Arkansas Sample Letter for Petition to Close Estate

Description

How to fill out Sample Letter For Petition To Close Estate?

Are you within a position the place you need papers for possibly business or person purposes virtually every working day? There are a variety of legal papers themes available on the Internet, but finding kinds you can rely on isn`t straightforward. US Legal Forms provides a large number of develop themes, like the Arkansas Sample Letter for Petition to Close Estate, that happen to be created to fulfill federal and state needs.

If you are currently acquainted with US Legal Forms website and get a free account, basically log in. Following that, you are able to download the Arkansas Sample Letter for Petition to Close Estate design.

Unless you provide an account and want to begin to use US Legal Forms, follow these steps:

- Get the develop you require and ensure it is to the correct city/state.

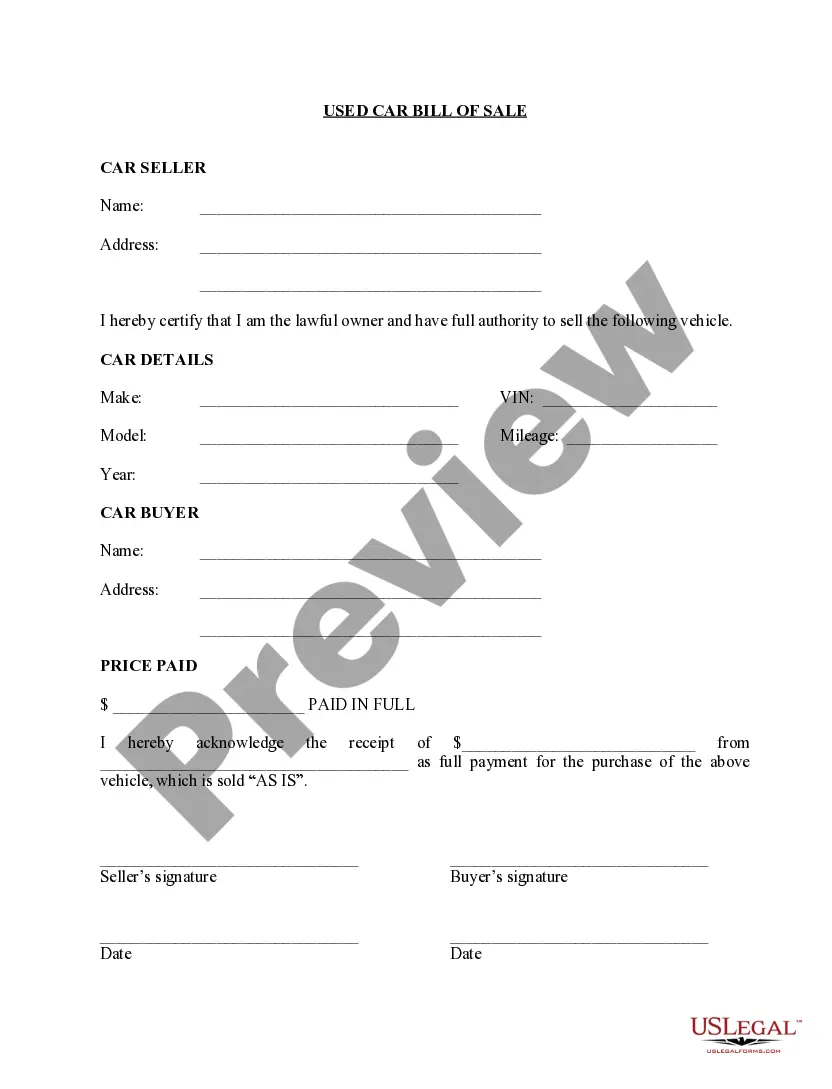

- Use the Review button to analyze the shape.

- Browse the description to ensure that you have selected the correct develop.

- In case the develop isn`t what you are searching for, utilize the Lookup field to get the develop that fits your needs and needs.

- Whenever you find the correct develop, just click Acquire now.

- Select the rates program you desire, fill in the necessary information to create your bank account, and purchase the order using your PayPal or charge card.

- Pick a convenient document format and download your copy.

Locate all of the papers themes you might have purchased in the My Forms food selection. You may get a further copy of Arkansas Sample Letter for Petition to Close Estate at any time, if required. Just select the essential develop to download or print the papers design.

Use US Legal Forms, one of the most comprehensive assortment of legal types, in order to save some time and prevent faults. The support provides professionally manufactured legal papers themes which you can use for an array of purposes. Make a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

How to Settle a Large Estate in Arkansas Step 1: Appoint a Personal Representative. ... Step 2: Petition the Probate Court. ... Step 3: Notify Named Heirs & Creditors. ... Step 4: Inventory & Appraise the Estate's Assets. ... Step 5: Handle the Property Sale. ... Step 6: Final Accounting. ... Step 7: Final Distribution & Estate Closing.

In Arkansas, executor fees are calculated based on a percentage of the estate's worth, with the rate varying depending on the size of the estate. The fees shouldn't be more than 10% of the first $1,000, 5% of the next $4,000, and 3% of the remaining estate balance.

In Arkansas, executor fees are calculated based on a percentage of the estate's worth, with the rate varying depending on the size of the estate. The fees shouldn't be more than 10% of the first $1,000, 5% of the next $4,000, and 3% of the remaining estate balance.

Even if there is a valid Last Will and Testament you must go through probate court. Arkansas Code Ann 28-40-104 states, ?No will shall be effectual for the purpose of proving title to or the right to the possession of any real or personal property disposed of by the will until it has been admitted to probate.?

To use the small estate process: Arrange for any estate debts to be paid. Submit an Affidavit for Collection of Small Estate by Distributee to the court (attach a copy of the death certificate and the will if any) The court will certify your affidavit, which you can then use to obtain possession of estate assets.

In Arkansas, executors have a fiduciary duty to act in the best interests of the estate and its beneficiaries. This means they must act with care, loyalty, and impartiality while carrying out their responsibilities. Executors may also hire professionals, such as attorneys or accountants, to assist them in their duties.

How to File a Petition for Probate in Arkansas Step 1: Gather Necessary Documentation. Step 2: Complete Your Probate Petitions. Step 3: Get Witness Signatures on the Proof of Will. Step 4: File Your Documents with the Probate Court.