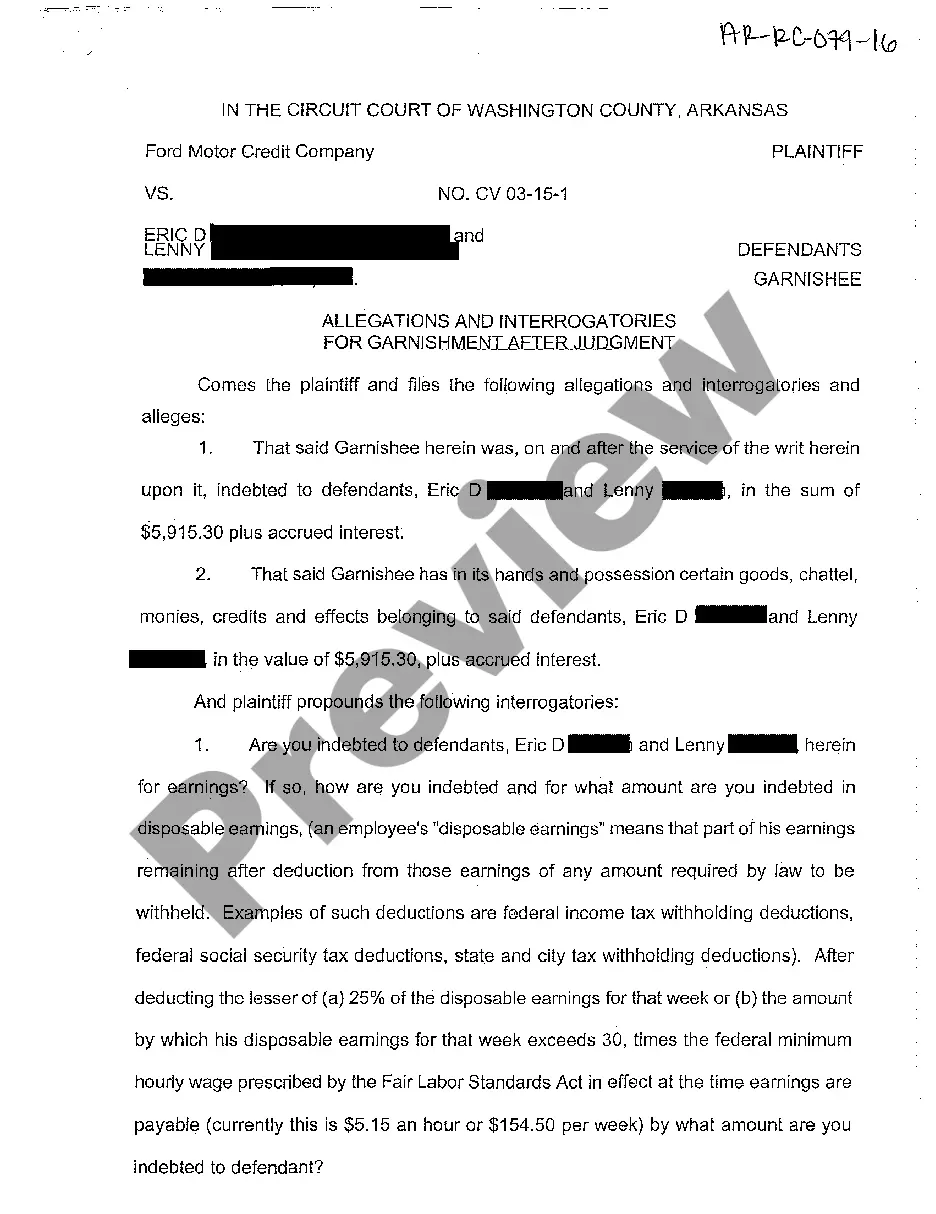

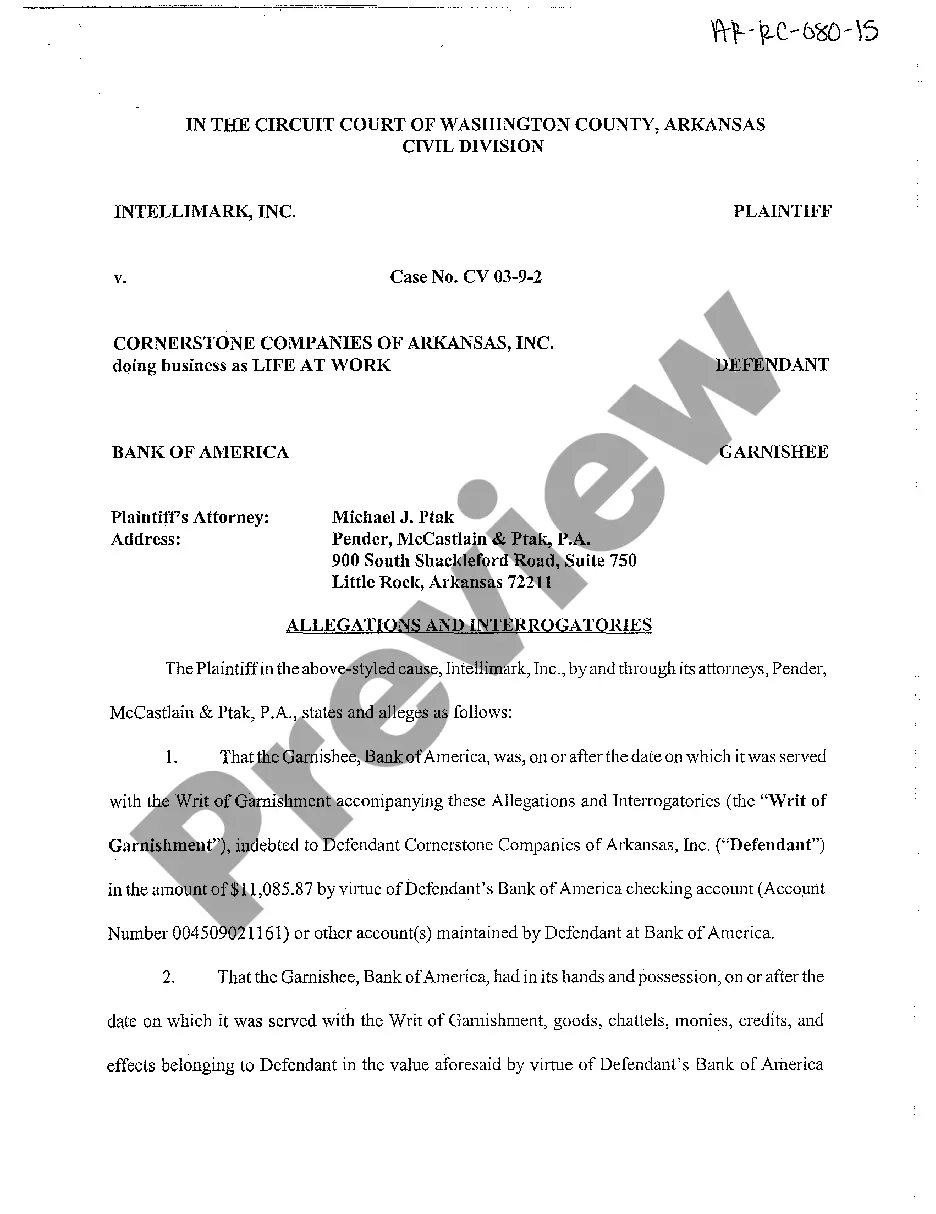

