Are you inside a placement that you will need documents for either enterprise or personal uses just about every time? There are a lot of authorized file web templates available on the net, but locating versions you can depend on isn`t easy. US Legal Forms delivers thousands of type web templates, just like the Arkansas Release of Judgment Lien on Properties and Assets of Defendant, which are composed to fulfill state and federal specifications.

If you are already knowledgeable about US Legal Forms website and possess an account, merely log in. Following that, it is possible to down load the Arkansas Release of Judgment Lien on Properties and Assets of Defendant template.

Unless you come with an accounts and would like to begin to use US Legal Forms, abide by these steps:

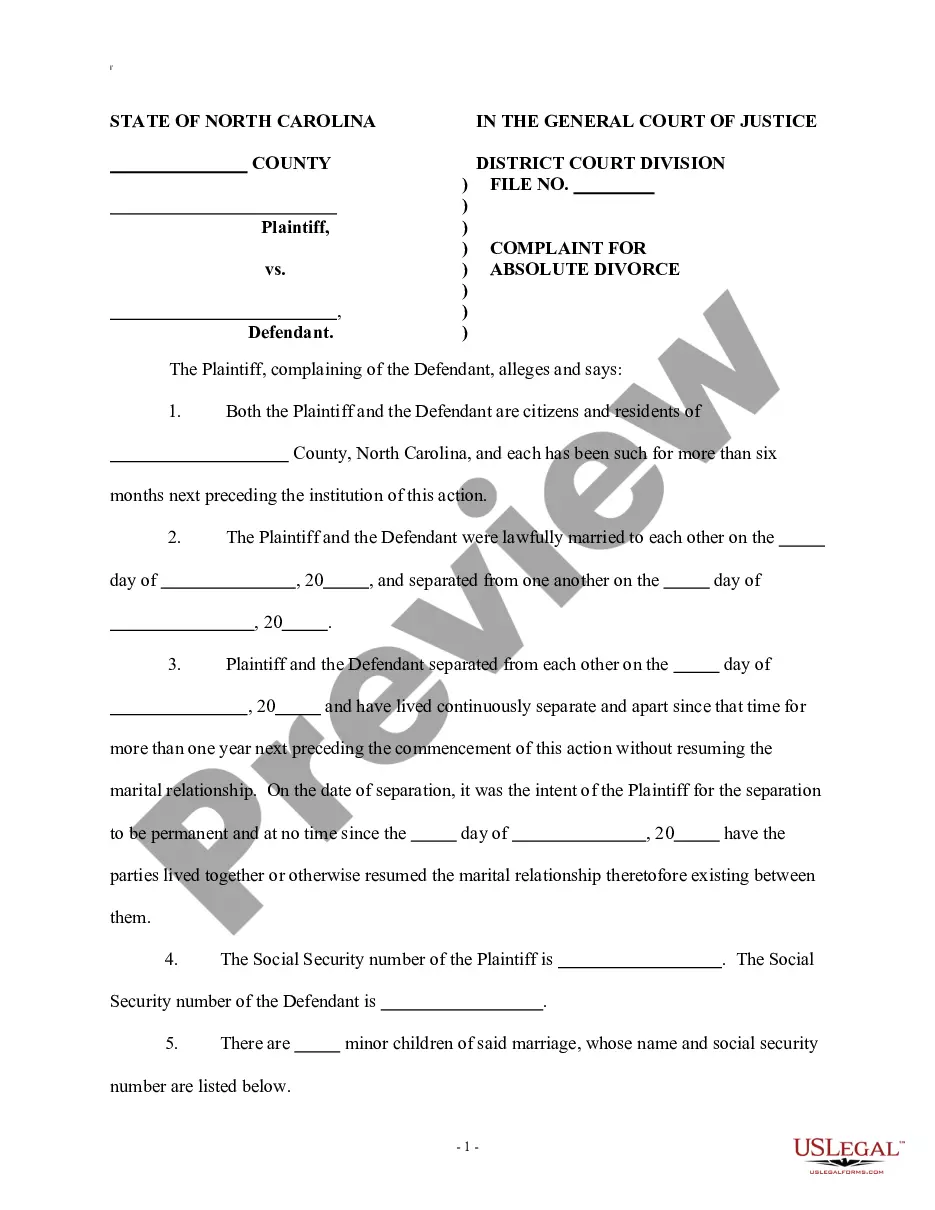

- Find the type you need and ensure it is for the proper city/area.

- Make use of the Review option to check the shape.

- Browse the information to ensure that you have chosen the appropriate type.

- In case the type isn`t what you are looking for, make use of the Research discipline to get the type that meets your needs and specifications.

- Whenever you discover the proper type, just click Purchase now.

- Opt for the prices program you need, submit the necessary information to produce your money, and pay for the order with your PayPal or credit card.

- Select a practical file formatting and down load your backup.

Locate all the file web templates you have purchased in the My Forms menu. You can get a further backup of Arkansas Release of Judgment Lien on Properties and Assets of Defendant any time, if required. Just click on the required type to down load or produce the file template.

Use US Legal Forms, by far the most substantial assortment of authorized varieties, to save lots of some time and prevent errors. The services delivers expertly produced authorized file web templates which you can use for a variety of uses. Create an account on US Legal Forms and begin producing your life a little easier.