Arkansas Sample Letter for Notice of Order of Conversion

Description

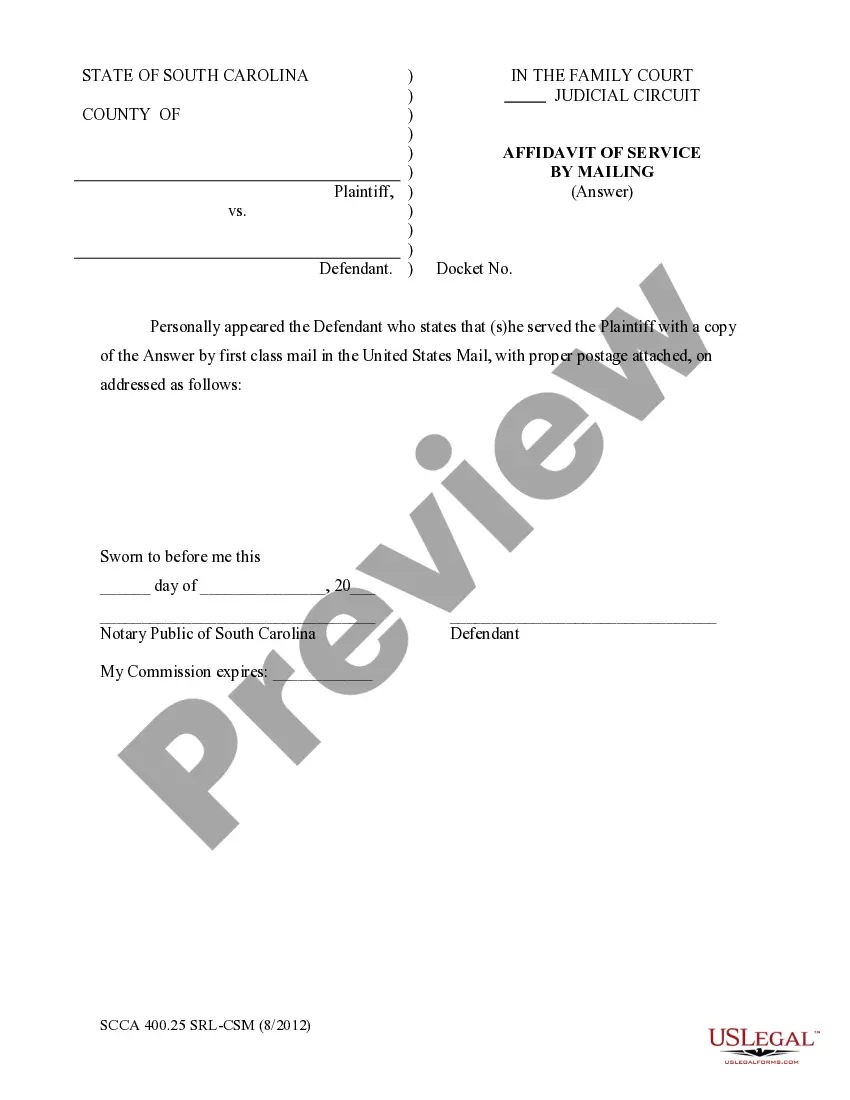

How to fill out Sample Letter For Notice Of Order Of Conversion?

You are able to spend hours on-line attempting to find the lawful document design that meets the federal and state requirements you will need. US Legal Forms offers a large number of lawful forms that happen to be analyzed by professionals. It is simple to obtain or printing the Arkansas Sample Letter for Notice of Order of Conversion from the service.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire switch. Next, you can total, edit, printing, or signal the Arkansas Sample Letter for Notice of Order of Conversion. Each lawful document design you purchase is the one you have forever. To get one more duplicate of the obtained kind, go to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website for the first time, keep to the basic directions beneath:

- Initial, ensure that you have selected the correct document design for your area/town of your choosing. Read the kind explanation to ensure you have picked the right kind. If offered, make use of the Preview switch to appear through the document design too.

- If you would like find one more model in the kind, make use of the Search area to discover the design that meets your needs and requirements.

- When you have found the design you desire, simply click Get now to proceed.

- Choose the prices strategy you desire, type in your credentials, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to purchase the lawful kind.

- Choose the formatting in the document and obtain it to your device.

- Make modifications to your document if needed. You are able to total, edit and signal and printing Arkansas Sample Letter for Notice of Order of Conversion.

Acquire and printing a large number of document web templates utilizing the US Legal Forms Internet site, that offers the biggest collection of lawful forms. Use specialist and state-specific web templates to tackle your small business or personal requires.

Form popularity

FAQ

A.C.A. § 26-54-101 et al., also known as the ?Arkansas Corporate Franchise Tax Act of 1979?, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax. Franchise Tax / Annual Report Forms - Arkansas Secretary of State arkansas.gov ? franchise-tax-report-forms arkansas.gov ? franchise-tax-report-forms

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

Benefits of starting an Arkansas LLC: Easily file your taxes and discover potential advantages for tax treatment. Create, manage, regulate, administer and stay in compliance easily. Protect your personal assets from your business liability and debts. Low cost to file ($45) Creating A Limited Liability Corporation (LLC) In Arkansas incfile.com ? arkansas-llc incfile.com ? arkansas-llc

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

The Division completes most filings such as articles of incorporation, amendments, mergers or dissolutions within two business days of receipt.

LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return. Generally, LLCs are required to pay a one-time filing fee as well as an annual fee. What does LLC mean and is it right for your business? - Citizens Bank citizensbank.com ? learning ? what-does-llc-... citizensbank.com ? learning ? what-does-llc-...

Two Ways to Start A New Business in Arkansas Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Arkansas Secretary of State. Get your business licenses. Set up a business bank account.