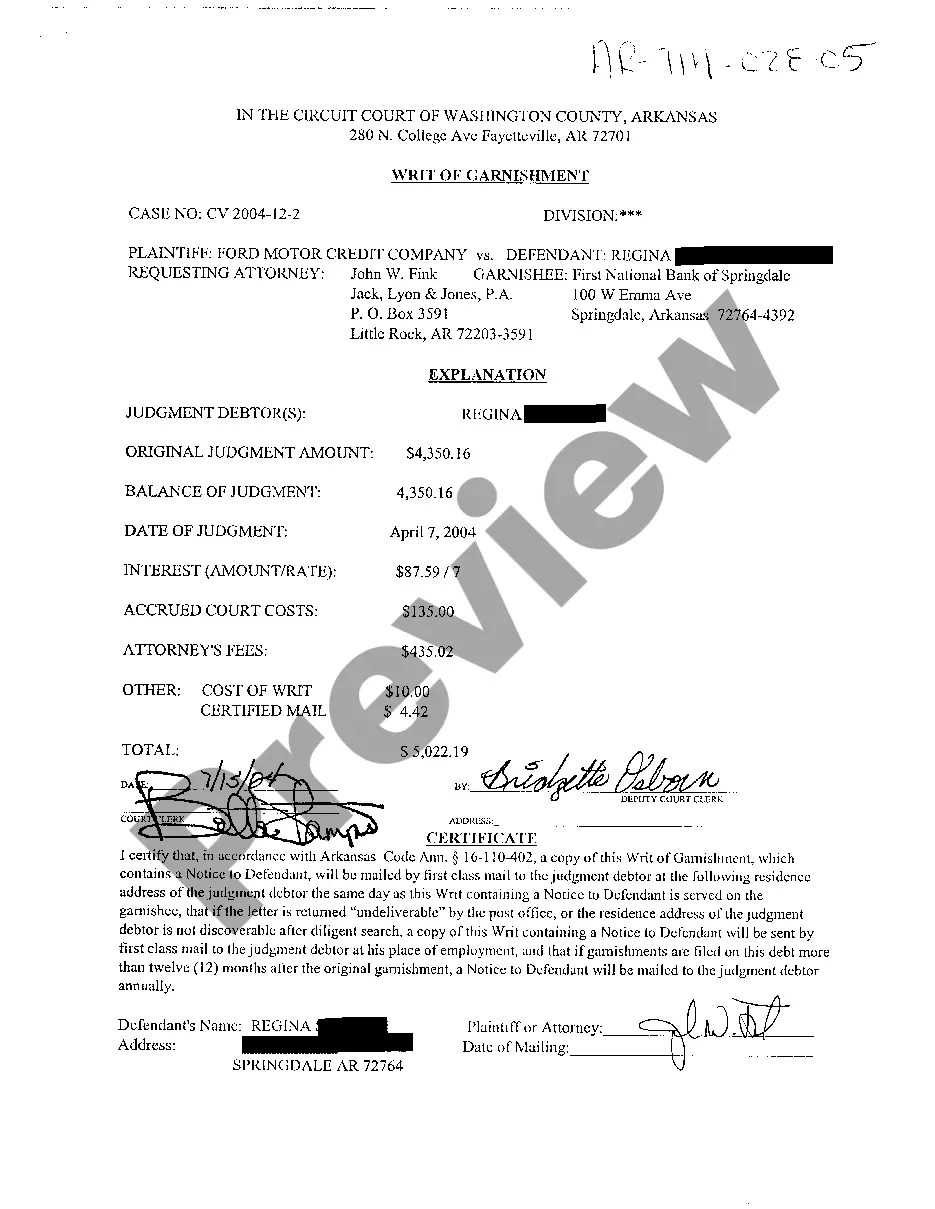

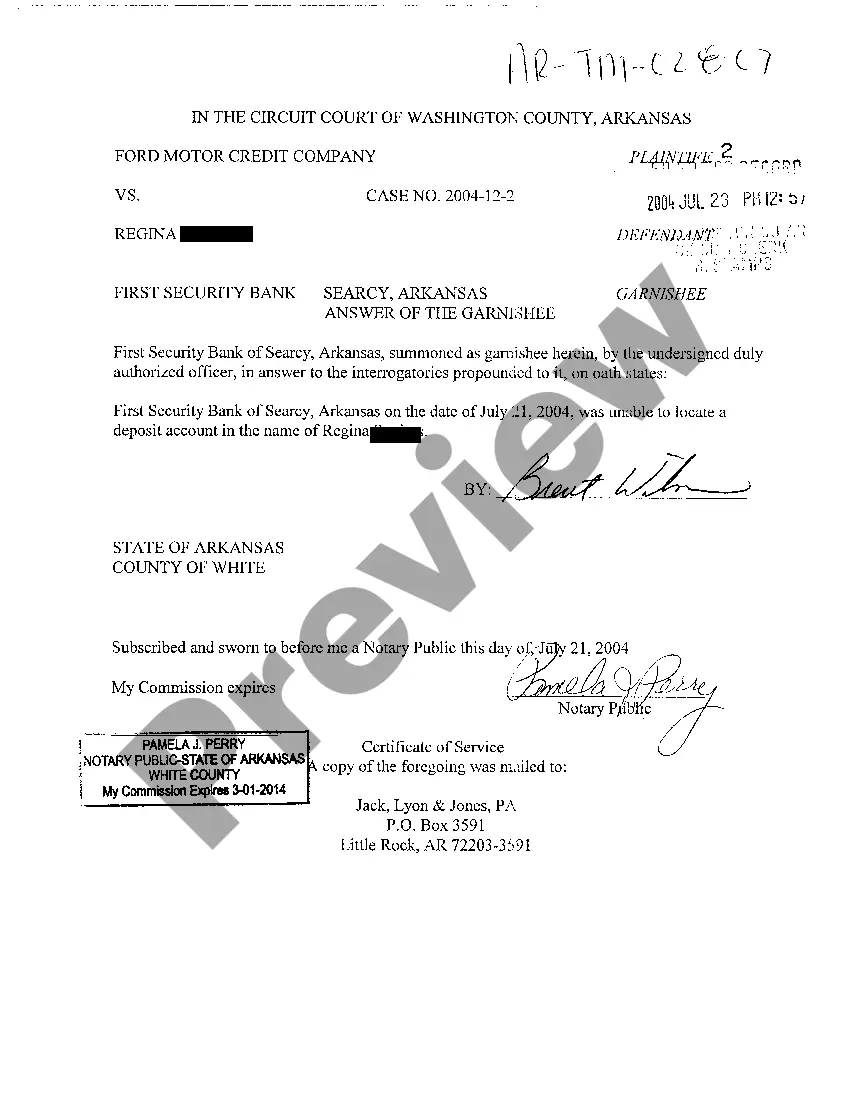

