Arkansas Summary of Schedules - Form 6CONTSUM - Post 2005

Description

How to fill out Summary Of Schedules - Form 6CONTSUM - Post 2005?

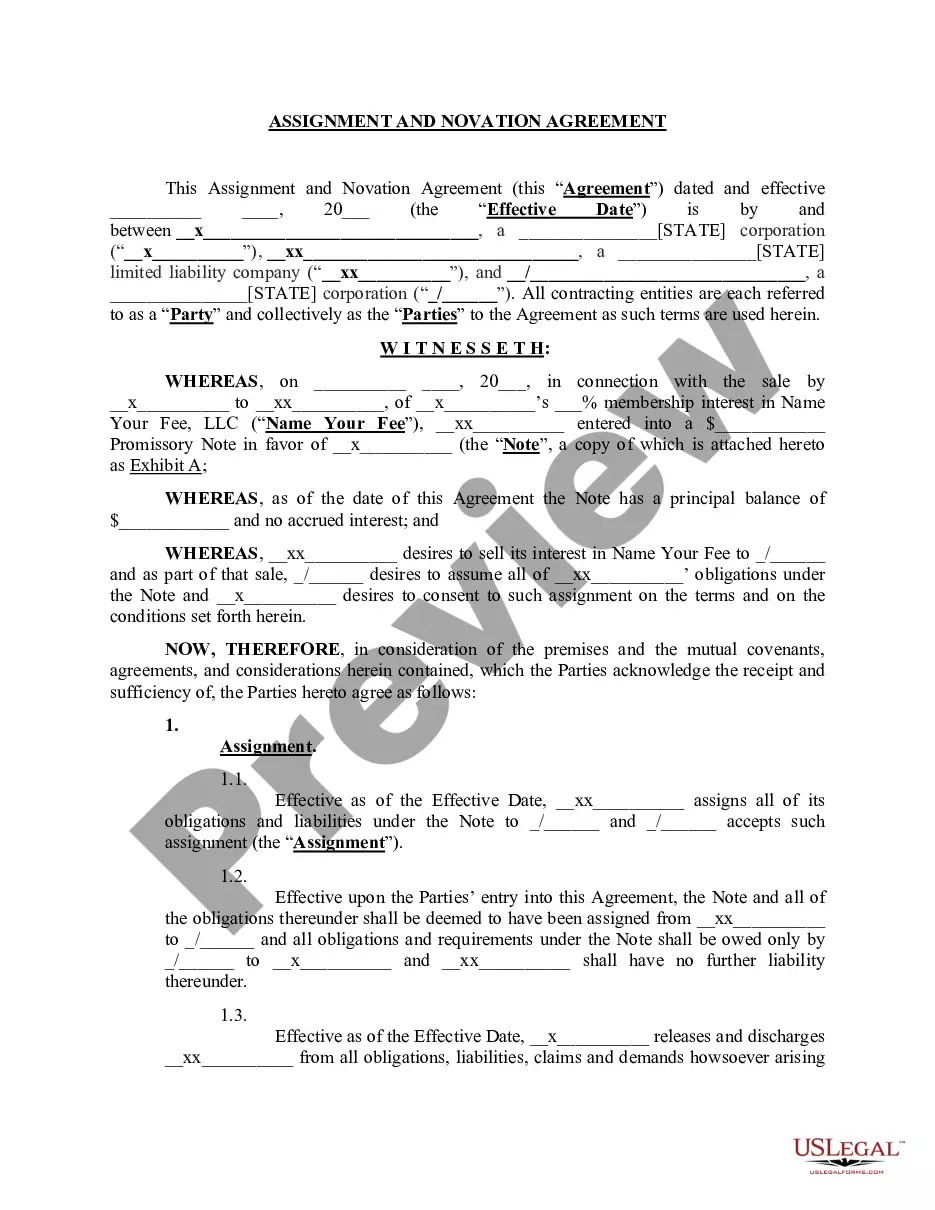

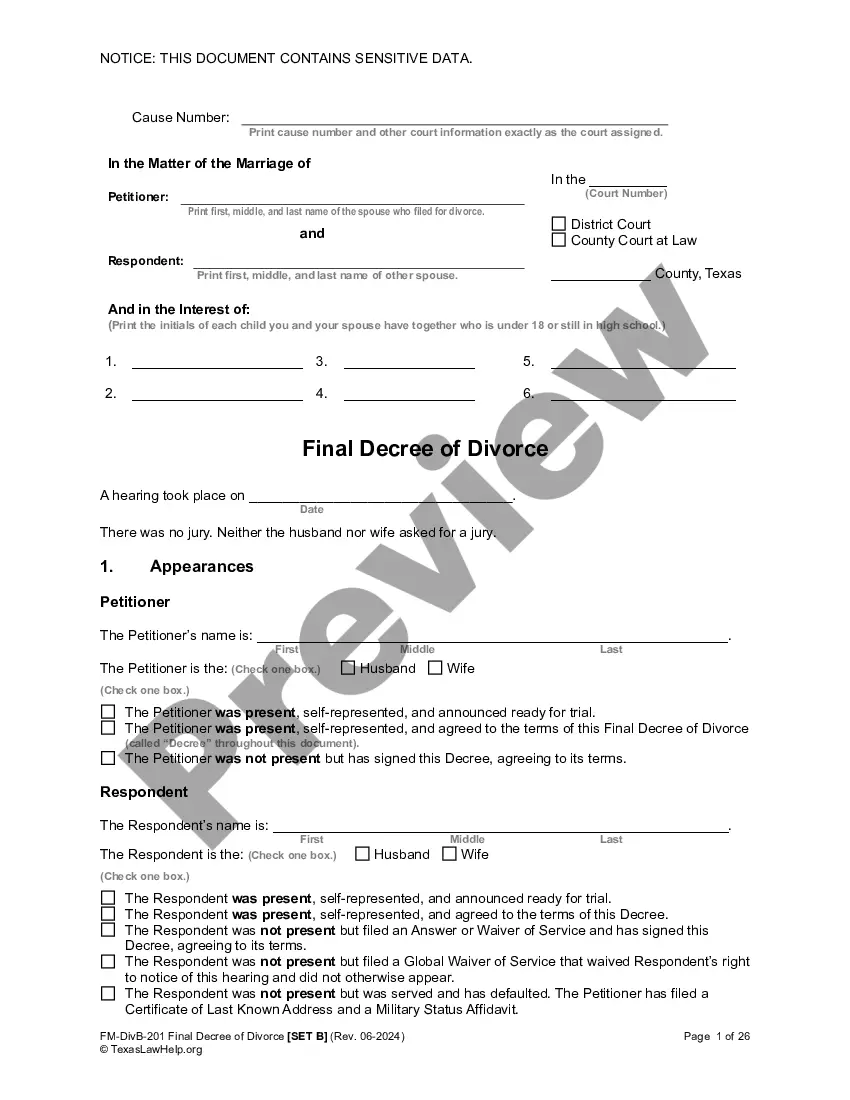

Are you currently inside a position in which you will need documents for sometimes enterprise or specific uses virtually every working day? There are a variety of legal document layouts available on the Internet, but finding types you can depend on is not effortless. US Legal Forms offers thousands of develop layouts, much like the Arkansas Summary of Schedules - Form 6CONTSUM - Post 2005, which can be written to satisfy federal and state requirements.

When you are previously familiar with US Legal Forms internet site and get an account, basically log in. Next, you are able to acquire the Arkansas Summary of Schedules - Form 6CONTSUM - Post 2005 web template.

If you do not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is to the right metropolis/area.

- Take advantage of the Preview switch to check the form.

- Read the outline to actually have selected the correct develop.

- When the develop is not what you are searching for, use the Research field to find the develop that meets your needs and requirements.

- Once you find the right develop, click Get now.

- Pick the prices prepare you need, fill out the desired information to produce your bank account, and pay for an order with your PayPal or credit card.

- Pick a practical document structure and acquire your copy.

Locate each of the document layouts you possess purchased in the My Forms food list. You can aquire a extra copy of Arkansas Summary of Schedules - Form 6CONTSUM - Post 2005 any time, if required. Just go through the necessary develop to acquire or print the document web template.

Use US Legal Forms, by far the most considerable variety of legal varieties, in order to save time and stay away from errors. The support offers skillfully made legal document layouts which can be used for a range of uses. Produce an account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Schedules of Assets and Liabilities means the "Schedule of All Liabilities of Debtor and Statement of All Property of Debtor" Filed by the Debtors, as the same have been or may be amended from time to time prior to the Effective Date.

Official Form 106Sum is the Summary of Your Assets and Liabilities and Certain Statistical Information. It contains the ?bottom line? kind of information from your schedules. Things like the total value of your property, the total amount of your debts, and information about your income and expenses.

Statement of Assets and Liabilities means the unaudited statement of assets and liabilities of the Business dated as of the Statement Date, and included in the Financial Statements. Statement of Assets and Liabilities are to the contents as shown in the Exhibit.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.