Arkansas Agreement between General Sales Agent and Manufacturer

Description

How to fill out Agreement Between General Sales Agent And Manufacturer?

If you intend to complete, obtain, or create authentic document templates, utilize US Legal Forms, the premier assortment of legal documents accessible online.

Utilize the website's straightforward and user-friendly search to locate the files you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Leverage US Legal Forms to find the Arkansas Agreement between General Sales Agent and Manufacturer with just a few clicks.

Fill out, modify, and print or sign the Arkansas Agreement between General Sales Agent and Manufacturer.

Every legal document format you obtain is yours permanently. You will have access to every document you downloaded within your account. Choose the My documents section and select a document to print or download again. Engage and acquire, and print the Arkansas Agreement between General Sales Agent and Manufacturer using US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- If you are an existing US Legal Forms customer, Log In to your account and select the Acquire option to locate the Arkansas Agreement between General Sales Agent and Manufacturer.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/country.

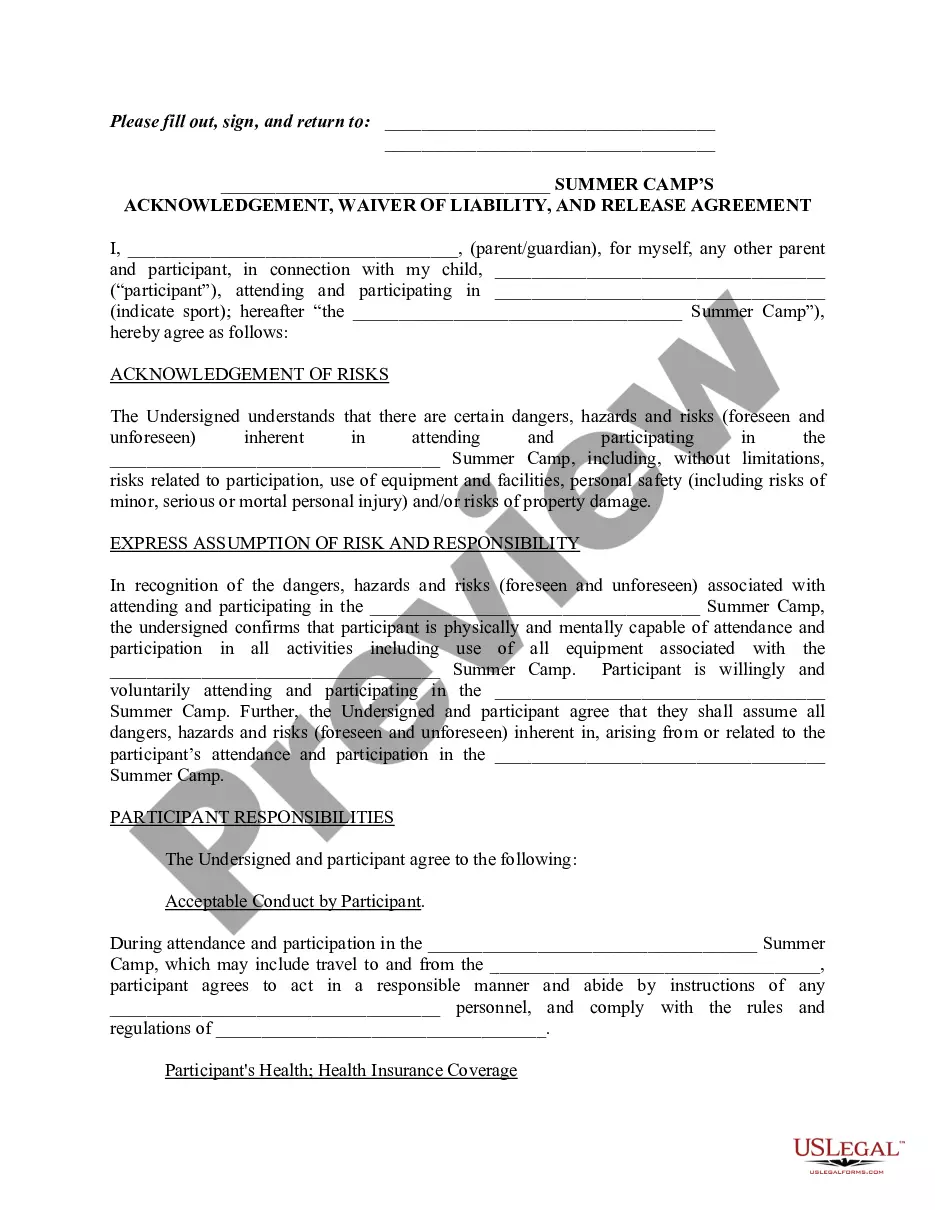

- Step 2. Use the Preview feature to inspect the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find other versions of the legal document format.

- Step 4. After you have found the form you need, click the Purchase now button.

- Step 5. Choose your preferred pricing plan and enter your details to register for an account.

- Step 6. Process the order. You can use your credit card or PayPal account to finalize the purchase.

- Step 7. Select the format of the legal document and download it to your device.

Form popularity

FAQ

To obtain a sales tax ID in Arkansas, you need to register your business with the Arkansas Department of Finance and Administration. You can complete this process online, providing necessary information about your business operations. Having a sales tax ID is essential for those engaging in an Arkansas Agreement between General Sales Agent and Manufacturer, as it streamlines tax compliance.

In Arkansas, various organizations and individuals qualify for tax exemption based on specific criteria such as nonprofit status or business purpose. Entities involved in sales under the Arkansas Agreement between General Sales Agent and Manufacturer may also be eligible for exemptions, depending on the nature of their transactions. Proper documentation is key to ensuring eligibility.

The Sales Representative Act in Arkansas outlines the legal relationships between sales representatives and manufacturers. This law protects the rights of sales agents and ensures they receive fair compensation for their efforts. It is particularly relevant to those operating under the Arkansas Agreement between General Sales Agent and Manufacturer, providing a legal framework for success.