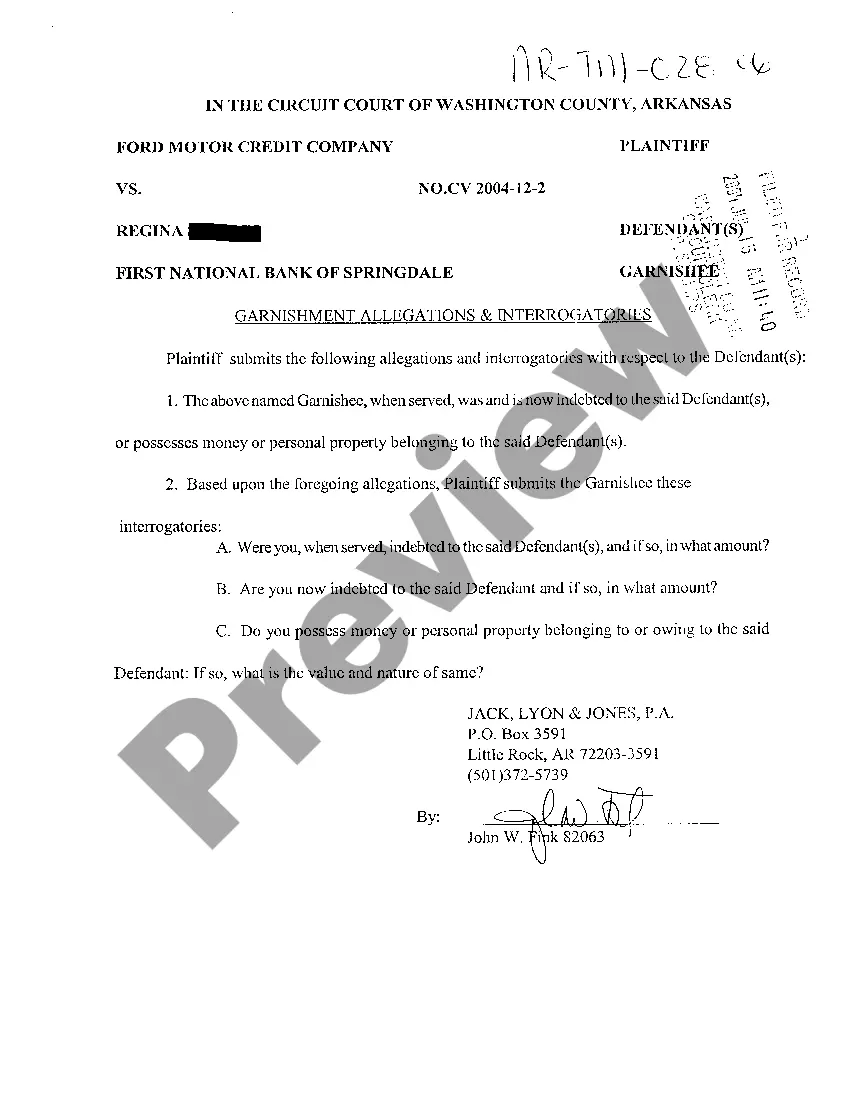

Arkansas Garnishment Allegations and Interrogatories

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Garnishment Allegations And Interrogatories?

