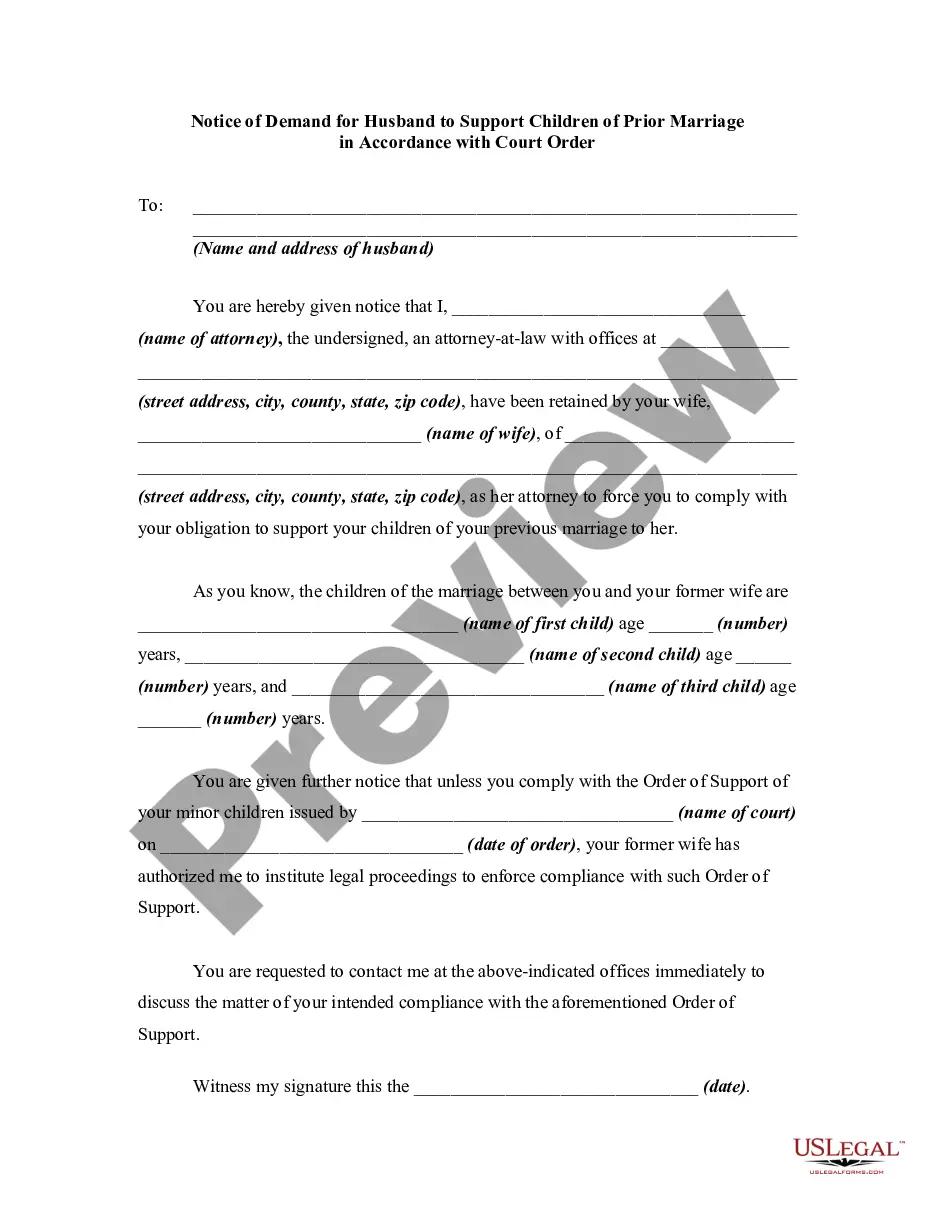

Arkansas Sample Letter for Withheld Delivery

Description

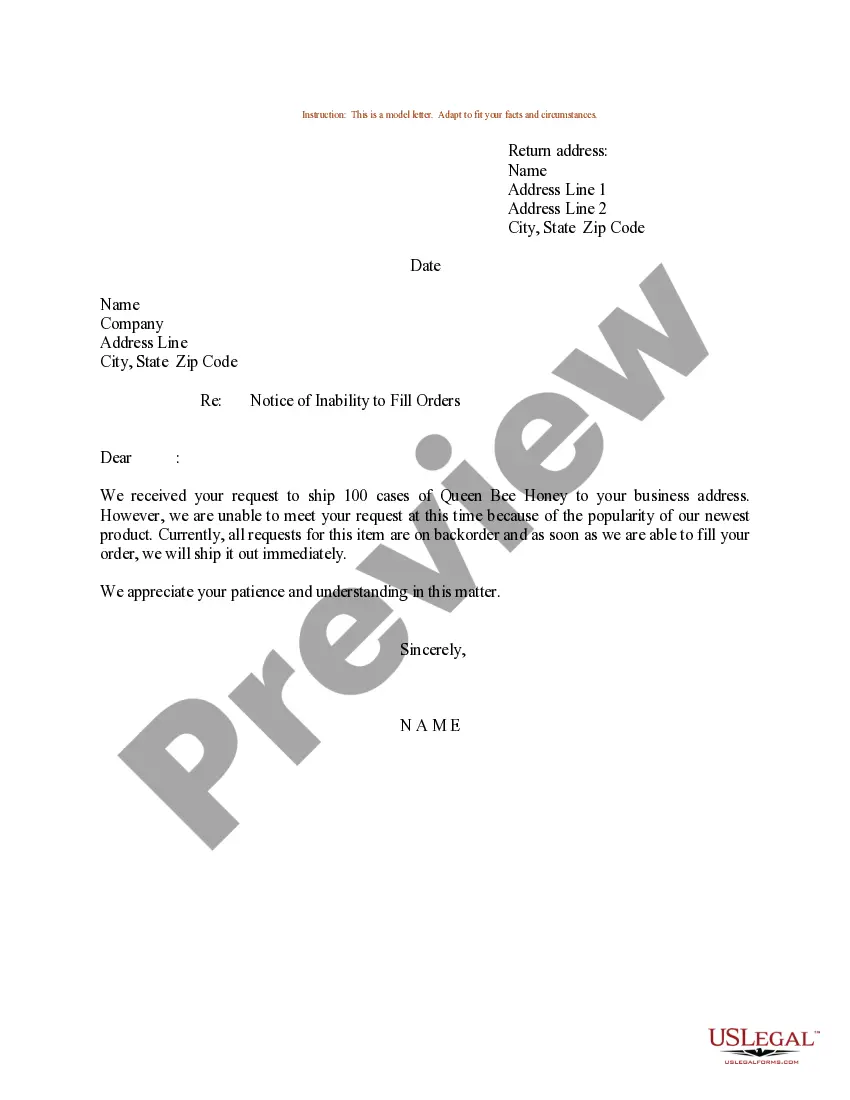

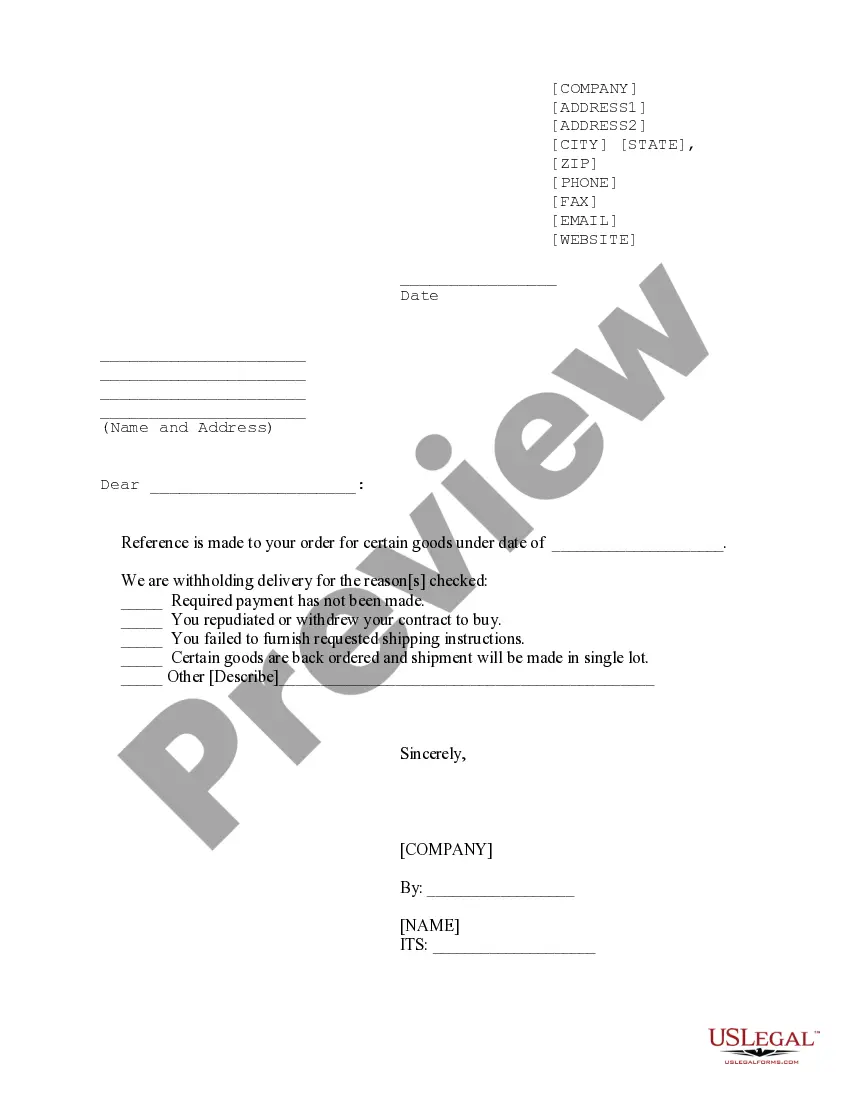

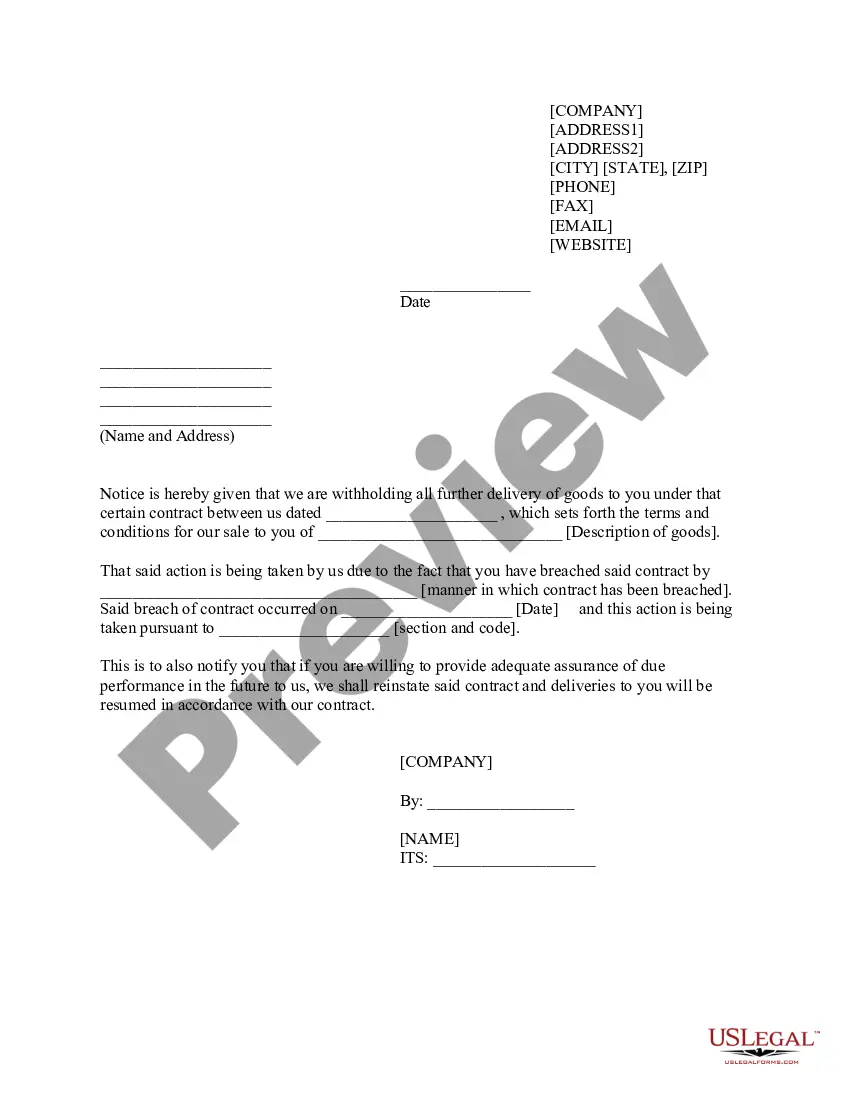

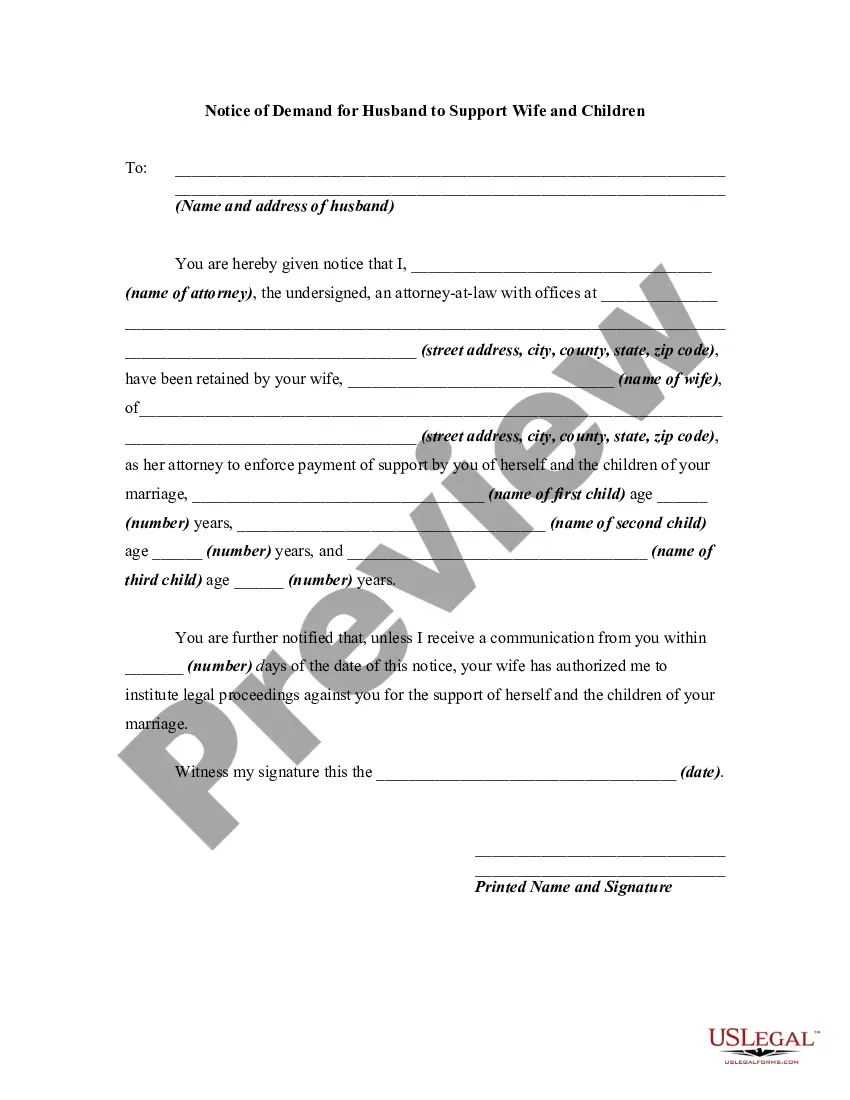

How to fill out Sample Letter For Withheld Delivery?

Are you in the situation where you frequently require documents for business or personal reasons? There are numerous legitimate document templates accessible online, but finding versions you can rely on isn't easy.

US Legal Forms provides a wide assortment of form templates, such as the Arkansas Sample Letter for Withheld Delivery, which are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Arkansas Sample Letter for Withheld Delivery template.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Arkansas Sample Letter for Withheld Delivery at any time, if needed. Just click