Arkansas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment

Description

How to fill out Guaranty By Distributor To Corporation Of Payment Of Distributorship Funds By Assignee Due To Assignment?

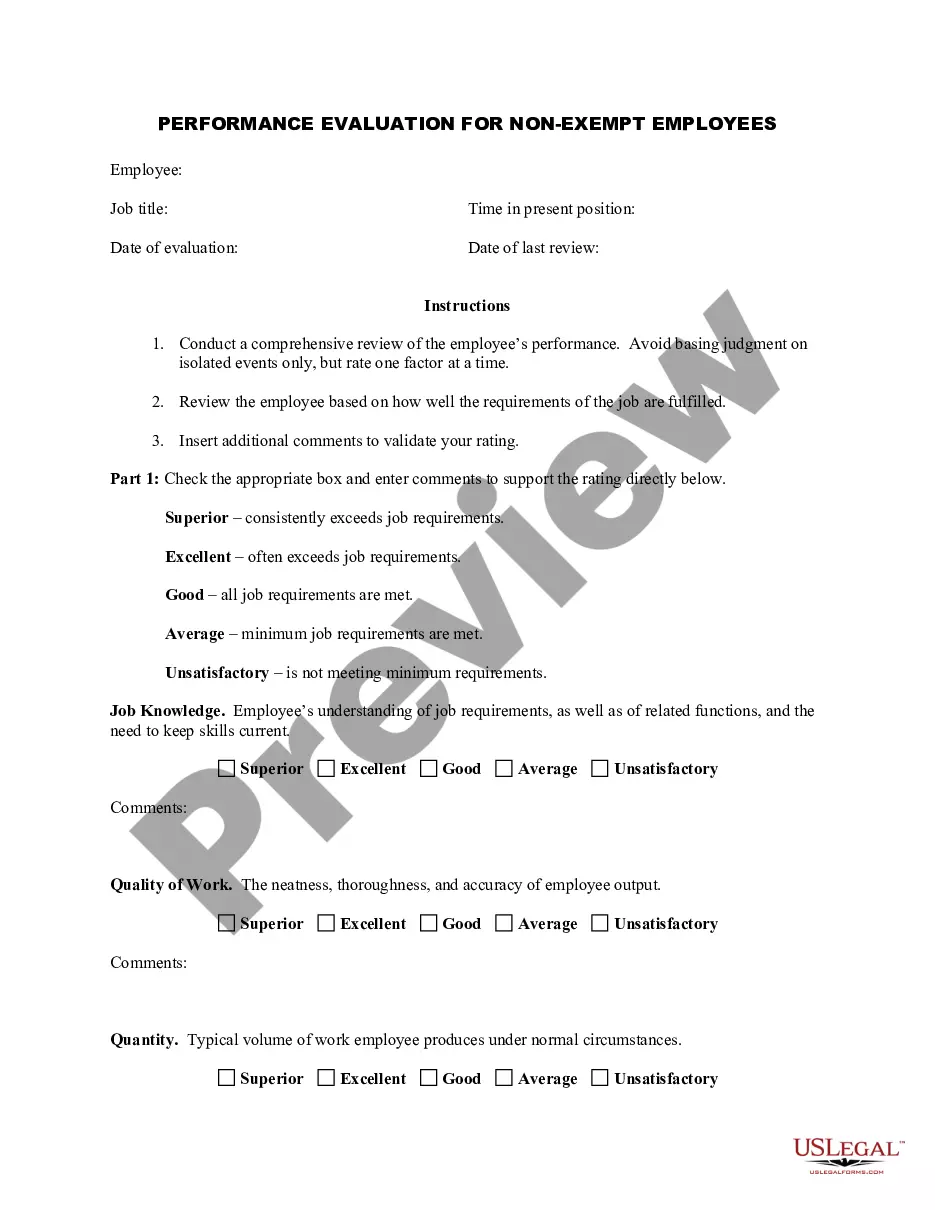

It is feasible to dedicate multiple hours online trying to locate the appropriate legal document template that meets both state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been assessed by experts.

You can easily obtain or print the Arkansas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment through our services.

Initially, ensure you have selected the correct document template for your chosen state/town. Review the form summary to confirm you have chosen the right type. If available, use the Preview button to view the document template simultaneously.

- If you possess a US Legal Forms account, you may sign in and click on the Obtain button.

- Afterward, you can fill out, modify, print, or sign the Arkansas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment.