Among a multitude of complimentary and premium instances available online, you cannot guarantee their dependability.

For instance, who made them or whether they possess the qualifications necessary to handle your requirements.

Always stay calm and utilize US Legal Forms! Explore templates for Arkansas Garnishment Allegations and Interrogatories crafted by proficient lawyers to avoid the costly and time-intensive task of searching for an attorney and subsequently compensating them to draft documents that you can easily obtain yourself.

Once you have registered and purchased your subscription, you can use your Arkansas Garnishment Allegations and Interrogatories as often as needed or while it remains valid in your state. Modify it in your preferred online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Ensure that the document you find is applicable in your residing state.

- Examine the document by utilizing the Preview function to read the information.

- Click on Buy Now to initiate the purchase process or look for another example using the Search bar at the top.

- Select a pricing plan and register for an account.

- Purchase the subscription with your credit/debit card or through PayPal.

- Download the document in the desired format.

Form popularity

FAQ

Rule 33 of the Arkansas Rules of Civil Procedure pertains to interrogatories, allowing one party to ask another party a set of written questions. The responding party must answer these questions truthfully and in a timely manner, typically within 30 days. This rule is vital when addressing Arkansas Garnishment Allegations and Interrogatories, ensuring that relevant information is shared. If you need to manage these procedures, consider uslegalforms for helpful templates and guidance.

Yes, Arkansas does have a discovery rule, which governs how parties can obtain evidence from one another. This rule is crucial for ensuring that all relevant information surfaces before trial. The discovery process helps clarify Arkansas Garnishment Allegations and Interrogatories, allowing both parties to prepare effectively. Using platforms like uslegalforms can help you navigate these rules smoothly.

In Arkansas, you must answer interrogatories within 30 days after receiving them. This timeframe allows you to gather the necessary information to provide accurate responses. Timely answers are essential, especially when dealing with complex matters such as Arkansas Garnishment Allegations and Interrogatories. If you need assistance, uslegalforms offers valuable resources to simplify this process.

A defendant typically has 30 days to answer a complaint in Arkansas after being served. This period is vital for you to prepare a thorough response to the claims made against you. Delaying this process can negatively impact your case. Understanding how to respond to Arkansas Garnishment Allegations and Interrogatories is essential to protect your rights.

In Arkansas, you generally have 30 days to respond to a motion. This timeline may differ slightly based on specific cases or types of motions filed. It’s essential to consider the exact date of service when calculating your response time. Meeting this deadline is crucial for addressing Arkansas Garnishment Allegations and Interrogatories effectively.

The wage garnishment law in Arkansas allows creditors to collect debts through the garnishment of a debtor's wages under specific conditions. This law stipulates the maximum amount that can be withheld and the process a creditor must follow to initiate garnishment. Familiarity with Arkansas Garnishment Allegations and Interrogatories is essential for both creditors and debtors. Leveraging resources from USLegalForms can assist you in navigating these legal waters effectively.

The maximum amount that can be garnished from your paycheck in Arkansas is usually 25% of your disposable income. However, if your wages fall below a certain threshold, the garnishment may be limited. It’s key to understand these limits to protect your financial well-being. Consulting with experts or using resources on USLegalForms can clarify how garnishment laws apply in your situation.

In Arkansas, the amount that can be garnished from your check typically depends on your disposable earnings. Generally, up to 25% of your disposable income can be garnished, but this amount may vary based on specific circumstances. Understanding Arkansas Garnishment Allegations and Interrogatories will provide clarity about what to expect in case of garnishment. You should always review your financial situation to plan accordingly.

To file a writ of garnishment in Arkansas, you must first obtain a judgment against the debtor. After winning the case, you fill out a writ of garnishment form and submit it to the court. The court then issues the writ, which you serve to the debtor's employer or bank. Utilizing tools like the USLegalForms platform can simplify this process and ensure you have all the necessary documentation.

Garnishment in Arkansas allows creditors to collect payments directly from a debtor's wages or bank account. When a creditor obtains a judgment, they can file for garnishment to receive a portion of the debtor's income until the debt is satisfied. This process is governed by Arkansas Garnishment Allegations and Interrogatories, which outline the legal steps involved. Understanding this process can help individuals better prepare for potential financial challenges.