Arkansas Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

You have the capacity to spend multiple hours online trying to locate the authentic document template that aligns with the state and federal criteria you require.

US Legal Forms offers thousands of authentic forms that have been reviewed by experts.

You can effortlessly download or print the Arkansas Approval for Relocation Expenses and Allowances from my services.

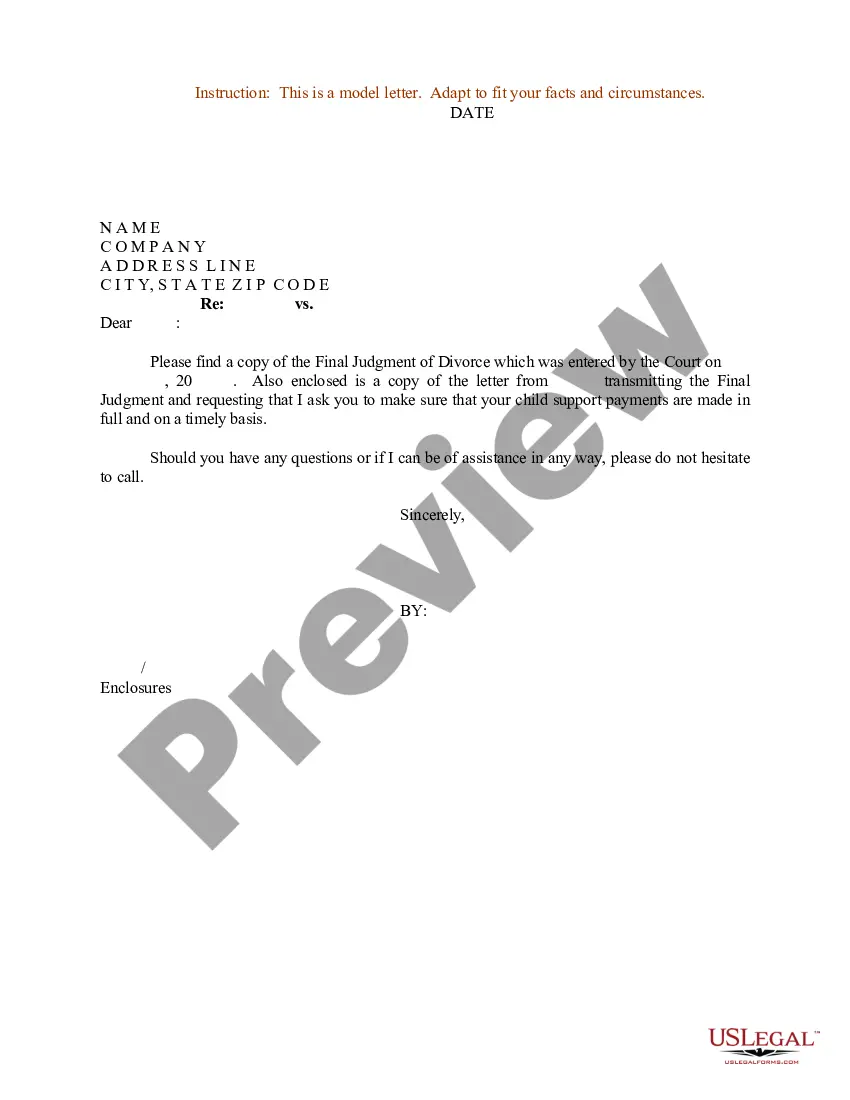

If available, utilize the Preview button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Acquire button.

- Subsequently, you may fill out, modify, print, or sign the Arkansas Approval for Relocation Expenses and Allowances.

- Each authentic document template you acquire is yours permanently.

- To obtain an additional copy of any obtained form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

- Review the form outline to confirm you have selected the appropriate template.

Form popularity

FAQ

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

A part of your HRA can be exempted from tax. Comparatively, relocation demands larger expenses such as shifting houses, moving goods, finding new schools, etc. These expenses can either be reimbursed by the company or directly paid to the employee as a lump-sum amount known as Relocation Allowance.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

If you have moving expenses that are greater than the amount of reimbursement shown in box 12 of Form 1040, or your reimbursement was reported as wages in box 1, then you can file Form 3903 with your tax return to report moving expenses and reimbursements to the IRS.

Essentially, when employees are given relocation benefits, the benefit amount becomes taxable income, which normally means they would have to pay income and FICA taxes on the amount received. Tax gross-ups can help make sure employees have no additional out-of-pocket tax expenses.

Essentially, when employees are given relocation benefits, the benefit amount becomes taxable income, which normally means they would have to pay income and FICA taxes on the amount received. Tax gross-ups can help make sure employees have no additional out-of-pocket tax expenses.