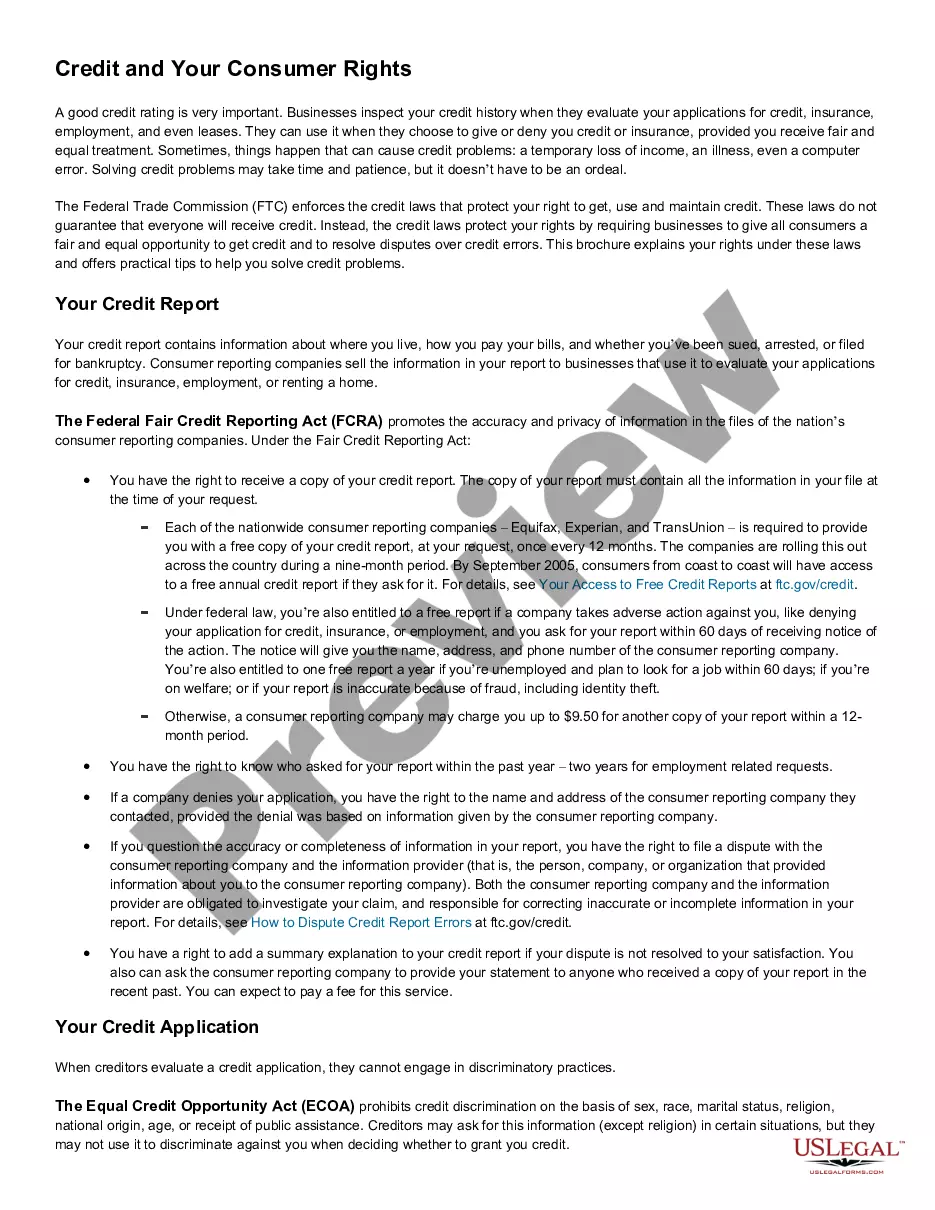

Arkansas A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

You may invest hours on the web trying to find the legal document format that meets the state and federal requirements you require. US Legal Forms supplies a huge number of legal varieties that happen to be examined by experts. It is simple to obtain or produce the Arkansas A Summary of Your Rights Under the Fair Credit Reporting Act from our service.

If you have a US Legal Forms accounts, you are able to log in and then click the Download button. Following that, you are able to complete, change, produce, or signal the Arkansas A Summary of Your Rights Under the Fair Credit Reporting Act. Each legal document format you buy is your own for a long time. To have an additional version of the obtained develop, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site initially, adhere to the basic instructions listed below:

- Very first, make certain you have selected the proper document format for that area/metropolis of your choosing. Look at the develop outline to make sure you have chosen the appropriate develop. If offered, make use of the Preview button to look from the document format too.

- If you want to locate an additional edition of the develop, make use of the Search field to find the format that meets your needs and requirements.

- When you have located the format you desire, simply click Acquire now to carry on.

- Pick the prices strategy you desire, type in your accreditations, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal accounts to purchase the legal develop.

- Pick the structure of the document and obtain it in your product.

- Make alterations in your document if possible. You may complete, change and signal and produce Arkansas A Summary of Your Rights Under the Fair Credit Reporting Act.

Download and produce a huge number of document layouts using the US Legal Forms Internet site, that offers the largest assortment of legal varieties. Use specialist and express-distinct layouts to handle your small business or personal requires.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Fair Credit Reporting Act | Federal Trade Commission Federal Trade Commission (.gov) ? legal-library ? browse ? statutes Federal Trade Commission (.gov) ? legal-library ? browse ? statutes

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

The Fair Credit Reporting Act of 1970 ensures that consumer reporting agencies use procedures which are fair and equitable to the consumer with regard to the confidentiality, accuracy, and relevancy of personal information. FAIR CREDIT REPORTING ACT Flashcards - Quizlet quizlet.com ? fair-credit-reporting-act-flash-cards quizlet.com ? fair-credit-reporting-act-flash-cards

The FCRA is designed to protect the privacy of consumer report information ? sometimes informally called ?credit reports? ? and to guarantee that information supplied by consumer reporting agencies (CRAs) is as accurate as possible. Consumer Reports: What Insurers Need to Know ftc.gov ? business-guidance ? resources ? co... ftc.gov ? business-guidance ? resources ? co...

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

CFPB Launches FCRA Rulemaking to Eliminate Creditor Use of Medical Debt. On September 21, 2023, with limited time to digest the comments received by September 11, 2023 from the request for information regarding medical payment products, the Consumer Financial Protection Bureau (CFPB) started the FCRA rulemaking process ... CFPB Launches FCRA Rulemaking to Eliminate Creditor Use of Medical ... consumerfinancemonitor.com ? 2023/09/27 consumerfinancemonitor.com ? 2023/09/27

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.