- Every legal document template you acquire is yours permanently.

- To retrieve another copy of a purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

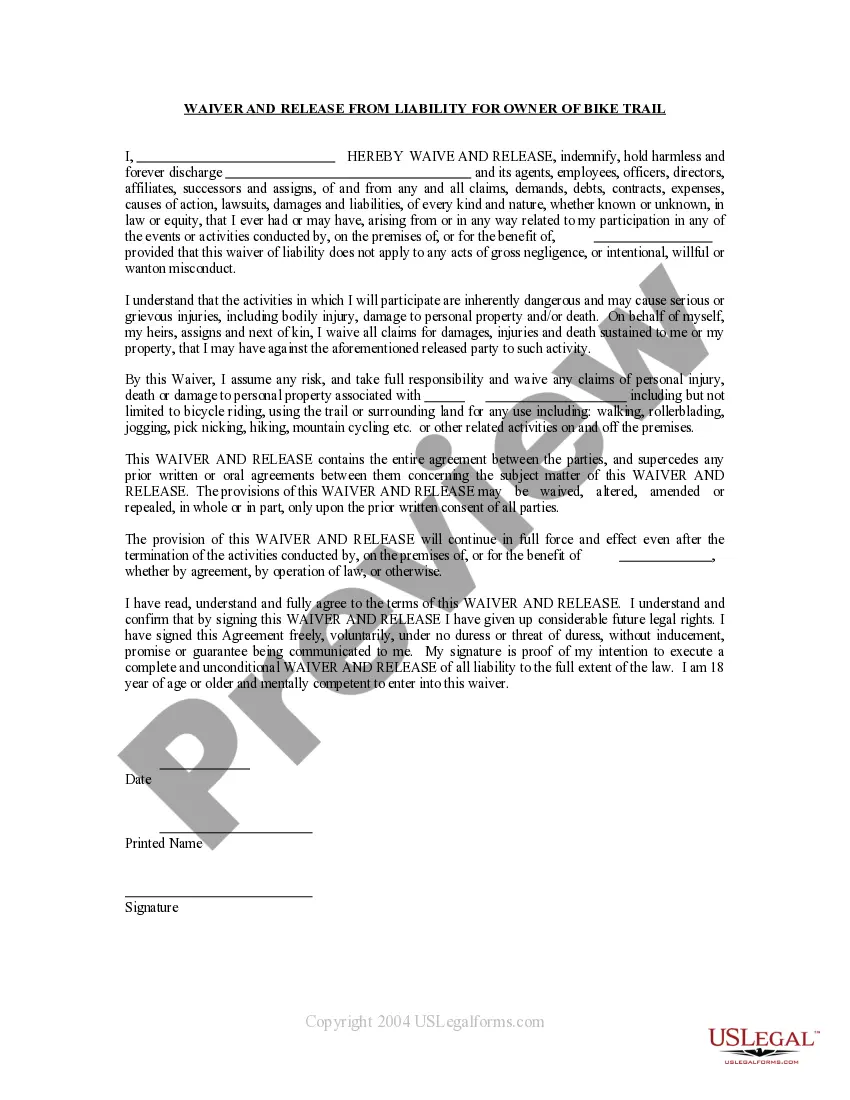

Guaranty Fund established by law in every state, guaranty funds are maintained by a state's insurance commissioner to protect policyholders in the event that an insurer becomes insolvent or is unable to meet its financial obligations.

It's all your income from all sources before allowable deductions are made. This includes both earned income from wages, salary, tips, and self-employment and unearned income, such as dividends and interest earned on investments, royalties, and gambling winnings.

Taxable income is more than just wages and salary. It includes bonuses, tips, unearned income, and investment income. Unearned income can be government benefits, spousal support payments, cancelled debts, disability payments, strike benefits, and lottery and gambling winnings.

What Is a State Guaranty Fund? A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer. Alimony payments (for divorce decrees finalized after 2018)

In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

How Funds Are Financed. Most states operate guaranty funds with money obtained from assessments on insurance companies. The assessments are typically made after an insurer has been declared insolvent. This means that insurers might be assessed in 2017 for insolvency that occurred in 2016.

State life and health insurance guaranty associations provide a safety net for their state's policyholders, ensuring that they continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent.

Guaranty funds pay both first-party and third-party claims. If a liability claim has been filed against your firm and defense is needed, the fund will pay your defense costs. Most guaranty funds specify a maximum amount they will pay for any claim. The most common limit is $300,000.