the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers properly drafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you require and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Check the summary to confirm that you have picked the appropriate form.

- If the form isn’t what you’re searching for, use the Search field to find the form that fits your needs and requirements.

- Once you locate the correct form, click on Acquire now.

- Choose the pricing plan you prefer, fill out the required details to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

The threshold for non-resident withholding in Arkansas depends on the amount of income earned in the state. If the income exceeds a certain limit, employers must withhold taxes accordingly. To navigate these thresholds efficiently, the Arkansas Sample Letter for Withheld Delivery can offer essential insights into your obligations.

The withholding tax for non-U.S. residents varies based on federal and state laws. Typically, states like Arkansas will impose different rates depending on the income type. Using the Arkansas Sample Letter for Withheld Delivery can assist you in understanding how to approach withholding for non-resident tax matters.

To get information on employer withholding in Arkansas, you can contact the Arkansas Department of Finance and Administration. They can provide guidance on tax rates and compliance for employers. For easier reference, the Arkansas Sample Letter for Withheld Delivery can help you structure your inquiries effectively.

The amount of state tax withheld from a paycheck in Arkansas varies based on the employee's income level and applicable tax rate. Generally, this withholding is calculated using the state’s tax tables. For specific documentation needs, the Arkansas Sample Letter for Withheld Delivery can guide you through the required procedures.

