Arkansas Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

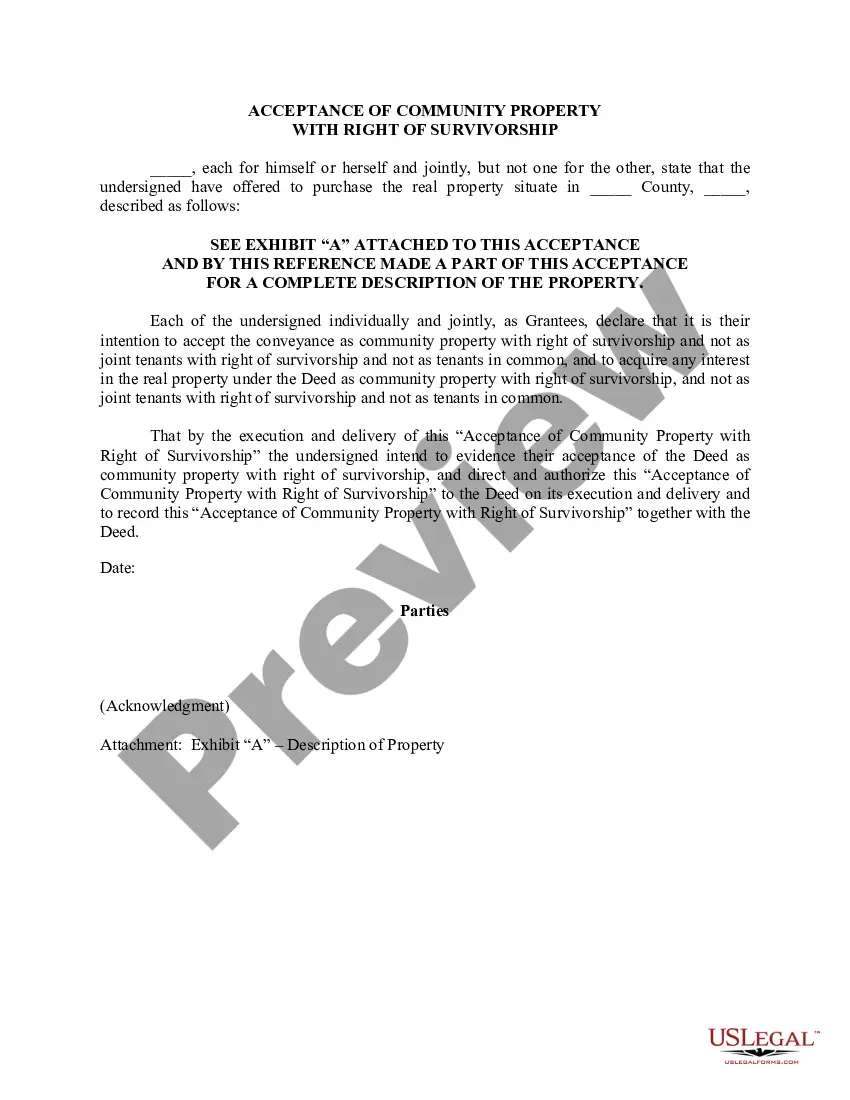

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

If you have to total, down load, or print lawful document themes, use US Legal Forms, the largest variety of lawful forms, that can be found on the web. Utilize the site`s easy and practical lookup to find the papers you need. Numerous themes for organization and person purposes are sorted by categories and states, or keywords. Use US Legal Forms to find the Arkansas Deed (Including Acceptance of Community Property with Right of Survivorship) in just a few clicks.

If you are previously a US Legal Forms buyer, log in to the accounts and click on the Down load switch to get the Arkansas Deed (Including Acceptance of Community Property with Right of Survivorship). You may also gain access to forms you in the past saved within the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for your right city/land.

- Step 2. Make use of the Preview solution to check out the form`s information. Don`t overlook to read the information.

- Step 3. If you are not satisfied together with the form, utilize the Search area at the top of the display to find other types of the lawful form format.

- Step 4. Once you have discovered the shape you need, select the Purchase now switch. Pick the costs plan you choose and add your references to sign up for an accounts.

- Step 5. Procedure the purchase. You may use your charge card or PayPal accounts to accomplish the purchase.

- Step 6. Find the file format of the lawful form and down load it on your device.

- Step 7. Comprehensive, revise and print or sign the Arkansas Deed (Including Acceptance of Community Property with Right of Survivorship).

Each lawful document format you purchase is your own eternally. You possess acces to each and every form you saved with your acccount. Click the My Forms portion and decide on a form to print or down load once more.

Be competitive and down load, and print the Arkansas Deed (Including Acceptance of Community Property with Right of Survivorship) with US Legal Forms. There are thousands of professional and status-particular forms you can use for your personal organization or person needs.

Form popularity

FAQ

The new owner or that person's agent must submit a signed real property tax affidavit of compliance?or just affidavit of compliance?when filing a deed with the county recorder. The affidavit gives details about the transfer?including the purchase price and transfer tax amount or any exemption.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.

A warranty deed makes a promise to the buyer that the seller has good title to the property. A quitclaim deed, on the other hand, makes no promises. A quitclaim deed just says; whatever interest I have in this property, I give to you.

The Real Property Transfer Tax is levied on each deed, instrument, or writing by which any lands, tenements, or other realty sold shall be granted, assigned, transferred, or otherwise conveyed. The tax rate is $3.30 per $1,000 of actual consideration on transactions that exceed $100.

There are two types of tenancies that possess the right of survivorship: joint tenancy and tenancy by the entirety.

Joint Tenants in Arkansas In particular, joint tenancies with right of survivorship involve all parties having equal ownership, and the right to assume another owner's interest in the event the other owner dies.

Arkansas Beneficiary (Transfer-on-Death) Deed At your death, the real estate goes automatically to the person you named to inherit it -- the "grantee beneficiary" -- without the need for probate court proceedings. (Ark. Code Ann. section 18-12-608.)

This deed must be signed, notarized, and recorded in the county where the property is located. Some counties have more than one recording office, so you need to be sure this deed is being recorded in the correct recording office. Must list the name and address of the person who prepared this deed.