Arkansas Assignment of LLC Company Interest to Living Trust

Description

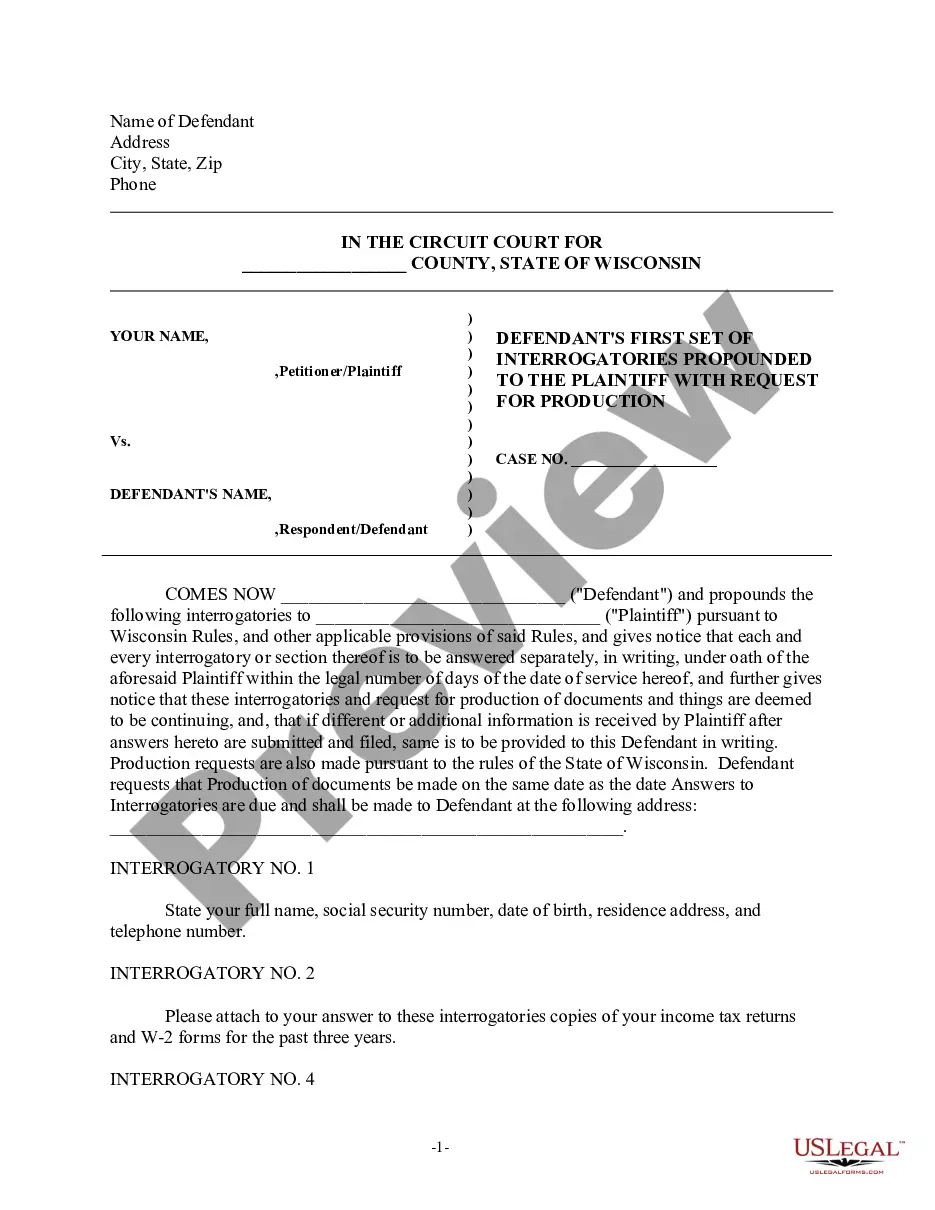

How to fill out Assignment Of LLC Company Interest To Living Trust?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal template forms that you can either download or print.

By utilizing the website, you can access thousands of forms for professional and personal use, organized by categories, states, or keywords.

You can obtain the most recent versions of forms such as the Arkansas Assignment of LLC Company Interest to Living Trust within moments.

Review the form description to confirm that you have chosen the right document.

If the form does not meet your needs, utilize the Search box located at the top of the page to find a suitable option.

- If you already have a subscription, Log In to download the Arkansas Assignment of LLC Company Interest to Living Trust from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms from the My documents section of your account.

- If you are new to US Legal Forms, here are some straightforward steps to get started.

- Ensure you have selected the correct form for your region/area.

- Click the button to examine the contents of the form.

Form popularity

FAQ

The best choice between a will and a trust depends on your specific needs. A trust, particularly for managing an Arkansas Assignment of LLC Company Interest to Living Trust, can help protect your assets from probate and provide more control over distribution. However, a will may suffice for straightforward cases. Consider your family dynamics and financial situation when making this decision.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

Most LLC agreements have a rule that members cannot sell or otherwise transfer their LLC interests unless approved in advance (typically by the manager or some percentage of the members) or allowed under another provision of the transfer section, such as an ROFR or ROFO.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.