This due diligence form is used to document "for the record" the scope, character, findings and recommendations of the entire diligence effort in business transactions.

Arkansas Diligence Compendium

Description

How to fill out Diligence Compendium?

Have you ever been in a location that requires documentation for possibly business or personal purposes almost every workday.

There are numerous valid document templates available online, but finding ones you can rely on is not simple.

US Legal Forms offers a vast collection of form templates, such as the Arkansas Diligence Compendium, designed to fulfill state and federal regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, fill out the required information to create your account, and complete your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arkansas Diligence Compendium template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/region.

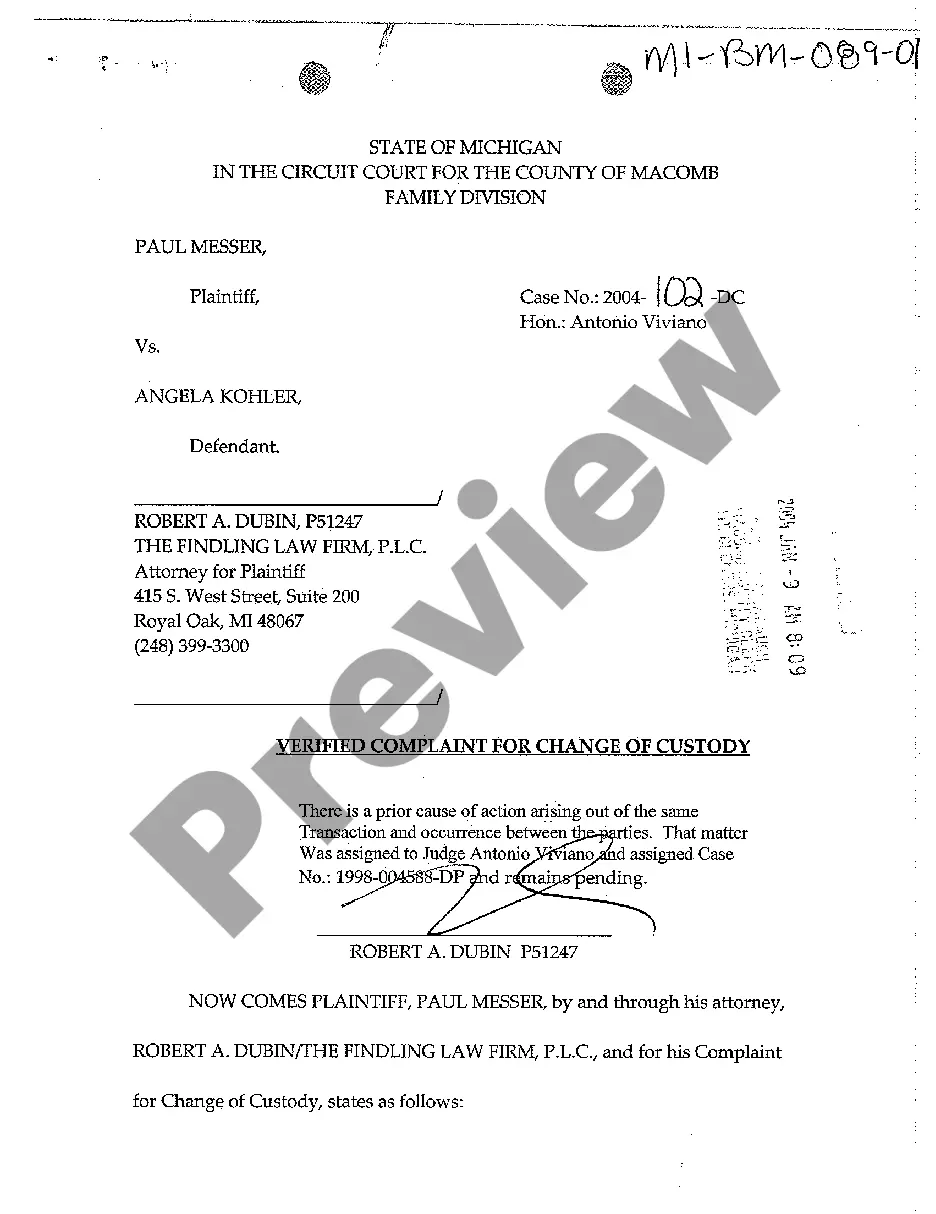

- Utilize the Preview option to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The four key requirements of the unclaimed property law in Arkansas include proper reporting of unclaimed assets, conducting due diligence, holding property securely, and timely remittance to the state. Adhering to these requirements is crucial for compliance and protecting consumer rights. For comprehensive guidance, the Arkansas Diligence Compendium can be an invaluable resource.

The abandoned property law in Arkansas outlines how lost, forgotten, or unclaimed assets are treated by the state. This law ensures that assets are held securely until they are claimed by the rightful owners, promoting transparency and accountability. The Arkansas Diligence Compendium offers essential resources to help you understand your rights under this law.

Unclaimed property in Arkansas is transferred to the state after the dormancy period expires. The state holds these assets in trust for the rightful owners until they claim them. The Arkansas Diligence Compendium provides detailed guidelines on how to navigate this process and reclaim ownership of any lost property.

In Arkansas, due diligence requirements necessitate property holders to attempt to contact owners before claiming property as unclaimed. You must perform reasonable efforts, such as sending notifications via mail. Leveraging insights from the Arkansas Diligence Compendium can help you fulfill these requirements and avoid penalties.

The dormancy period for unclaimed property in Arkansas varies based on the type of asset, ranging from three to five years. After this period, assets become eligible for reporting as unclaimed property. Understanding the timeline can help you manage your assets effectively; thus, referring to the Arkansas Diligence Compendium can be beneficial.

To submit unclaimed property in Arkansas, you must first gather the necessary documentation about the unclaimed assets. Once you have the required files, you can complete the submission process online through the Arkansas Diligence Compendium or send it via mail. This streamlined approach simplifies handling and ensures that you meet all legal requirements.

A due diligence letter for unclaimed property in Arkansas serves as a formal notification to property owners about their unclaimed assets. This letter outlines the specific items considered unclaimed and prompts the owners to take action to recover their property. Utilizing the Arkansas Diligence Compendium, you can ensure compliance and understand the necessary steps in this process.

In Arkansas, unclaimed property can be held for a period of up to five years before it is considered abandoned. After this period, the property is transferred to the Arkansas Department of Finance and Administration. The Arkansas Diligence Compendium provides guidance on how to properly claim these assets. By utilizing this resource, you can ensure you take the necessary steps to recover any unclaimed property you may have.