Numerous states require nonresident withholding, particularly those where non-residents earn income. Each state has its own set of rules regarding this withholding. The Arkansas Sample Letter for Withheld Delivery serves as an excellent resource to clarify state-specific nonresident withholding regulations.

To register for an employer withholding account in Arkansas, you must complete the necessary forms through the Arkansas Department of Finance and Administration. This registration enables you to withhold state taxes from employee paychecks. Utilizing the Arkansas Sample Letter for Withheld Delivery can help ensure you have the correct documentation during this process.

Yes, Arkansas taxes the income of non-residents earned within the state. This means that if you are a non-resident working in Arkansas, you will need to comply with state tax withholding. To facilitate this process, consider using the Arkansas Sample Letter for Withheld Delivery for effective communication.

Many states in the U.S. require employers to withhold state taxes from employee paychecks. The specific requirements vary from state to state. Employers looking for guidance on state-specific withholding practices can utilize the Arkansas Sample Letter for Withheld Delivery for clear instruction.

Nonresidents working in Arkansas must withhold state taxes on any income earned within the state. The withholding amount is similar to the rates applied to Arkansas residents. Using the Arkansas Sample Letter for Withheld Delivery can help you address these requirements accurately.

Yes, Arkansas does implement state tax withholding for income earned by residents and non-residents. The amount withheld depends on the employee's wages and the tax rate applicable. For proper documentation, you may refer to the Arkansas Sample Letter for Withheld Delivery to ensure compliance with state requirements.