Arkansas Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Sample Letter For Employee Automobile Expense Allowance?

If you need to fill out, acquire, or reproduce sanctioned document templates, utilize US Legal Forms, the most extensive compilation of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require. Numerous templates for business and personal purposes are categorized by sectors and claims, or keywords.

Use US Legal Forms to access the Arkansas Sample Letter for Employee Automobile Expense Allowance in just a few clicks.

Every legal document format you acquire is yours indefinitely. You have access to all forms you downloaded from your account. Click on the My documents section and choose a form to print or download again.

Complete and download, and print the Arkansas Sample Letter for Employee Automobile Expense Allowance using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are an existing US Legal Forms customer, sign in to your account and click on the Obtain button to retrieve the Arkansas Sample Letter for Employee Automobile Expense Allowance.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have chosen the form corresponding to the correct city/state.

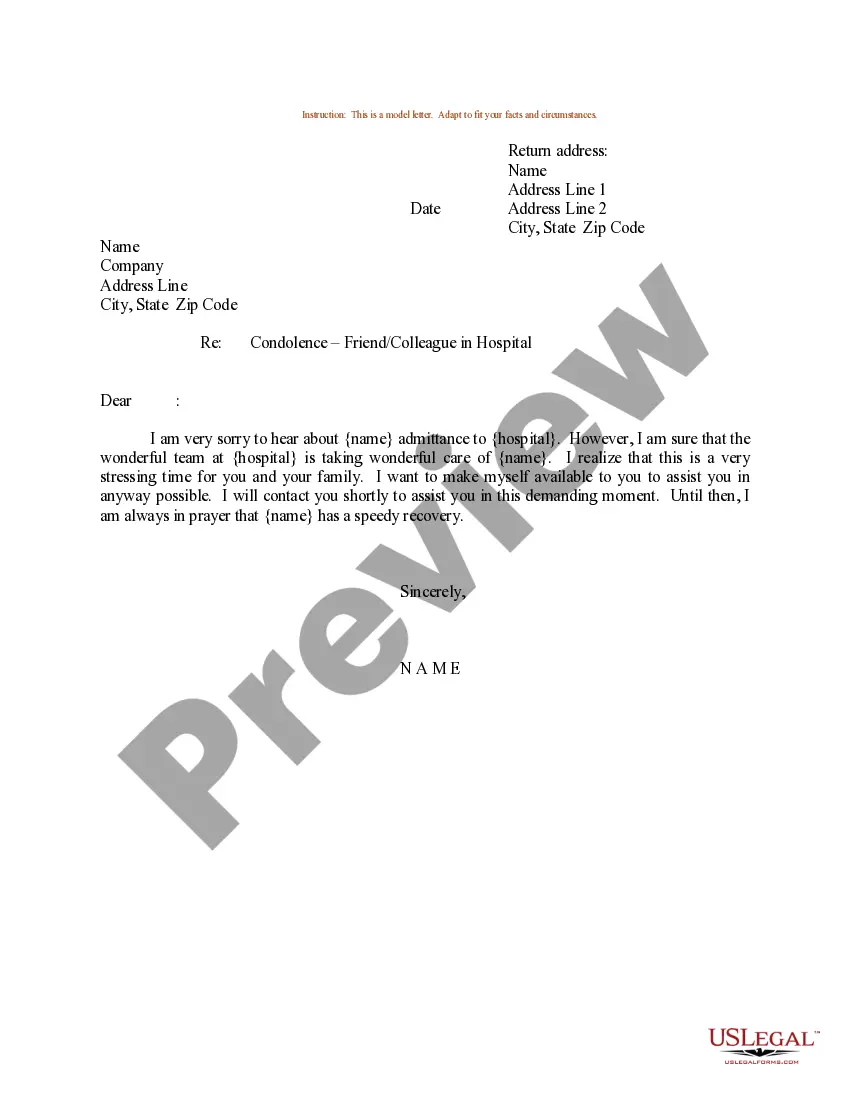

- Step 2. Utilize the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If the form does not meet your expectations, use the Search box at the top of the screen to find alternative versions in the legal form format.

- Step 4. Once you find the form you need, click the Get now button. Select your preferred pricing plan and enter your details to create your account.

- Step 5. Complete the payment process. You can use your Мisa or Ьastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arkansas Sample Letter for Employee Automobile Expense Allowance.

Form popularity

FAQ

A company car can be great for those who commute lots of miles to benefit as the vehicle is paid for meaning you don't have to worry about unexpected costs. Car allowance is less common but offers more flexibility as the money can be used to purchase a new set of wheels or pay its running costs.

Using a standard vehicle of a certain age, you can generally predict the yearly maintenance costs for each band of miles driven. Divide it by 12, and you've got the monthly amount.

A car allowance is a set amount that you give to your employees to cover a period of time. This car allowance is intended to cover typical costs of owning a vehicle, such as maintenance, wear-and-tear, insurance, fuel and depreciation.

A car allowance is a one-time cash sum you can use to buy a personal vehicle. The choice of vehicle is usually up to you. Yet, your employer may give you the minimum specifications for the vehicle. These specifications may include age, CO2 emissions, number of seats and more.

Because a standard car allowance is a non-accountable plan, it should be taxed fully as W-2 income. The employer should withhold federal income taxes, FICA/Medicare taxes, and (if applicable) state income taxes on the full allowance amount. The car allowance should be taxed at the employee's income bracket.

A fixed monthly car allowance is considered taxable income at federal and state levels. Both employee and employer must also pay FICA/Medicare taxes on the allowance. A typical car allowance may be reduced by 3040% after all these taxes.

A car allowance is taxable unless you substantiate business use of the payment. You can avoid taxation if you track business mileage and demonstrate that the allowance never exceeds the equivalent of the IRS business mileage rate ($. 585 per mile for 2022). This is called a mileage allowance, or mileage substantiation.

A standard vehicle allowance is a monthly compensation for the costs of using a motor vehicle for work. This payment is typically part of a paycheck. It's up to the employee whether to put that money toward a car payment or to use it to defray gas expense, wear and tear, and other car costs.

2021 Average Car Allowance The average car allowance in 2021 is $575. And, believe it or not, the average car allowance in 2020 was also $575. This allowance may be greater for different positions in the company. Executives for example may receive an allowance of around $800.