This office clause is a form dealing with compliance with legal requirements and insurance recommendations covering most all of the issues covered.

Arkansas Clause Addressing Compliance with Legal Requirements and Insurance Recommendations

Description

How to fill out Clause Addressing Compliance With Legal Requirements And Insurance Recommendations?

Choosing the best legal papers template might be a have difficulties. Of course, there are a lot of themes available on the Internet, but how can you find the legal type you need? Make use of the US Legal Forms website. The assistance offers 1000s of themes, including the Arkansas Clause Addressing Compliance with Legal Requirements and Insurance Recommendations, which can be used for company and personal needs. All the types are checked out by pros and fulfill state and federal demands.

When you are currently listed, log in in your profile and click the Download button to obtain the Arkansas Clause Addressing Compliance with Legal Requirements and Insurance Recommendations. Utilize your profile to appear throughout the legal types you might have ordered formerly. Proceed to the My Forms tab of your profile and obtain another copy of the papers you need.

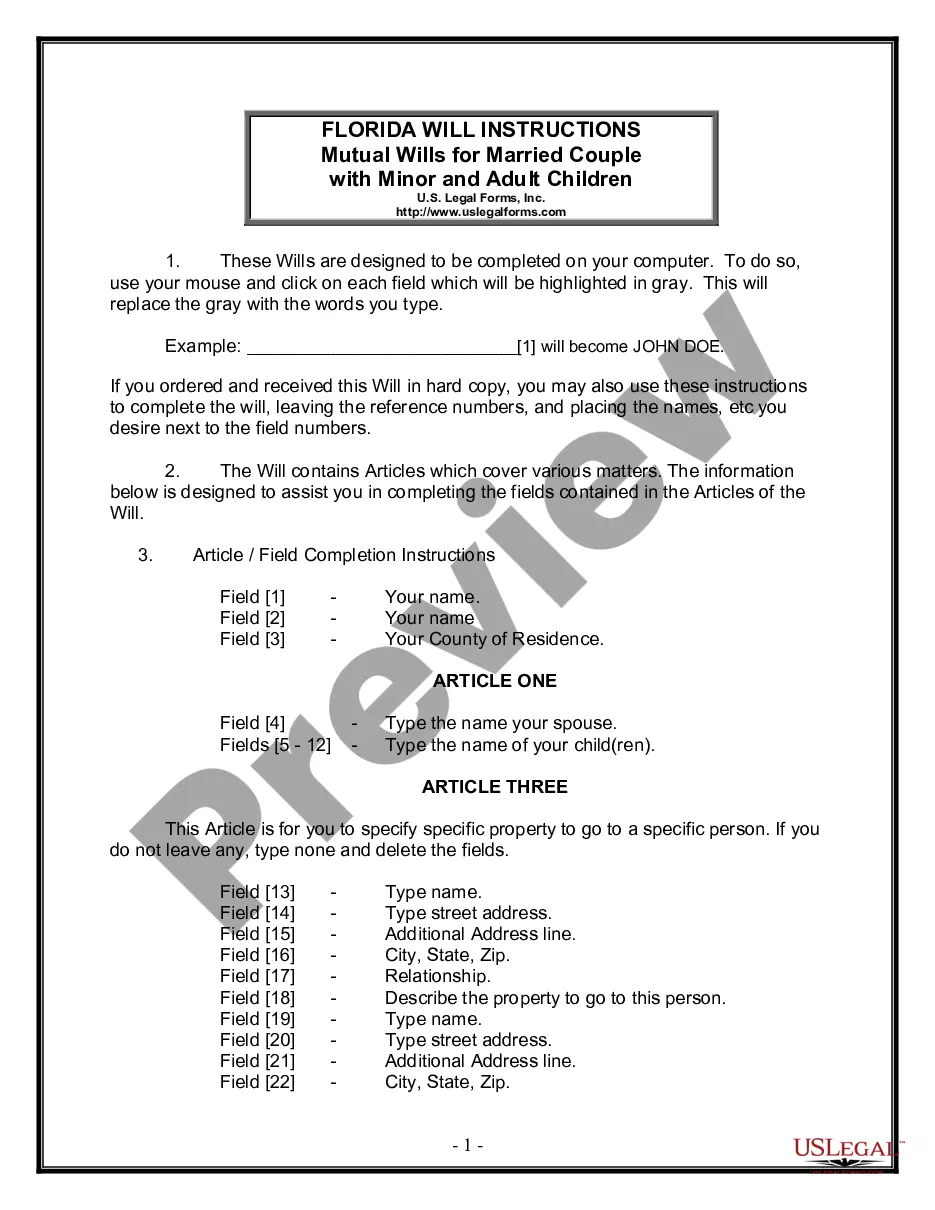

When you are a fresh user of US Legal Forms, allow me to share easy recommendations that you should stick to:

- Very first, ensure you have chosen the proper type to your town/county. You may examine the shape while using Preview button and look at the shape outline to guarantee this is the best for you.

- In case the type will not fulfill your requirements, take advantage of the Seach discipline to obtain the proper type.

- Once you are certain the shape is proper, click the Buy now button to obtain the type.

- Select the pricing prepare you need and enter in the needed details. Create your profile and purchase your order using your PayPal profile or credit card.

- Pick the submit format and down load the legal papers template in your product.

- Full, change and print and indicator the obtained Arkansas Clause Addressing Compliance with Legal Requirements and Insurance Recommendations.

US Legal Forms may be the biggest library of legal types that you can see different papers themes. Make use of the service to down load appropriately-made papers that stick to status demands.

Form popularity

FAQ

Before insurers may transact business in a specific state, they must apply for and be granted a license or Certificate of Authority from the state department of insurance and meet any financial (capital and surplus) requirements set by the state.

Insurance required--Minimum coverage. (B) An insurance policy issued by an insurance company authorized to do business in this state. (ii) The online insurance verification system fails to show current insurance coverage for the driver or the insured.

All insurers (domestic, foreign, or alien) must obtain a Certificate of Authority before transacting insurance within a given state.

An unauthorized insurer is an insurance company that is operating without the permission or oversight of its state insurance regulator. Operating an unauthorized insurer is illegal, and can result in legal or financial penalties.

An Admitted or Authorized insurer must have a Certificate of Authority granted from the California Department of Insurance.

In order to transact insurance within a given state, an insurer must obtain an insurer's license. This license is granted by the state insurance regulatory authority and authorizes the insurer to conduct insurance business within that particular state.