To avoid paying sales tax on a used car in Arkansas, you can present a valid sales tax exemption certificate. This process often involves meeting specific criteria outlined by the state. If you’re involved in transactions as outlined in the Arkansas Agreement between General Sales Agent and Manufacturer, understanding these exemptions can save you significant costs.

The Arkansas sales tax exemption number is crucial for businesses engaging in transactions that qualify for sales tax exemptions. To obtain this number, you must apply through the Arkansas Department of Finance and Administration. This number simplifies compliance with state regulations and can specifically benefit those involved in the Arkansas Agreement between General Sales Agent and Manufacturer.

The Arkansas Sales Representative Act provides legal protections and regulatory guidelines for sales representatives in the state. This legislation governs the agreements between sales agents and their manufacturers, including the Arkansas Agreement between General Sales Agent and Manufacturer. Understanding this act can help you navigate the legal landscape and ensure compliance.

General sales refers to the overall process of selling goods or services in a marketplace. It encompasses everything from marketing to transaction completion. In relation to the Arkansas Agreement between General Sales Agent and Manufacturer, general sales highlight the role of the sales agent in promoting and selling the manufacturer's products.

A general agreement contract is a broad term referring to any contract that lays out the terms of a business arrangement. In the case of the Arkansas Agreement between General Sales Agent and Manufacturer, this contract details expectations, deliverables, and performance metrics for the involved parties. It serves as a foundational document that helps prevent disputes and clarifies each party's role.

A general sales agreement is a legal document that outlines the terms and conditions between a sales agent and a manufacturer. In the context of the Arkansas Agreement between General Sales Agent and Manufacturer, it specifies the duties, responsibilities, and compensation of the sales agent. This agreement helps protect both parties and ensures a clear understanding of the business relationship.

Reporting sales tax in Arkansas involves completing the Arkansas Sales and Use Tax Permit application. Once registered, you must file your sales tax returns regularly, depending on your sales volume. You can easily manage this process through the US Legal Forms platform, which provides templates and guidance. Ensure you understand the Arkansas Agreement between General Sales Agent and Manufacturer if you plan to engage in sales activities.