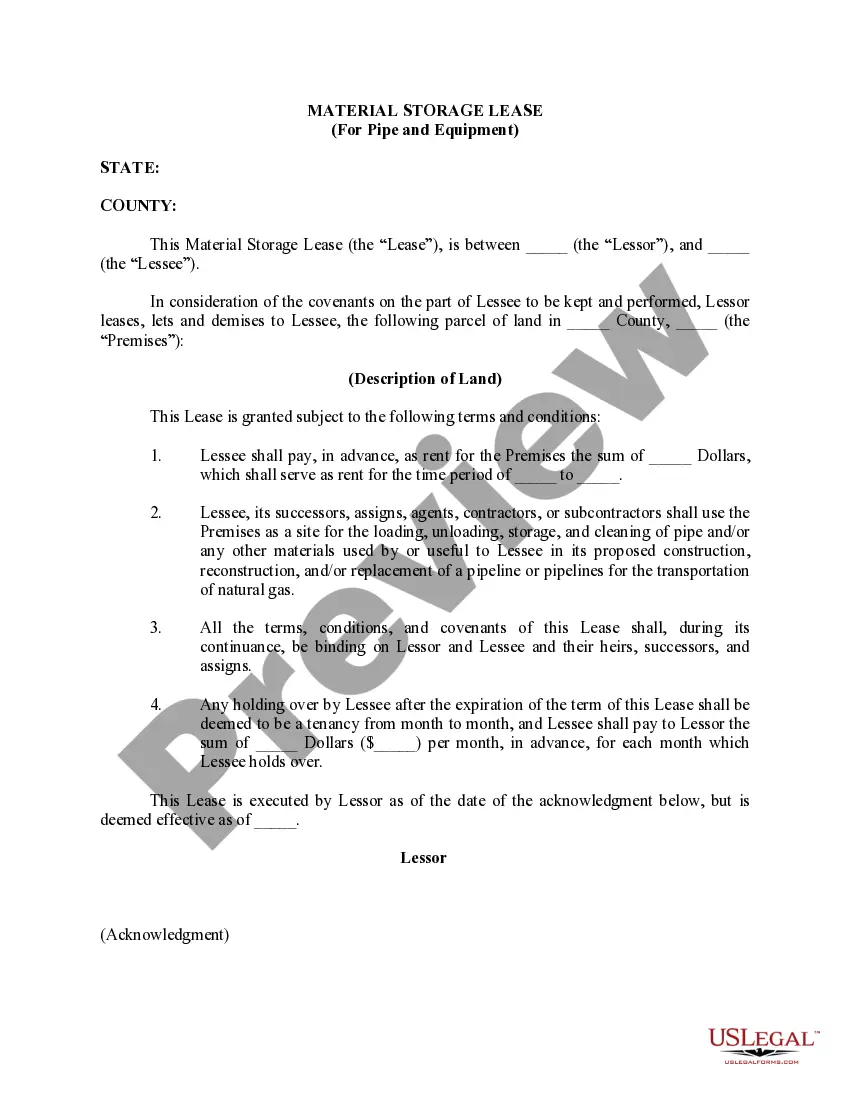

Arkansas Material Storage Lease (For Pipe and Equipment)

Description

How to fill out Material Storage Lease (For Pipe And Equipment)?

Finding the right lawful file design can be a battle. Obviously, there are plenty of templates accessible on the Internet, but how do you obtain the lawful form you need? Make use of the US Legal Forms website. The services gives thousands of templates, including the Arkansas Material Storage Lease (For Pipe and Equipment), which you can use for organization and personal demands. Each of the forms are checked out by specialists and satisfy state and federal specifications.

When you are previously listed, log in for your profile and click on the Acquire switch to find the Arkansas Material Storage Lease (For Pipe and Equipment). Utilize your profile to search through the lawful forms you may have ordered earlier. Visit the My Forms tab of the profile and obtain yet another duplicate from the file you need.

When you are a whole new end user of US Legal Forms, listed below are straightforward instructions for you to follow:

- Very first, ensure you have selected the proper form for your personal area/region. You can examine the form making use of the Preview switch and browse the form explanation to ensure it will be the best for you.

- In case the form will not satisfy your requirements, utilize the Seach industry to find the correct form.

- When you are positive that the form is suitable, select the Buy now switch to find the form.

- Choose the costs plan you want and enter the needed info. Make your profile and pay money for the transaction utilizing your PayPal profile or credit card.

- Pick the submit structure and acquire the lawful file design for your system.

- Complete, edit and print and signal the obtained Arkansas Material Storage Lease (For Pipe and Equipment).

US Legal Forms is definitely the most significant catalogue of lawful forms that you can find numerous file templates. Make use of the service to acquire skillfully-created paperwork that follow state specifications.

Form popularity

FAQ

In general (there are some important exceptions) anyone doing remodeling or repair work (any type of "home improvement" work) at a single family residence, when the cost of the work is $2,000 or more, labor and material, must be licensed. FAQs - Arkansas Contractors Licensing Board arkansas.gov ? faqs arkansas.gov ? faqs

Tax-exempt customers Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Plumbing. The installation, replacement or repair of pipes and non-mechanical plumbing fixtures are not taxable services. CONTRACTORS, 006-05-06 Ark. Code R. § 5-GR-21 | Casetext ... casetext.com ? regulation ? gross-receipts-tax-rules casetext.com ? regulation ? gross-receipts-tax-rules

Painting services are not enumerated as a taxable service under the Arkansas Gross Receipts Tax Act. ingly, a painting contractor is not required to collect sales tax from its customers on painting services. Department of Finance and Administration - Arkansas.gov ark.org ? api ? document ? download ark.org ? api ? document ? download

?Sale? includes the lease or rental of tangible personal property. Taxable services include sales of gas, water, electricity, most solid waste disposal, telephone and prepaid telecommunications and repair services. Repair and replacement parts for manufacturing machinery are generally taxable.

The initial installation in new or substantially modified construction, and the repair or replacement of mechanical or electrical components, such as a ceiling fan, is a taxable service. Any parts used in the service are also taxable to the customer.

The provider of cleaning and janitorial services is required by law to collect state and local sales tax from the purchaser of cleaning and janitorial services and to remit the tax to the Arkansas Department of Finance and Administration.

The Arkansas gross receipts tax is a tax imposed upon the sale of tangible personal property and not the property itself. Thus, when a sale of tangible personal property occurs in Arkansas, a taxable event has occurred and the tax should be collected and remitted. Gross Receipts Tax Regulations, 006-05-92 Ark. Code R. § 5 - Casetext casetext.com ? division-05-division-of-revenues casetext.com ? division-05-division-of-revenues